Summarize with AI

You’re watching your Bitcoin climb, and then an unexpected expense hits. Selling your crypto means missing future gains and triggering capital gains taxes. That’s where crypto loans come in—a way to unlock liquidity from your digital assets without selling them.

Crypto lending involves using your cryptocurrency as collateral to borrow cash or stablecoins. Think of it like borrowing against your house, except your assets as collateral live on the blockchain. This guide covers what crypto loans are, how to get a loan, the best crypto loan platforms in 2025, and whether taking out a loan makes sense for you.

What Is a Crypto Loan? (Quick Answer)

A crypto loan lets you borrow money—typically in cash or stablecoins like USDT—by using your cryptocurrency as collateral. Crypto holders provide collateral to access funds without selling their digital assets as collateral.

The key difference from traditional types of loans? Most crypto lending platforms don’t run credit checks. Your loan approval depends entirely on your crypto collateral value rather than your credit score. You deposit your crypto holdings as collateral, receive the crypto loan amount based on a percentage of that value, and get your assets back once you repay with interest.

Crypto lending platforms come in two types: centralized crypto lending services (CeFi) that operate like traditional institutions, and decentralized lending platforms (DeFi) that use smart contracts and crypto lending protocols to automate the process without intermediaries.

How Does Crypto Lending Work?

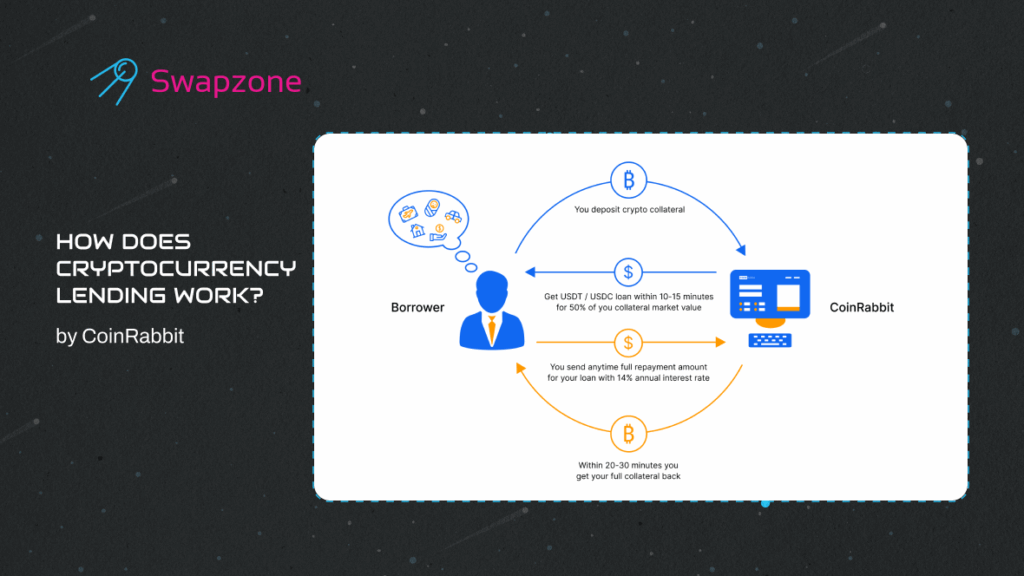

Getting a crypto-backed loan is surprisingly straightforward. Here’s the step-by-step breakdown of how crypto loans work:

Check Your Cryptocurrency Balance and Collateral

First, determine what crypto assets you have available to use as collateral. Best crypto loan platforms accept major cryptocurrencies like Bitcoin and Ethereum.

Here’s the catch: crypto loans require overcollateralization. To borrow $10,000, you might need to deposit $15,000-20,000 worth of crypto as collateral. This buffer protects lenders from cryptocurrency price volatility.

Choose a Crypto Lending Platform

When you apply for a crypto loan, you’ll choose between centralized and decentralized options. Centralized crypto loan platforms like Nexo, CoinRabbit, and YouHolder offer user-friendly interfaces and customer support but require trusting a third party.

Decentralized lending platforms use blockchain-based smart contracts and crypto lending protocols to facilitate borrow loans without intermediaries. These DeFi options offer transparency and lower fees but require more technical knowledge.

