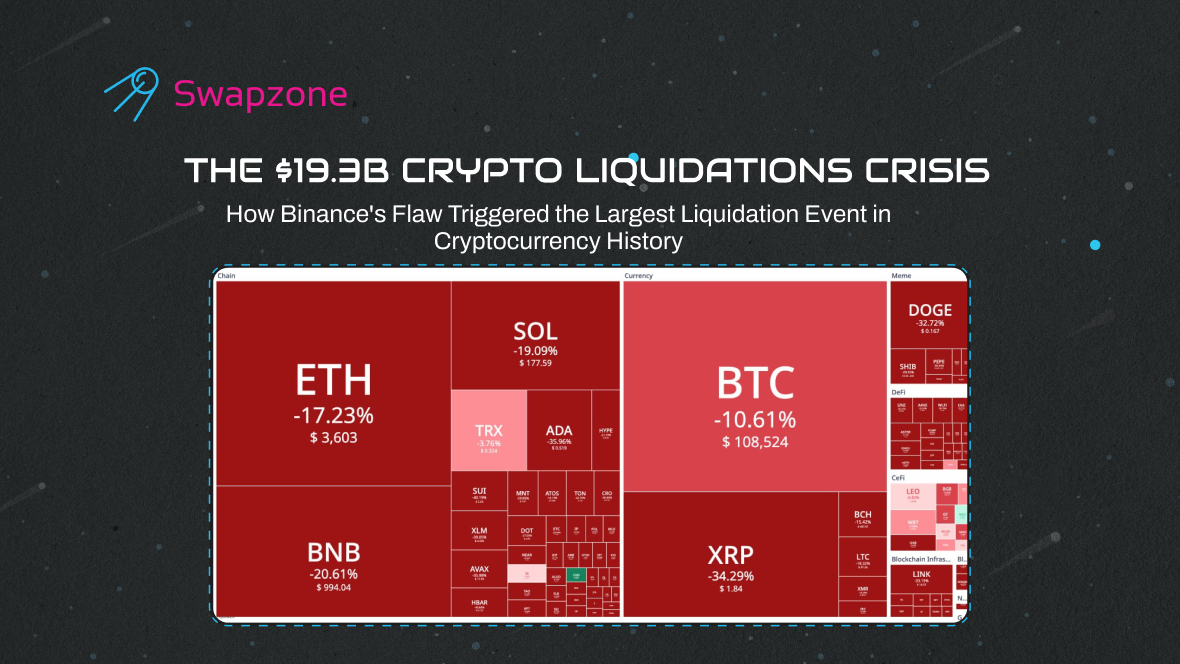

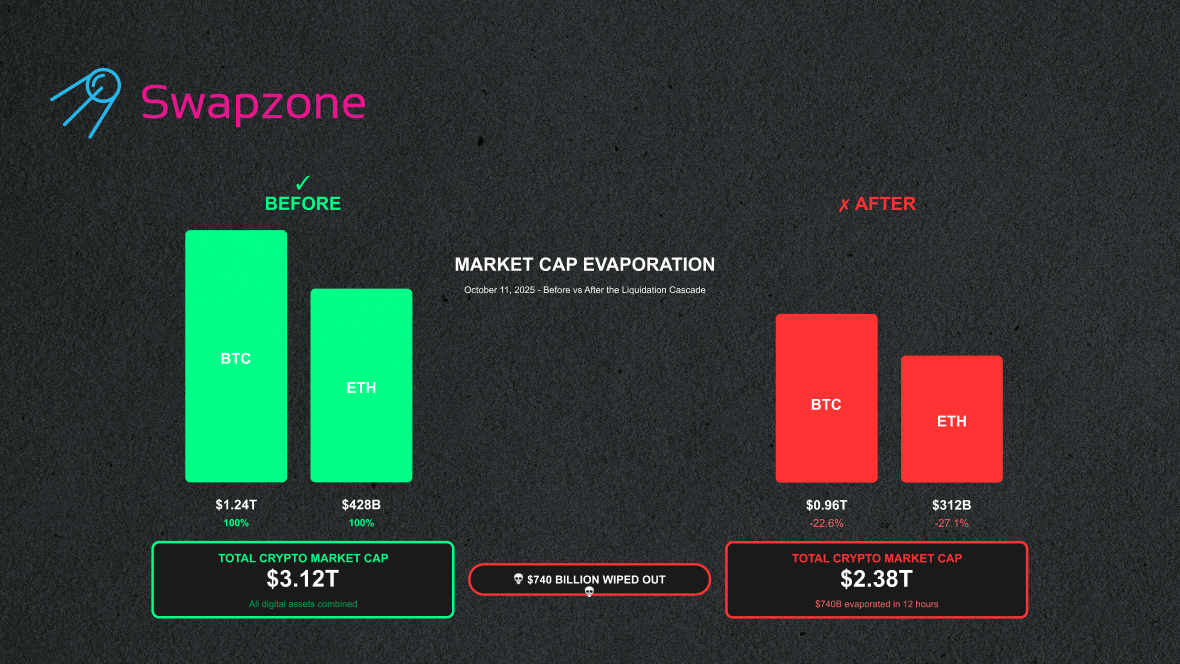

October 11, 2025 will haunt crypto traders for years. While most of us slept, the cryptocurrency market experienced a catastrophic collapse—the 19.3 billion liquidations wiped out leveraged positions across global exchanges. Bitcoin plunged. Ethereum cratered. Even XRP, typically resilient during sell-offs, bore the brunt of this unprecedented chaos.

Only four digital assets out of 429 on Binance stayed green that night. Four.

This wasn’t your typical crypto market downturn. What looked like panic actually masked something far more sinister-a coordinated exploit of Binance’s internal pricing system that turned roughly $90 million in manipulation into the largest single-day liquidation event the cryptocurrency market has ever witnessed.

What Happened During the October 11 Liquidations: The Timeline

The stage was set days earlier. On October 6, Binance announced they’d transition from internal pricing to external oracles for collateral valuation. Smart move. Problem? They scheduled implementation for October 14-creating an eight-day vulnerability window that sophisticated actors exploited with surgical precision.

Here’s how October 11 unfolded. Attackers drained approximately $60-90 million worth of USDe (a stablecoin) on Binance, deliberately crashing its price to 0.65 on the exchange while it held steady at 1.0 everywhere else. Since Binance valued collateral using their own orderbook rather than external market prices, this local depegging instantly reset margin requirements across thousands of accounts.

