The artist formerly known as Kanye West launches a meme coin and hits $3 Billion in market cap before crashing.

The crypto world just saw one of the wildest celebrity token launches ever. Kanye West, now formally known as Ye, dropped his YZY token with promises of changing digital payments. But what started as a vision for “A NEW ECONOMY, BUILT ON CHAIN” turned into a cautionary tale about insider trading and market manipulation.

Within hours of launch, the YZY token went to a billion market cap and then crashed. CoinGecko reports that while early investors made millions, retail buyers suffered significant losses. This Solana-based memecoin is making waves in both the crypto world and the pop culture world. Here’s what you need to know.

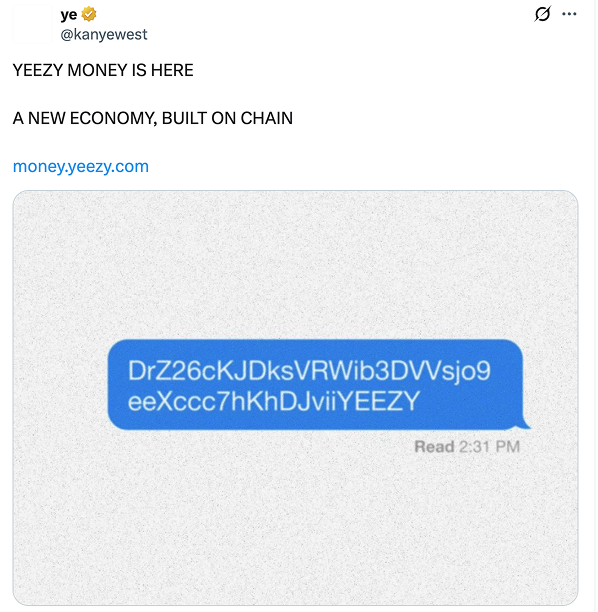

Kanye West didn’t just make another meme coin. His X (formerly Twitter) post said, “Yeezy money is here” and “A NEW ECONOMY, BUILT ON CHAIN.” This release wasn’t just meant to be speculation; it was meant to be a whole financial system.

The YZY token is the basis for three products that work together:

- YZY Token: The memecoin on Solana that you can use for any transaction

- Ye Pay: A crypto payment processor that says its fees are lower than 3.5%.

- YZY Card: A debit card that doesn’t need a bank account to use around the world

CoinGecko says that the token’s price shot up by 6,800% and reached a high of $3.16 and a market cap of $1 billion in just a few hours. The formerly Kanye West artist shared a self-filmed video confirming the launch, but some questioned its authenticity.

Breakdown of Token Distribution

Lock Period for the Allocation Percentage Amount Yeezy Investments, LLC 70% of 700 million YZY in 24 months (Jupiter Lock) Public Sale 20% of 200 million YZY Immediate Liquidity Pool 10% of 100 million YZY Available

The aspiration for a “NEW ECONOMY, BUILT ON CHAIN” swiftly transformed into a distressing reality as on-chain data exposed extensive insider trading. Crypto investigators uncovered evidence that connected wallets had advance knowledge of the YZY token contract address.

The Smoking Gun Evidence

Wallet 6MNWV8 became the poster child for this scandal. Analysis shows this wallet:

- Knew the contract address in advance and even attempted purchases before launch

- Spent 450,611 USDC to buy 1.29 million YZY at around $0.35 each

- Sold 1.04 million YZY for 1.39 million USDC

- Kept 249,907 tokens worth around $600,000

- Total profit: Over $1.5 million in hours

But that wasn’t the only suspicious activity. Another whale investor put $2.28 million into the YZY token and saw unrealized gains of $6 million almost instantly. This wallet bought 2.67 million YZY tokens using 12,170 SOL.

Anti-Sniping System Failure

Ye’s team claimed they implemented an anti-sniping system by deploying 25 different contract addresses simultaneously, with only one randomly selected as the official YZY token. The idea was to confuse bot traders and create a fairer launch.

But the evidence shows this system failed:

- Insiders still accessed the correct contract address

- Multiple wallets prepared funds in advance

- Coordinated buying patterns emerged immediately at launch

- Retail investors were at a disadvantage despite anti-bot measures

The high didn’t last long. What goes up fast in crypto comes down even faster. The YZY token had one of the most epic price drops in meme coin history.

By the Numbers: The Big Fall

- Peak Price: $3.16 YZY

- Peak Market Cap: $3 billion (for a hot second)

- Current Price: $0.86-$1.00

- Market Cap Drop: From $3 billion to $300 million

- Total Decline: 70%+ from peak in under 24 hours

According to CoinGecko, early retail buyers got crushed. One wallet (6ZFnRH) bought 996,453 YZY for 1.55 million USDC at $1.56 and sold at $1.06 for 1.05 million USDC—losing $500,000 in under 2 hours.

Warning Signs Investors Missed

Looking back, there were several red flags that retail investors ignored:

- Ye’s previous statement: “Coins prey on fans with hype.”

- Single-sided liquidity pool: Only YZY tokens, no USDC pairing

- 70% insider allocation: Massive concentration risk

- No proven utility: No Ye Pay or YZY Card at launch

The primary concern was the lack of single-sided liquidity. This setup allows devs to add and remove liquidity in ways that let them cash out, similar to the LIBRA token that recently collapsed in Argentina.

