Key Takeaways

- What Is Bitcoin and How Does Blockchain Technology Work?

- How Many Types of Cryptocurrency Are There? The 4 Main Categories

- Top 10 Cryptocurrencies by Market Cap You Should Know

- Coins vs Tokens: What’s the Difference?

- What Are Altcoins and Why Do They Matter?

- Types of Cryptocurrency for Beginners: Where to Start?

- Understanding DeFi Tokens and Decentralized Finance

- What Are the Types of Crypto Mining?

- Conclusion

The cryptocurrency market exploded to a staggering $2.76 trillion valuation in 2025. But here’s the catch–there are now over 25,000 different cryptocurrencies out there. If you’re just getting started, that number probably feels overwhelming. Where do you even begin?

Bitcoin kicked off this digital revolution back in 2009, but today’s crypto world includes altcoins, stablecoins, tokens, DeFi platforms, and way more. Don’t worry–you don’t need to understand all 25,000. You just need to grasp the main types of cryptocurrencies and how blockchain technology powers them.

This guide breaks down Bitcoin basics, explains blockchain in plain language, walks you through the 4 main cryptocurrency categories, and shows you how to get started swapping crypto assets.

What Is Bitcoin and How Does Blockchain Technology Work?

Bitcoin: The First Cryptocurrency

Bitcoin changed everything. Back in 2009, an anonymous creator (or group) called Satoshi Nakamoto launched Bitcoin as a peer-to-peer electronic cash system. The idea? Cut out banks and middlemen. Instead of needing a central clearing authority to approve your transactions, Bitcoin lets you send money directly to anyone, anywhere.

Here’s what makes Bitcoin special: there will only ever be 21 million Bitcoins. That fixed supply is baked into the code. No government can print more. No central bank can inflate it away. This scarcity is why many people call Bitcoin “digital gold.”

Bitcoin uses something called a proof of work consensus mechanism. Miners compete to solve complex puzzles, and whoever wins gets to add the next block of transactions to the Bitcoin network. This process secures the blockchain and keeps it decentralized.

Today, Bitcoin has the largest crypto market cap–around $2.34 trillion as of 2025. It’s the most established cryptocurrency and the entry point for most newcomers.

Blockchain Technology Explained Simply

Blockchain is the tech that makes cryptocurrency work. Think of it as a digital ledger that’s copied across thousands of computers in a peer-to-peer network. Every time someone makes a transaction, it gets recorded in a “block.” Once that block fills up, it links to the previous block–forming a chain.

Here’s why this matters: because the blockchain lives on so many computers at once, nobody can cheat the system. You can’t fake a transaction or spend the same Bitcoin twice. The distributed ledger technology eliminates the need for a central clearing authority like a bank.

Transactions across a peer-to-peer network happen 24/7, with no bank holidays or business hours. The blockchain records everything transparently, but your real identity stays hidden behind cryptographic addresses. This balance of transparency and privacy is what makes blockchain revolutionary.

Multiple blockchains exist today–Bitcoin has one, Ethereum has another, Solana has its own. Each blockchain platform serves different purposes, from simple payments to running complex smart contracts.