The cascade began immediately:

- Initial forced liquidations: $500 million to $1 billion

- Global liquidation total: $19.3 billion across all exchanges

- Altcoin devastation: 50-70% drops within hours

- BTC and ETH positions: Obliterated on thin liquidity

- Profit extracted by attackers: $192 million

Then Trump announced 100% tariffs on China. The macro shock hit at the exact moment Binance’s system was hemorrhaging. Coincidence? Not likely.

| Metric | Impact |

|---|---|

| Total Liquidations | $19.3 billion |

| Binance Reported Liquidations | $2.4 billion (likely understated) |

| Hyperliquid Liquidations | $10.2 billion |

| Initial Manipulation Capital | $60-90 million USDe |

| Attacker Net Profit | $192 million |

| Assets in Green (out of 429) | 4 |

The four survivors? Zcash jumped 17%, RDNT climbed 15%, Succinct gained 12%, and Morpho edged up 3%. Everyone else got destroyed.

The Attack Mechanism: How $90M Triggered 19.3B in Liquidations

Understanding how such a small amount could trigger **the 19.3 billion liquidations requires grasping Binance’s fundamental architectural flaw. The exchange allowed users to post USDe, wBETH, and BNSOL as collateral under their Unified Account system. Sounds reasonable-until you realize they valued this collateral based on Binance’s own spot prices instead of aggregated market data or external oracles.

This created a massive attack surface. Manipulate Binance’s orderbook, and you could artificially deflate collateral values across the entire platform. The attackers knew this. They studied the system, identified the weakness, and waited for the perfect moment.