Kanye West’s YZY token is not operating in isolation. It’s following a pattern of celebrity-backed crypto projects that always end in disaster for regular investors.

Recent Celebrity Token Disasters

Trump’s TRUMP Token:

- Originally asked for 80% allocation (same as Ye’s ask)

- Same insider-heavy distribution model

- Massive volatility and retail losses

Kim Kardashian’s EthereumMax:

- SEC fines of $1.26 million for undisclosed promotion

- Class-action lawsuits from investors

- 98% price collapse after celebrity hype

Argentina’s LIBRA Scandal:

- President Javier Milei’s endorsed coin

- Pump-and-dump scheme allegations

- Same single-sided liquidity as YZY

What Makes YZY Different?

Despite the patterns, Ye’s project claims to offer real utility beyond pure speculation:

- Ye Pay: Actual payment processing infrastructure

- YZY Card: Physical debit card for crypto spending

- Brand Integration: Connection to existing Yeezy products

- Long-term Vision: Building sustainable crypto ecosystem

But none of these utilities were functional at launch, so YZY is just another speculative meme coin riding on celebrity hype.

As crypto exchange SwapZone, seen this before. The YZY token launch is what we’re calling YZYmani—a clever play on words meaning this is “easy money” for insiders while being anything but easy for retail investors.

Technical Issues Was Found

Our analysis uncovered several technical difficulties:

Failure of the Anti-Sniping System: The deployment of 25 contracts was intended to create equal opportunities. Instead, it created a false sense of security while insiders still got early access to the correct contract address.

Centralization Hypocrisy: According to the website, YZY Money is designed to empower you by eliminating centralized authority. But @LDNCryptoClub data shows the six largest address holders control 90.38% of the token supply. This coin is one of the most centralized tokens we’ve seen.

Liquidity Structure Issues: The single-sided liquidity pool (only YZY tokens, no USDC) is a dangerous situation. Developers can manipulate prices by adding or removing liquidity, just like the failed LIBRA token that recently collapsed.

SwapZone Trading Availability

Despite the risks, the YZY token is now available for trading and exchanging on multiple platforms, including SwapZone. Our platform allows you to:

- Monitor real-time rates across multiple exchanges

- Compare prices to get the best execution

- Track market movements with our advanced charting tools

- Set price alerts for better timing

Remember: Always trade responsibly and never invest more than you can afford to lose, especially with high-risk assets like celebrity meme coins.

Is “A NEW ECONOMY, BUILT ON CHAIN” cool? It is. The question is whether the YZY token can deliver or if it’s just another celebrity cash grab in disguise.

High-Risk Factors

- 70% Insider Control: Ye and his team control most of the tokens

- Proven Manipulation: On-chain evidence of insider trading

- Regulatory Risks: SEC investigation possible given the evidence

- Celebrity Token History: 90%+ failure rate

- Technical Vulnerabilities: Single-sided liquidity makes it easy to manipulate

Potential Upside Scenarios

- Payment Ecosystem Growth: Ye Pay could achieve significant adoption.

- Yeezy Brand Integration: Existing fashion empire provides utility foundation

- Solana Ecosystem Benefits: Fast, cheap transactions enable real-world use

- Celebrity Influence: Kanye West’s huge following drives adoption

How to Participate Safely (If You Choose To)

If you decide to trade YZY tokens despite the risks:

- Use reputable wallets: Phantom or Solflare for Solana tokens

- Trade on established platforms: Bitget, SwapZone and other verified exchanges

- Set strict stop-losses: Limit potential losses to 5-10% of the portfolio.

- Monitor insider activity: Watch large wallet movements for exit signals

- Never invest emergency funds: Only use money you can completely lose

The future of “A NEW ECONOMY, BUILT ON CHAIN” depends on Ye being able to turn his vision into reality. Several key factors will decide success or failure.

Upcoming Milestones

Ye Pay Launch: The payment processor needs to get real merchant adoption. Success here could justify the billion-dollar valuations. Failure means YZY is just another meme coin.

YZY Card Rollout: Physical debit cards require extensive regulatory compliance. The waitlist is active, but delivering functional cards globally is a massive logistical challenge.

SEC Investigation Risk: With evidence of insider trading mounting, regulatory scrutiny is inevitable. The project’s success hinges on how Ye and his team manage this situation.

Expert Predictions

Divergent opinions exist among crypto analysts regarding YZY’s future prospects:

- Optimists point to the integrated ecosystem and Ye’s brand power

- Skeptics note the pattern of celebrity token failures and bad launch metrics

- Realists say wait for actual utility before investing big

Bottom Line

Kanye West’s vision of “A NEW ECONOMY, BUILT ON CHAIN” is real innovation in celebrity crypto. Unlike pure meme coins, YZY has real utility through Ye Pay and YZY Card.

But the execution has been terrible. Insider trading allegations, concentrated token distribution, and technical vulnerabilities kill the revolutionary potential. Until Ye fixes these fundamental issues and delivers working products, the YZY token is a high-risk speculation, not a legitimate investment.

The crypto space needs more real innovation, not more celebrity cash grabs. Ye has the chance to set a new standard—but only if he prioritizes transparency and utility over quick profits.

Disclaimer: This content is not financial advice. Cryptocurrency investments are high risk. For all your research, consult financial professionals before making investment decisions.