How Many Types of Cryptocurrency Are There? The 4 Main Categories

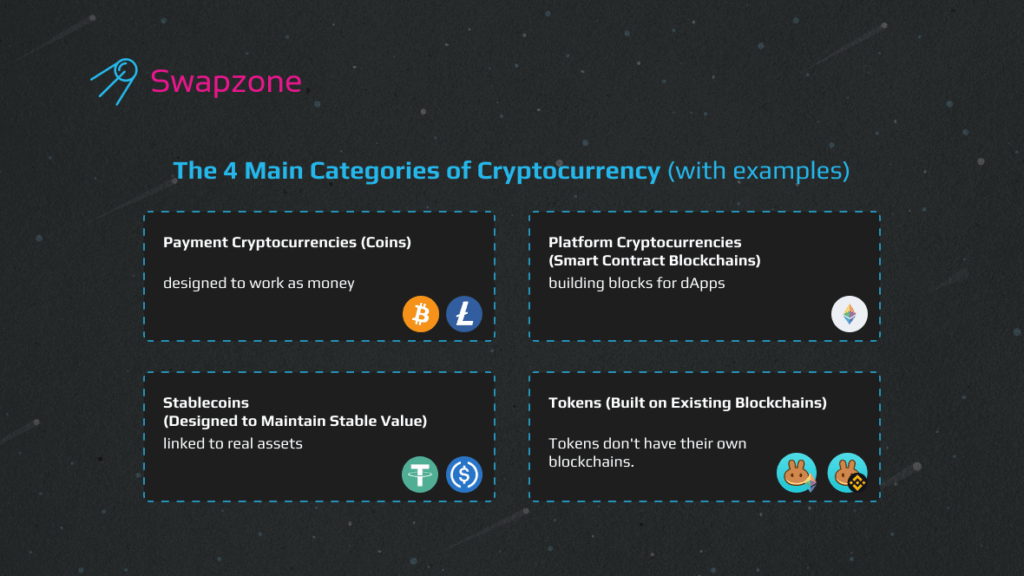

You’ll find crypto grouped into different categories based on their purpose and technology. While the exact classification varies, most experts agree on 4 main types of cryptocurrency:

1. Payment Cryptocurrencies (Coins)

These are digital currencies designed to work as money. Bitcoin is the king here, but you’ve also got Litecoin and Bitcoin Cash. These coins run on their own blockchains and function primarily as a medium of exchange or store of value.

Payment coins represent the original vision of cryptocurrency–peer-to-peer transfers without banks. They’re the largest cryptocurrencies by market capitalization because they’ve been around longest and have the most adoption.

2. Platform Cryptocurrencies (Smart Contract Blockchains)

Ethereum changed the game by introducing smart contracts–self-executing agreements written in code. These blockchain platforms let developers build decentralized applications (dApps) on top of them.

The Ethereum network runs on Ether (ETH), which you need to pay for transactions and run smart contracts. Other smart contract platforms include Solana, Cardano, and Avalanche. Each blockchain platform tries to solve different problems around speed, cost, or features.

3. Stablecoins (Designed to Maintain Stable Value)

Stablecoins are pegged to real-world assets, usually the US dollar. Tether (USDT) and USD Coin (USDC) maintain a 1:1 ratio with USD. This means 1 USDT should always equal $1.

Why do these exist? Because regular crypto is volatile. Bitcoin can swing 10% in a day. Stablecoins give you a way to hold value in the crypto ecosystem without the wild price swings. They’re perfect for trading–you can swap volatile crypto into a stablecoin when you want to lock in profits.

4. Tokens (Built on Existing Blockchains)

Here’s where things get interesting. Tokens don’t have their own blockchains. Instead, they’re built on existing platforms–usually Ethereum. Tokens serve specific functions: governance, rewards, access to services, or representing unique items.

Types of crypto tokens include:

- Utility tokens like Chainlink that power specific services

- Governance tokens like Uniswap that give holders voting rights

- DeFi tokens that unlock financial services

- Non-fungible tokens (NFTs) representing unique digital assets

Many other cryptocurrencies blur these lines. Some projects combine features from multiple categories. But understanding these 4 types gives you a solid foundation.

Top 10 Cryptocurrencies by Market Cap You Should Know

Want to know which crypto assets actually matter? Here’s the top 10 list by market capitalization:

1. Bitcoin (BTC) – $2.34 trillion market cap. The OG cryptocurrency. Fixed supply of 21 million coins. Digital gold and store of value.

2. Ethereum (ETH) – $430 billion market cap. Smart contract platform created by Vitalik Buterin. Powers most DeFi and NFTs.

3. Tether (USDT) – Largest stablecoin. Pegged 1:1 to USD. Used everywhere for crypto trading and swaps.

4. Binance Coin (BNB) – Native token for the Binance ecosystem. Offers discounts on trading fees and powers Binance Smart Chain.

5. Solana (SOL) – Super-fast blockchain platform. Handles thousands of transactions per second with minimal fees.

6. USD Coin (USDC) – Regulated stablecoin backed by actual US dollar reserves. More transparent than Tether.

7. Ripple (XRP) – Designed for cross-border payments. Banks and financial services use it to move money globally.

8. Cardano (ADA) – Research-driven blockchain using proof of stake. Known for careful, academic approach to development.

9. Dogecoin (DOGE) – Started as a meme, became a peer-to-peer cryptocurrency with a massive community.

10. Litecoin (LTC) – Early Bitcoin alternative. Faster transaction times and lower fees than Bitcoin.

Each of these top crypto assets serves different purposes. Bitcoin works as digital gold. Ethereum enables smart contracts. Stablecoins provide stability. And altcoins experiment with new features.