The execution was flawless. Well-funded wallets systematically drained USDe from Binance’s orderbook. The price crashed locally while maintaining parity on Coinbase, Kraken, and every other major exchange. Binance’s risk engine saw collateral values plummeting and did what it’s programmed to do-liquidate positions that fell below maintenance margin requirements.

Traders woke up to margin calls they couldn’t answer. Positions closed automatically. The selling pressure fed on itself. Other exchanges picked up the contagion through arbitrage bots and cross-platform hedging. Market makers, caught off guard, dumped positions everywhere to manage risk. Liquidity evaporated exactly when it was needed most.

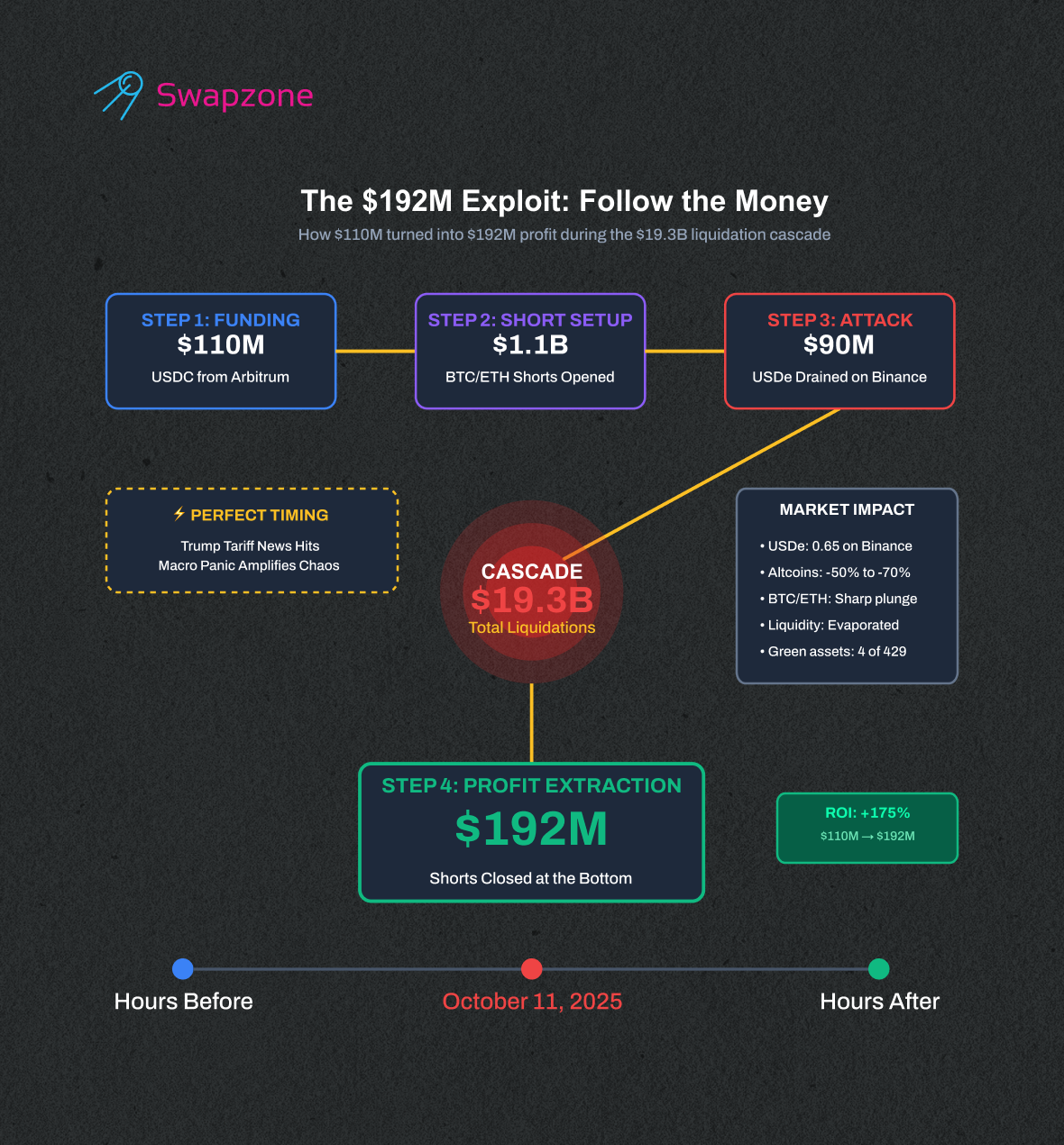

But here’s where it gets really dark. Minutes before the chaos erupted, new wallets on Hyperliquid opened $1.1 billion in BTC and ETH short positions. These accounts received $110 million USDC funding from sources traced to Arbitrum. When Bitcoin and Ethereum crashed during the liquidation cascade, those shorts printed $192 million in profit.