Not sure which crypto loan platforms in 2025 offer the best rates? Check out Swapzone’s loan comparison to evaluate different platforms side-by-side.

Deposit Your Collateral

Once you’ve chosen a platform, you’ll deposit your crypto as collateral. The platform calculates your Loan-to-Value (LTV) ratio—the percentage of your collateral’s value you can borrow.

For example, with a 50% LTV and $20,000 worth of Bitcoin collateral, you can borrow up to $10,000. Conservative lenders offer 30-50% LTV ratios, while aggressive platforms go up to 70% or higher.

Receive Your Loan

After depositing, funds are typically disbursed within hours. You’ll receive your crypto loan amount in either fiat currency or stablecoins like USDT or USDC.

Interest rates for crypto loans vary from 5% to 15% APR depending on the platform and current crypto market conditions. The best part? No credit check required.

Make Payments and Manage Your Loan

Repayment terms differ across platforms. Some require monthly interest payments, while others let you repay everything at the loan term’s end. Many offer flexibility—pay early without penalties or extend your loan.

Monitor your LTV ratio closely. If your collateral’s value drops due to market volatility, your LTV increases, potentially triggering a margin call.

Reclaim Your Collateral

Once you repay the loan with interest, the platform releases your crypto holdings back to you. The entire process takes just days—much faster than traditional loans.

Types of Crypto Lending Platforms

Understanding different crypto loan platforms helps you choose the right fit.

Centralized vs Decentralized Crypto Lending

Centralized crypto lenders (CeFi) operate like traditional banks. A company holds your collateral and manages the loan process with customer support. They’re user-friendly but require trusting a single entity with your assets.

Decentralized lending platforms (DeFi) use smart contracts and crypto lending protocols to automate everything. Your collateral goes into lending pools managed by code. DeFi offers transparency and lower fees but requires more technical knowledge and carries smart contract risks.

Collateralized vs. Crypto Loans Without Collateral

Most crypto loans are collateralized loans where you provide cryptocurrency as security. These types of loans are safer and more accessible.

Crypto loans without collateral are extremely rare. The few that exist include flash loans (unique to DeFi, borrowed and repaid within a single transaction) and institutional credit lines after rigorous verification.

For practical purposes, when you apply for a crypto loan, expect to provide collateral.

Crypto Loans vs Traditional Lending: What’s the Difference?

How do crypto-backed loans compare to conventional financing?

Speed: Traditional loans take days or weeks. Crypto loan platforms approve loans in minutes once you deposit collateral.

Credit checks: Banks scrutinize credit history and employment. Crypto lenders only care about your collateral value.

Interest rates: Crypto loans often offer competitive rates (5-15% APR) compared to unsecured personal loans (10-36% APR), but they’re typically higher than secured traditional loans due to cryptocurrency volatility.

Collateral risk: Traditional collateral (houses, cars) changes value slowly. Cryptocurrency can swing 20% in a day, making crypto-backed loans riskier.

Regulation: Traditional lending has established consumer protection. The crypto lending industry is still developing its regulatory framework.

Pros and Cons of Crypto Lending

Let’s break down the real advantages and risks of crypto lending.

Benefits of Crypto-Backed Loans

Retain ownership: Keep exposure to potential crypto price appreciation. If Bitcoin doubles after taking out a loan, you benefit from those gains.

Quick funding: Crypto lending platforms disburse funds within hours, perfect for time-sensitive needs.

No credit check: Bad credit doesn’t matter. Your crypto holdings are your qualification.

Tax advantages: Borrowing isn’t typically taxable, unlike selling crypto assets which triggers capital gains.

Better rates: Compared to credit cards or unsecured personal loans, crypto-backed loans may offer lower interest rates.

Risks of Crypto Lending

Volatility: The biggest risk. If your crypto collateral value drops significantly, you’ll face margin calls or liquidation. A 30% Bitcoin crash could wipe out your buffer overnight.

Margin calls: When your LTV crosses thresholds, lenders require you to add more crypto as collateral or repay part of the loan. Fail to act, and they’ll automatically sell the crypto to cover the debt.

Platform security: Centralized platforms are hacking targets. Smart contracts can have vulnerabilities.