Coins vs Tokens: What’s the Difference?

This confuses a lot of people. Both coins and tokens are types of crypto assets, but they work differently.

Cryptocurrency Coins:

Coins operate on their own blockchain. Bitcoin runs on the Bitcoin network. Ether runs on the Ethereum network. Solana runs on–you guessed it–the Solana blockchain.

These are native cryptocurrencies. You need them to pay for transactions on their respective blockchains. Think of coins as the “official currency” of their blockchain.

Crypto Tokens:

Tokens are built on top of existing blockchain platforms. They don’t have their own separate blockchain. Most tokens live on Ethereum, following standards like ERC-20.

Tether (USDT) is actually a token–it runs on multiple blockchains including Ethereum, Tron, and others. It’s not its own blockchain platform.

Types of Crypto Tokens:

Utility tokens give you access to services. Chainlink tokens let you use the Chainlink oracle network.

Governance tokens let you vote on protocol decisions. If you hold Uniswap tokens, you can vote on changes to the Uniswap decentralized exchange.

DeFi tokens power decentralized finance applications–lending, borrowing, yield farming.

Non-fungible tokens (NFTs) represent unique digital items. Each one is different, unlike regular tokens where 1 = 1.

Stablecoin tokens maintain price stability. USD Coin is a token, not a coin, even though “coin” is in the name.

Understanding this difference helps when you’re ready to exchange Bitcoin or swap Ethereum for other crypto assets.

What Are Altcoins and Why Do They Matter?

“Altcoin” is crypto slang for “alternative coin”–basically, any cryptocurrency that’s not Bitcoin. The term came about because Bitcoin was first, and everything else was an alternative.

Altcoins solve different problems. Bitcoin does one thing really well: peer-to-peer digital cash with a fixed supply. But what if you want smart contracts? That’s Ethereum. What if you want instant transactions? That’s Solana. Privacy? Monero.

Types of Altcoins:

Smart contract platforms like Ethereum and Cardano let developers build dApps and DeFi protocols.

Payment-focused coins like Litecoin and Bitcoin Cash prioritize fast, cheap transactions for everyday use.

Privacy coins like Monero and Zcash hide transaction details, keeping your financial activity private.

Layer 2 solutions like Polygon and Arbitrum scale existing blockchains, making them faster and cheaper.

Types of Cryptocurrency Investments with Altcoins:

High-cap altcoins (Ethereum, BNB) offer more stability than smaller projects. They’re established blockchain platforms with real users.

Mid-cap altcoins (Solana, Avalanche) have higher growth potential but more risk.

DeFi tokens let you earn yield by providing liquidity or staking.

Stablecoins aren’t really “investments” since their value doesn’t change, but they’re useful for parking funds between trades.

The number of altcoins keeps growing. Focus on projects with strong use cases, active development, and real adoption rather than chasing every new token.

Types of Cryptocurrency for Beginners: Where to Start?

If you’re new to crypto, don’t try to understand everything at once. Start with the big players that have proven themselves.

Best Starting Points:

1. Bitcoin (BTC)

This is crypto 101. Bitcoin is the most established, most trusted, and easiest to understand. Its role as a store of value makes it less risky than experimental altcoins. You can swap Bitcoin on virtually any cryptocurrency exchange.

2. Ethereum (ETH)

Once you understand Bitcoin, learn about Ethereum. It’s the gateway to DeFi, NFTs, and smart contracts. The Ethereum network powers most crypto innovation. Understanding how Ethereum works helps you grasp the broader crypto ecosystem.

3. Stablecoins (USDT, USDC)

Stablecoins are perfect training wheels. They don’t have price volatility, so you can practice sending, receiving, and swapping crypto without worrying about losing value. They’re the bridge between fiat currency and crypto.

4. Major Altcoins (SOL, ADA, BNB)

Once you’re comfortable with the basics, explore established blockchain platforms. These have lower prices than Bitcoin, making it easier to buy a whole coin. But they also carry more risk.

Getting Started Tips:

Start small. Buy $50 or $100 worth of Bitcoin just to learn how it works.

Use stablecoins to practice. Swap USDT between different formats (ERC-20, TRC-20) to understand how tokens work on different blockchains.