The timing wasn’t lucky. It was calculated.

Follow the Money: Who Profited from 19.3 Billion in Chaos

Blockchain doesn’t lie. Analysts traced the money flow and found patterns that scream coordination. Fresh Hyperliquid wallets appeared just hours before October 11. They received substantial USDC transfers from Arbitrum-connected addresses. Then they opened massive leveraged positions betting against BTC and ETH-right before the 19.3 billion liquidations that would shake cryptocurrency market history.

For detailed analysis of the wallet movements and timing, see: [ https://x.com/elontrades/status/1977340254047649966 ]

The profit mechanism worked like this:

- Fund new wallets with $110 million USDC

- Open $1.1 billion in short positions on Hyperliquid (using high leverage)

- Trigger the Binance exploit simultaneously with tariff news

- Watch BTC and ETH crash as forced liquidations cascade

- Close shorts at the bottom for $192 million net profit

Some call this market manipulation. Others argue it’s merely exploiting publicly known vulnerabilities. The legal distinction matters, but the ethical picture is clear-someone used Binance’s weakness to extract nearly $200 million while retail traders lost everything.

The sophistication level suggests professional actors. This wasn’t some teenager in a basement. The coordination between platforms, the timing with macroeconomic news, the funding sources-all point to organized groups with deep pockets and technical expertise.

Who’s Actually Responsible for the Liquidation Crisis

Let’s be direct. Binance screwed up. Massively.

The exchange knew their collateral pricing system was flawed. They announced the fix on October 6. They scheduled implementation for October 14. That eight-day gap? That’s negligence. Any competent risk manager would’ve either paused the affected collateral types or expedited the oracle integration immediately.

Instead, Binance left a glaring vulnerability open during one of the most volatile periods in recent crypto history. Their API crashed during peak liquidations, preventing traders from managing positions. Their liquidation reporting remains suspiciously opaque-they publicly admitted that thousands of liquidation orders often appear as just one in their data. That means the real carnage on Binance was likely far worse than the reported $2.4 billion.

This isn’t Binance’s first rodeo with controversy. The echoes of FTX and Alameda’s collapse still reverberate through the industry. When the world’s largest crypto exchange by volume makes architectural errors this fundamental, it shakes confidence across the entire ecosystem. The 19.3 billion liquidations proved that even giants can fall.

But Binance wasn’t alone in failure. The attackers bear moral responsibility even if they technically exploited a known flaw rather than creating it. The level of coordination, the funding mechanisms, the timing-this wasn’t opportunistic. It was predatory.

Here’s who deserves credit though: Ethena Labs and the USDe protocol. Despite being the vehicle used in the attack, USDe performed flawlessly. The stablecoin maintained its peg on every exchange except Binance. Redemptions processed normally. The protocol’s security held firm. USDe got dragged into this mess through no fault of its own-a victim of Binance’s pricing failure, not a cause of it.

The macro environment played its part too. Trump’s tariff announcement wasn’t coordinated with the attack (probably), but it created perfect cover. Market participants couldn’t distinguish between legitimate panic selling and forced liquidations. The confusion amplified volatility and deepened the crash.

