Instant swap services function as the primary solution for cryptocurrency users who need fast and convenient transactions. The platform offers a simple user interface which lets traders select trading pairs while showing them up-to-date market prices before placing their trades. The management system for crypto liquidity operations functions as a complex network which reveals its full structure when you analyze its internal components. The platforms function through two distinct systems. Certain platforms maintain reserves for liquidity provision, yet most operate as routers that search for external liquidity during trade execution.

Understanding this difference is essential for setting the right expectations and avoiding unpleasant surprises.

What Liquidity Really Means

In financial markets, liquidity functions as a measure to determine how quickly assets can be sold without triggering major price fluctuations. The swap platforms need to hold enough token reserves to enable instant trades at current market prices.

The system enables traders to execute trades instantly when reserves become available and slippage patterns start to show consistent patterns. The service obtains liquidity from outside sources which causes its performance to depend on current market conditions.

That distinction is at the heart of what many users perceive as “crypto fake liquidity.”

The Front-End Liquidity Effect

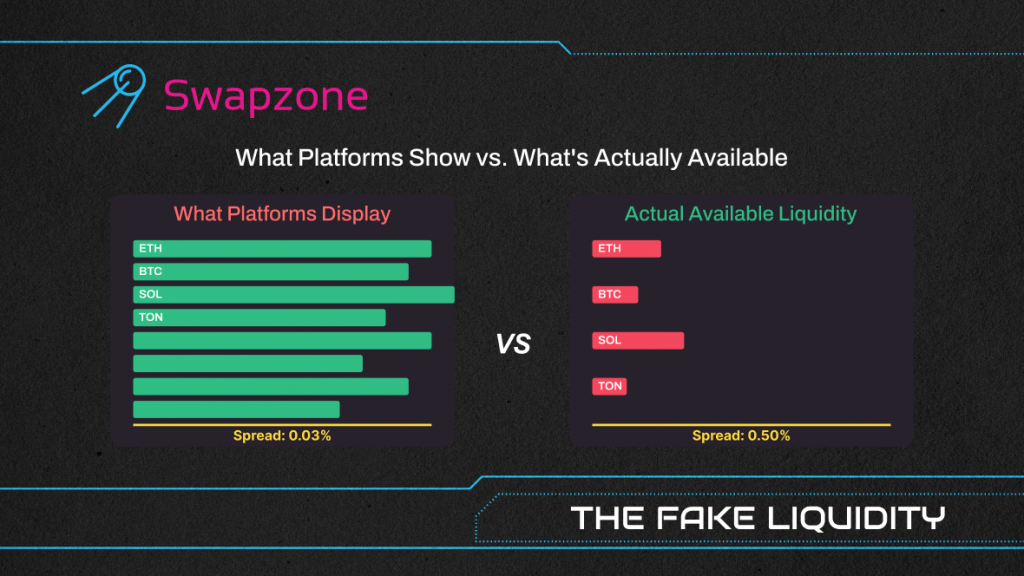

Many swap platforms operate as basic user interfaces in their current state. The platform displays a rate that appears fixed. It collects this price data from centralized exchanges, decentralized liquidity pools, and OTC partners. The platform needs to find the assets from other sources before the trade can proceed.

The method decreases service costs while defending against cost changes yet it creates a difference between digital display results and actual outcomes.Market instability leads to payment disruptions for users because it causes their transaction rates to fluctuate and their payments to be delayed or canceled.

Why This Model Became Widespread

The majority of routing models exist because of specific operational requirements. Organizations require substantial financial resources to create complex systems for storing reserves across various tokens and blockchains. They must also address extra security risks and follow additional regulatory requirements. By outsourcing liquidity, platforms avoid these costs and risks, while still providing users with the convenience of an “always-on” interface.

For users, the trade-off is straightforward: a polished interface with broad access to markets, but without guaranteed liquidity on the service’s balance sheet.

The Risks for Users

The trading community faces new uncertainty inherent to this operating structure. The offsetting trades executed during transactions could produce unexpected results. This happens due to market timing, price movements, and swap liquidity variations. Transparency is also a challenge: most services don’t clearly explain whether they operate reserves or rely entirely on external providers.

In the DeFi space, the concept of “crypto fake liquidity” goes further. Malicious actors create pools that seem to have liquidity but actually function as traps for executing rug pulls and stealing user funds. While that’s a more extreme scenario, it underscores the importance of knowing how liquidity is actually managed.

Can You Tell the Difference?

While a user’s ability to authenticate reserve holdings by centralized services is quite limited, there are some useful signals that can help users. For example, users can see their reserves inside decentralized protocols, since the smart contracts executing them are directly running on blockchain networks. Some centralized providers have reports of their proof of reserves, which show snapshots of holdings from cryptographic verification or auditor verification (however limited in scope).

Transparency over execution is also a very useful signal because the squeaky clean aggregators will indicate to which exchanges and pools they route in service of their clients. And if swaps are more often fast and accurate over more than one switch, then that may indicate stronger access for liquidity – otherwise it could be an indirect indicator too.

Ultimately, openness provides the best signal. When a platform describes their infrastructure in some detail, users can make better, informed choices about trust.

Where the Market Is Heading

The market shows positive development because it moves toward better transparency. The development of cross-chain liquidity protocols and decentralized aggregators into more advanced systems reduces the requirement for centralized middlemen. Different regulatory organizations, have enhanced their supervision of reserve adequacy. As a result, service providers must disclose extra details about their business operations.

People acquire modern technology skills through education, which leads to better knowledge acquisition. The competition between swap services will move away from interface design and fee structures toward transparency and reliability in liquidity provision.

Conclusion

What is often described as “crypto fake liquidity” is less a scandal and more a reflection of the trade-offs in how today’s swap services are built. Some individuals select outside liquidity sources because they want fast access to funds, yet others keep their own reserves to handle liquidity needs. Users need to learn about crypto liquidity operations and risk assessment methods and provider evaluation standards to get this information.

If your goal is to minimize those risks while still enjoying the convenience of instant swaps, it helps to use platforms that don’t just show numbers on the screen but also reveal where the liquidity comes from. The platform shows users their complete execution route through simultaneous provider comparisons to achieve this function. The trading platform Swapzone operates through this method, which displays real deals from multiple sources instead of fake options to provide users with total trading transparency.