Compare rates across cryptocurrency exchanges. Even small differences add up when you’re swapping crypto assets.

Learn before you leap. Understand blockchain technology and decentralization before putting serious money in.

Don’t invest more than you’re okay losing. Crypto is volatile. Even Bitcoin can drop 20% in a week.

One user who was new to cryptocurrency shared that they felt overwhelmed by the number of services available. What helped them was finding a platform where they could compare prices from familiar exchanges all in one place–making their first swap fast and easy without the usual confusion.

Understanding DeFi Tokens and Decentralized Finance

DeFi flipped traditional finance on its head. Instead of banks and brokers, you have smart contracts on blockchain platforms. Decentralized finance lets you lend, borrow, trade, and earn interest–all without a central clearing authority.

The numbers tell the story. DeFi’s total value locked exceeded $120 billion in 2025. That’s billions of dollars locked in protocols that run themselves through code.

Popular DeFi Tokens:

Uniswap (UNI) governs the largest decentralized exchange. Holders vote on protocol changes.

Aave (AAVE) powers a lending protocol where you can deposit crypto to earn interest or borrow against your holdings.

Chainlink (LINK) connects smart contracts to real-world data through its oracle network.

DAI is a decentralized stablecoin created through smart contracts rather than a company holding US dollars.

DeFi Use Cases:

Yield farming lets you earn rewards by providing liquidity to decentralized exchanges.

Decentralized exchanges (DEXs) let you trade crypto assets without giving up control of your funds.

Lending protocols let you earn interest on your crypto or borrow without credit checks.

Stablecoin swaps happen instantly through automated market makers.

DeFi tokens represent the next evolution of financial services. They’re built on blockchain technology and run through smart contracts on platforms like the Ethereum network. No banks. No middlemen. Just code.

What Are the Types of Crypto Mining?

Mining is how new cryptocurrency gets created–but not all crypto uses mining anymore.

Three Main Mining Types:

1. Proof of Work (PoW) Mining

This is traditional Bitcoin mining. Miners use specialized computers called ASICs to solve mathematical puzzles. The first miner to solve the puzzle adds the next block to the Bitcoin network and earns newly minted Bitcoin plus transaction fees.

Litecoin and Bitcoin Cash also use the proof of work consensus mechanism. It’s energy-intensive but incredibly secure.

2. Proof of Stake (PoS) “Mining” (Staking)

This isn’t really mining–it’s staking. Instead of running mining hardware, you lock up tokens to help secure the network. Ethereum switched from proof of work to proof of stake to reduce energy consumption.

Validators get chosen based on how many tokens they stake. More stake = more chances to validate blocks and earn rewards. It’s like earning interest on a savings account.

3. Cloud Mining

Don’t want to buy expensive mining rigs? Cloud mining lets you rent mining power from companies that run the hardware. You pay a fee and get a share of the profits.

Cloud mining is easier for beginners but has higher fees and more scams. Be careful choosing providers.

Bitcoin specifically uses proof of work, which means you need serious computing power to mine it profitably. Most individuals now join mining pools rather than solo mining.

Conclusion

Cryptocurrency has come a long way since Bitcoin launched in 2009. What started as a single peer-to-peer electronic cash system evolved into an ecosystem of 25,000+ digital currencies, each serving different purposes.

The 4 main types of cryptocurrency–payment coins, platform tokens, stablecoins, and utility tokens–form the foundation of this digital economy. Bitcoin remains the largest crypto by market cap and the gateway for most beginners. Ethereum powers smart contracts and DeFi. Stablecoins bridge traditional finance and crypto. And tokens unlock countless specialized functions.

Understanding blockchain technology helps you see why this matters. The distributed ledger eliminates the need for central clearing authorities. Transactions happen peer-to-peer, 24/7, across borders, with minimal fees.

From Bitcoin’s 21 million supply cap to Ethereum’s smart contracts, from Tether’s stable value to Monero’s privacy features–each crypto asset brings something unique to the table.

Ready to start your crypto journey? When you’re ready to swap between Bitcoin, Ethereum, or stablecoins, Swapzone lets you compare rates from 18+ exchanges instantly. No registration required. Just find the best rate and swap.

Start comparing exchange rates now and discover why thousands of users trust Swapzone for their crypto swaps.