Hyperliquid vs Binance: Transparency Matters

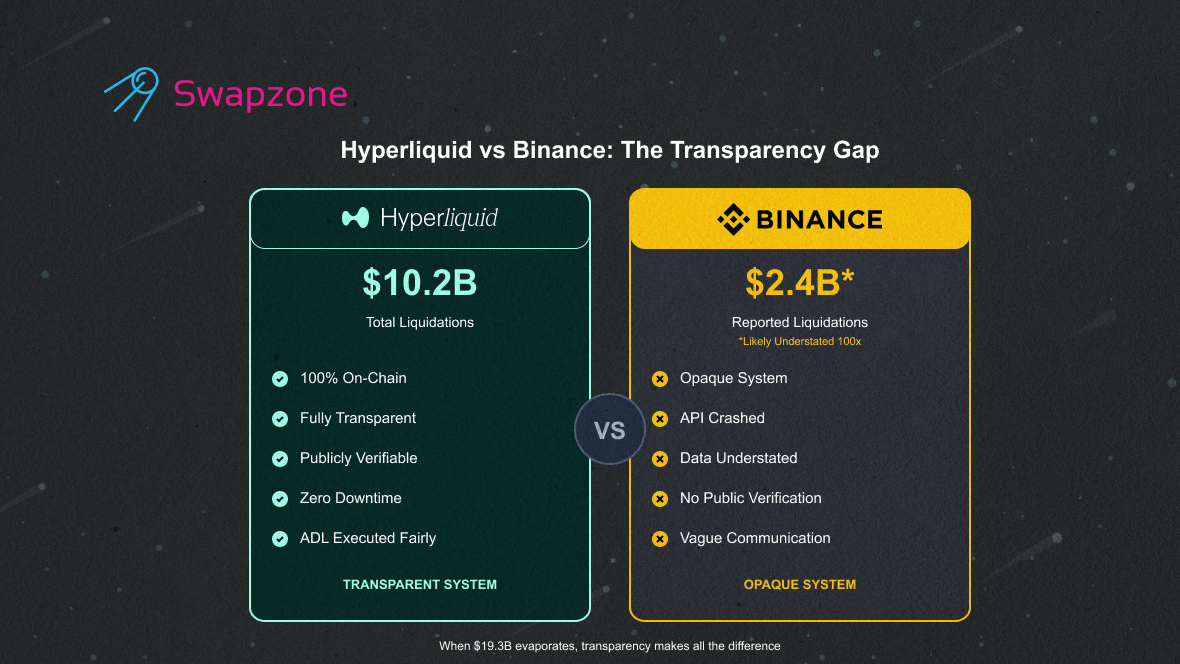

When analysts tallied the damage, Hyperliquid showed $10.2 billion in liquidations compared to Binance’s $2.4 billion. Surface-level reading suggests Hyperliquid got hammered harder. Dig deeper and a different story emerges.

Hyperliquid operates entirely on-chain. Every order, every liquidation, every trade gets recorded on a public blockchain that anyone can verify. When liquidity dried up during the cascade, Hyperliquid executed Automatic Deleveraging (ADL)-forcibly closing profitable positions to cover underwater ones. Sounds harsh, but it’s transparent. Users knew exactly what happened. The platform stayed operational without a single second of downtime. You can verify every liquidation yourself if you want.

Binance? Complete opacity. Their system crashed when traders needed it most. They acknowledged vague “technical problems.” They promised compensation to affected users but provided few details on how they’d calculate it. Most damning, Binance’s own documentation admits their liquidation data is “significantly underestimated”-sometimes by factors of 100x when thousands of orders process simultaneously.

“Hyperliquid’s on-chain liquidations cannot be compared to CEX’s understated liquidations. Transparency and neutrality are the key reasons why fully on-chain DeFi is ideal infrastructure for global finance.” – Chameleon Jeff

[Source: https://x.com/lawmaster/status/1977225947461071273]

The contrast couldn’t be starker. One platform shows you everything. The other shows you what they want you to see. When $19.3 billion evaporates, that distinction matters.

A1 Research cofounder captured the frustration perfectly: “I really don’t understand why everyone is attacking Hyperliquid, and almost no one is talking about Binance. The largest exchange since 2017, earning $15B per year, has completely collapsed due to the news about tariffs?”

[Source: https://x.com/Louround_/status/1977605112903131255]

He’s right. Hyperliquid handled catastrophic conditions transparently. Binance created the conditions through negligence, then hid behind technical jargon and incomplete data.