Asset inaccessibility: Your collateral is locked during the loan term. You can’t sell even if you spot opportunities.

Minimums: Many platforms set high minimums ($500-$5,000), making small loans impractical.

Understanding Margin Calls and Liquidation

Margin calls and liquidation are where crypto loans get risky.

Crypto loan platforms set specific thresholds:

- Initial LTV: Maximum you can borrow at start (e.g., 50%)

- Margin call LTV: Warning level to add collateral (e.g., 70%)

- Liquidation LTV: Automatic collateral sale point (e.g., 85%)

Example: You deposit $20,000 in Bitcoin and borrow $10,000 at 50% LTV. If Bitcoin drops 30%, your collateral is now $14,000, pushing LTV to 71%. You get a margin call requiring you to add more cryptocurrency or repay part of the loan within 24 hours. If Bitcoin keeps falling, the platform liquidates your collateral.

Monitor your LTV religiously and maintain a safety buffer. Never borrow at maximum LTV.

How to Choose a Crypto Lending Platform

Not all crypto loan platforms are equal. Evaluate these factors:

Interest rates: Shop around—rates vary significantly between best crypto loan platforms in 2025.

Fees: Watch for origination, withdrawal, late payment, and liquidation fees.

Repayment terms: Need flexibility or prefer set schedules? Some allow early repayment without penalties.

LTV maximums: Higher LTV means borrow more but increases liquidation risk. Conservative 30-50% LTV is safer.

Supported currencies: Ensure the platform accepts your current crypto holdings.

Platform risks: Research security measures, insurance, and track record.

Liquidation policies: Understand exactly when and how liquidation occurs.

Compare your options at Swapzone’s crypto loan comparison to evaluate best crypto loan platforms like Nexo, CoinRabbit, and YouHolder side-by-side.

Alternatives to Crypto Loans

Crypto-backed loans aren’t your only option when you need liquidity.

Sell Your Crypto

Sometimes selling makes more sense than taking out a loan. If you don’t believe in long-term potential or prices are near peaks, sell the crypto outright. Just remember: selling triggers taxable capital gains, and you’ll miss out if prices rise.

Take Out a Traditional Personal Loan

Good credit? A personal loan might offer better terms without risking your crypto holdings. Traditional loans provide stable schedules and avoid liquidation risk but require credit checks and longer processing.

Use Crypto for Payments

Why borrow when you can spend cryptocurrency directly? Check out who accepts Bitcoin to use digital assets without converting to fiat.

Other Options

- Credit cards with 0% intro APR for excellent credit holders

- DeFi lending protocols through decentralized platforms to earn interest instead of borrowing

- Buy more crypto with stablecoins rather than taking loans

Tax Considerations for Crypto Loans

Taking out a crypto loan isn’t taxable. You’re borrowing money, not selling cryptocurrency, so no capital gains apply.

Liquidation is taxable. If your collateral gets liquidated, that’s treated as selling your crypto assets. You’ll owe capital gains taxes on any appreciation.

Repaying with fiat or stablecoins isn’t taxable—you’re paying back borrowed money.

Tax rates depend on holding period. Assets held over a year qualify for lower long-term capital gains rates. Always consult with a crypto tax professional for your specific situation.

Making Smart Decisions About Crypto Lending

Crypto loans offer powerful access to liquidity without selling digital assets. When you apply for a crypto loan, you get fast funding, no credit checks, and maintain exposure to potential gains. But the risks of crypto lending are real—market volatility, liquidation threats, and platform security concerns.

Before taking out a loan, assess your risk tolerance honestly. Can you handle a 50% price drop? Do you have backup funds to add more crypto as collateral during margin calls? Understanding how much crypto you need to secure the loan and monitoring your LTV ratio is critical.

If crypto lending makes sense for your situation, choose your platform carefully. Compare interest rates, understand liquidation policies, and never borrow at maximum LTV.

Ready to explore the best crypto loan platforms? Visit Swapzone’s crypto loan comparison to find the right platform for your needs. Compare rates from Nexo, CoinRabbit, YouHolder, and other trusted providers—all in one place. Your cryptocurrency can work for you without selling a single token.