Understanding How Liquidations Cascade Through Markets

Most crypto traders use leverage without truly understanding the risks. You borrow money to amplify potential gains. When prices move in your favor, leverage multiplies profits. When prices reverse, leverage multiplies losses even faster.

Exchanges require traders to maintain minimum collateral levels-the maintenance margin. Drop below that threshold and the exchange liquidates your position automatically to prevent losses exceeding your account balance. Makes sense in theory. In practice, liquidations create self-reinforcing cycles that destroy markets.

Here’s why cascades happen:

When one large position gets liquidated, it dumps assets into the orderbook. If liquidity is thin, prices drop sharply. That price drop triggers margin calls on other leveraged positions. Those positions liquidate, creating more selling pressure. The cycle feeds itself until it burns through every overleveraged trader in the system.

October 11 demonstrated this mechanism at catastrophic scale. Binance’s pricing manipulation triggered the first wave of liquidations. Those sells hit orderbooks already nervous from tariff news. Prices plunged, triggering more liquidations on Binance and spreading to other exchanges through arbitrage bots. Market makers trying to hedge across platforms were forced to sell everywhere simultaneously. Liquidity vanished.

The crypto market’s interconnectedness meant that Binance’s local problem became everyone’s problem within minutes. Cross-exchange trading algorithms detected price discrepancies and attempted to profit, inadvertently spreading the contagion. DEXes saw volume spike as panicked traders fled CEXes. The entire digital asset ecosystem shuddered under the weight of forced liquidations.

This wasn’t just a crypto phenomenon. Traditional fintech systems face similar risks when leverage concentrates during low liquidity periods. The 2025 event marks the largest liquidation in cryptocurrency history, but it follows patterns visible in traditional finance during flash crashes and systematic deleveraging events.

What This Crisis Reveals About Crypto in 2025

The 19.3 billion liquidation event exposed uncomfortable truths about where crypto stands in 2025. Despite years of maturation, despite institutional adoption and ETF approvals, despite all the promises of decentralization-the cryptocurrency market remains vulnerable to single points of failure.

Binance processes enormous volume daily. When their system failed, it didn’t just hurt their users. It triggered a global sell-off that affected every exchange, every token, every trader. That’s concerning. The industry has consolidated around a few mega-exchanges that wield outsized influence over market prices and liquidity.

The leverage problem deserves serious attention. Exchanges compete by offering higher and higher margin ratios. Some platforms let traders leverage 100x or even 125x on volatile digital assets. That’s insane. Traditional markets learned these lessons decades ago through painful crashes. Crypto seems determined to repeat every historical mistake.

Risk management across the industry remains woefully inadequate. Most retail traders don’t understand position sizing. They chase gains using maximum leverage without considering downside scenarios. Exchanges profit from this behavior through liquidation fees and trading volume, creating perverse incentives against user protection.

Yet the crisis also highlighted crypto’s strengths. Platforms built on transparency-like Hyperliquid-demonstrated resilience under pressure. On-chain systems let users verify everything independently. No trust required. When centralized exchanges like Binance fail, decentralized alternatives show their value proposition clearly.

The rebound tells its own story. Bitcoin recovered faster than many expected. ETF inflows resumed. Institutional investors, initially spooked, recognized the October 11 event as an exchange-specific failure rather than a fundamental crypto weakness. XRP and other major tokens found new support levels. The cryptocurrency market proved resilient even after the largest liquidation event in its history.

Protecting Yourself: Lessons Every Trader Must Learn

You can’t prevent exchanges from screwing up. But you can protect yourself from getting caught in liquidation cascades. Start by getting religious about position sizing. Never risk more than you can afford to lose completely. That old wisdom? It’s old because it works.

Practical risk management strategies include:

- Use conservative leverage ratios: 2-3x maximum for volatile assets like BTC and ETH. Higher leverage might seem tempting, but it guarantees you’ll get liquidated eventually.

- Diversify across exchanges: Don’t keep all your collateral on one platform. Binance’s failure wouldn’t have hurt as much if traders spread risk across multiple venues.

- Set strict stop-losses: Automated protection beats emotional decision-making during crashes. Every single time.

- Monitor liquidity conditions: When orderbooks thin out, reduce leverage immediately. Low liquidity amplifies price swings.

- Watch for warning signs: Unusual price deviations between exchanges, platform technical issues, major macro events-these signal elevated risk.

The October 11 crisis revealed that even “safe” collateral like stablecoins carries exchange-specific risk. USDe worked fine everywhere except Binance. That taught sophisticated traders to verify collateral pricing mechanisms before posting assets. Ask exchanges directly: Do you use oracle pricing or internal orderbooks? The answer matters more than you think.

Never trust exchange-provided liquidation data completely. Binance’s admissions about understating liquidations by factors of 100x should terrify anyone trading with leverage on centralized platforms. You might think you’re monitoring risk accurately when the real exposure is orders of magnitude larger.

If you must use high leverage, do it on transparent platforms where you can verify execution independently. Pay the premium for on-chain certainty. It’s worth it when billions are getting liquidated and you need to know your position is actually safe.

Could 19.3B Liquidations Happen Again?

Yes. Absolutely.

Other exchanges still use internal pricing for some collateral types. Leverage ratios remain dangerously high across the industry. The next macro shock could trigger similar cascades-maybe worse if institutional participation has grown since the last event.

Binance implemented fixes after getting burned. They added oracle pricing, established minimum price thresholds, and improved their risk systems. But Binance isn’t the only major exchange. Competitors might harbor similar vulnerabilities that haven’t been tested under extreme conditions yet.

What’s improved since October 2025:

- More exchanges adopting oracle-based pricing

- Industry discussions about mandatory leverage limits

- Greater transparency requirements from regulators

- Improved circuit breaker mechanisms

- Better user education about margin trading risks

What still needs work:

- Standardized collateral valuation across platforms

- Real-time solvency verification for all exchanges

- Mandatory liquidation reporting with full transparency

- Leverage caps that actually protect retail traders

- Insurance funds large enough to handle systemic events

The U.S. regulatory environment remains uncertain. Some analysts believe tighter oversight could prevent future catastrophes. Others argue that heavy-handed regulation will drive innovation offshore without improving safety. The debate continues while leverage keeps climbing.

Market capitalization has grown substantially despite the October shock. More institutional money means deeper liquidity in theory. But it also means larger absolute losses when cascades happen. The next $19.3 billion event might look like $50 billion given current market cap levels.

Key factors that could trigger future liquidations include unexpected rate cuts (or hikes), major geopolitical events, large-scale hacks, regulatory crackdowns, or simply another exchange making Binance’s mistakes. The cryptocurrency market has matured in many ways since its early days. Risk management isn’t one of them.

The Wake-Up Call Crypto Needed

October 11, 2025 marked the largest liquidation event in crypto history-$19.3 billion vaporized through a combination of architectural failure, sophisticated exploitation, and macro panic. The event exposed critical weaknesses in centralized exchange infrastructure while simultaneously demonstrating the value of transparency and on-chain verification.

Binance’s pricing flaw triggered everything. Their delayed response created the opportunity. Attackers capitalized on known vulnerabilities to extract $192 million while retail traders lost fortunes. The cryptocurrency market experienced a violent correction that reverberated globally, affecting bitcoin, ethereum, XRP, and virtually every digital asset.

Yet the market survived. Bitcoin found support and began its rebound. New highs followed months later as confidence returned. Institutional investors distinguished between exchange failures and fundamental crypto weaknesses. The largest single-day liquidation became a painful but ultimately survivable learning experience.

The lesson? Transparency matters more than marketing. On-chain verification beats trust-based systems. Conservative risk management outlasts aggressive leverage. These truths emerged crystal clear from the wreckage of October 11.

Every trader should study what happened. Not to assign blame or chase conspiracy theories, but to understand how cascading liquidations work and how to avoid getting caught in the next one. Because there will be a next one. Markets always find new ways to test leverage and liquidity under stress.

The $19.3 billion liquidation crisis changed crypto. Whether those changes prove sufficient remains to be seen. For now, we’ve got a stark reminder that even the largest exchanges can fail catastrophically-and when they do, everyone pays the price.