Bitcoin ETFs launched in January 2024, bringing crypto into traditional brokerage accounts. BlackRock’s IBIT now holds $67.6 billion across 662,707 Bitcoin, competing with Vanguard’s VOO (0.03% expense ratio, $680 billion AUM) and SPDR’s GLD (0.40% fee, $137 billion in gold). Should portfolios include Bitcoin etfs alongside S&P 500 index fund holdings and Nasdaq exposure, or does gold provide better diversification? This comparison breaks down fees, performance, and risk across crypto and traditional etfs.

What Are Crypto ETFs?

Crypto ETF products like IBIT track Bitcoin’s spot price by holding actual cryptocurrency in secure vaults rather than futures contracts. The SEC approved 11 spot Bitcoin etfs on January 11, 2024, following a decade-long industry push. Each share represents fractional Bitcoin ownership held by custodians like Coinbase Prime ($245 billion in custody).

Unlike futures-based funds from 2021, spot etfs provide direct bitcoin exposure without rolling costs or tracking errors. You buy shares through standard brokerage accounts where you’d trade stock, accessing crypto without managing wallets or navigating cryptocurrency exchanges. IBIT charges 0.25% annually, while competitors range from 0.20% to 1.5% in fees.

Crypto vs Traditional ETFs: The Numbers

The fee gap between crypto and traditional equity etfs is striking. Vanguard’s S&P 500 ETF (VOO) charges just 0.03% annually–that’s $3 per year on a $10,000 investment. Bitcoin ETFs at 0.25% cost $25 on the same amount. The Invesco QQQ trust tracking the Nasdaq-100 sits in the middle at 0.18% after its recent restructuring, while gold etfs like GLD charge 0.40%.

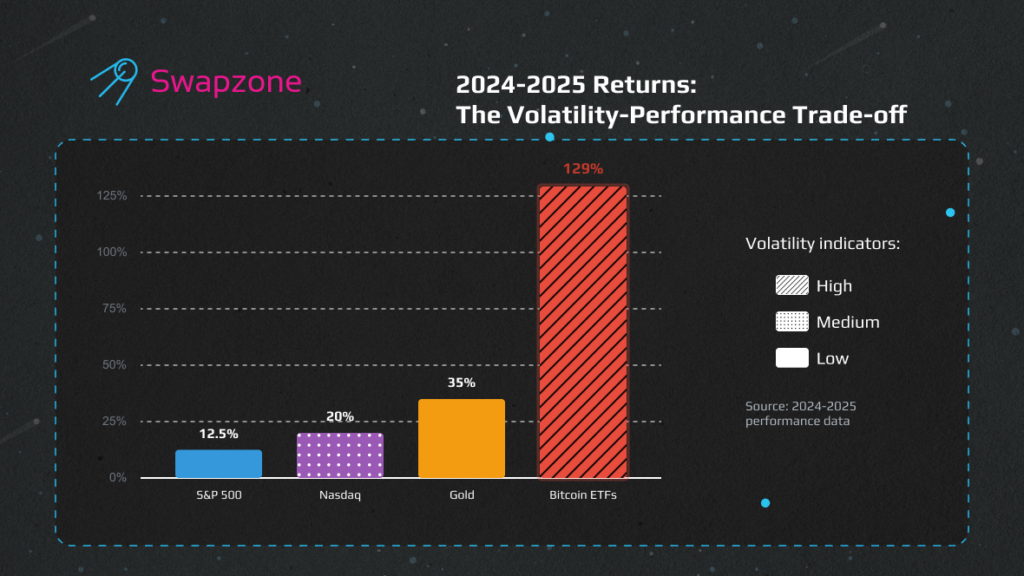

Performance tells a different story. Bitcoin delivered 129% returns in 2024, crushing traditional benchmarks. The nasdaq returned roughly 20% thanks to its 54.7% technology concentration, the S&P 500 posted 10-15% gains across its diversified 500-company portfolio, and gold climbed 35% to nearly $4,000 per ounce. But volatility matters–Bitcoin’s price swings dwarf everything else. Where the S&P 500 index offers stable exposure to companies like Nvidia, Apple, and Microsoft with dividend income around 1.5%, Bitcoin ETFs provide zero dividends and can drop 20-30% in weeks during market stress.

The ishares Bitcoin Trust holds only cryptocurrency, while VOO spreads risk across healthcare, financials, energy, and consumer sectors. QQQ concentrates 54.7% in technology stocks, creating leverage to innovation trends but higher sensitivity to tech selloffs. This structural difference means crypto etfs act more like individual stock positions than diversified funds.

Gold vs Bitcoin: The 2025 Reality

Gold and Bitcoin both claim “store of value” status, but 2025 data shows different roles. Gold gained 35% in 2024 while Bitcoin surged 135%, yet gold outperforms during geopolitical crises. Duke University research confirms gold maintains stronger crisis-hedge properties–when markets panic, gold attracts flows while Bitcoin sells off with equities.

Their correlation stayed tight from 2022-2024, but broke down early in 2025. Bitcoin’s 21 million coin cap creates absolute scarcity, while gold’s supply increases 1.5-2% annually through mining. This makes Bitcoin theoretically better against inflation, but gold’s 5,000-year track record wins during uncertainty.

GLD offers physical gold in JPMorgan vaults, traded through brokerage accounts without handling metal. Bitcoin etfs provide similar convenience for cryptocurrency. Many portfolios hold both: gold for stability during bond or currency risk, Bitcoin for upside during liquidity expansion.

Traditional Market Access for Crypto Investors

Crypto traders exploring traditional markets find the S&P 500 remarkably simple. The vanguard S&P 500 etf (VOO) or SPY give ownership in America’s 500 largest companies–tech giants to healthcare to energy. You’re buying equity that generates profits, pays dividends, and grows with the economy. The expense ratio at 0.03-0.09% barely impacts returns.

These index funds require only a brokerage account at Fidelity, Schwab, or Interactive Brokers. No blockchain networks or gas fees. Buy fractional shares, set up automatic investing, hold in tax-advantaged accounts. The dividend yield around 1.5% provides income Bitcoin can’t match, and volatility stays far below cryptocurrency levels.

QQQ skews toward growth–100 non-financial companies heavy in technology. It’s delivered 20.30% annualized over 10 years versus the S&P’s 15.27%, but with nasdaq drawdowns during tech corrections. For crypto investors used to 50% swings, QQQ’s volatility feels moderate.

Which ETF Fits Your Strategy?

Your risk tolerance determines the right mix. Conservative investors seeking steady capital appreciation stick with VOO–its 0.03% fee and diversified portfolio across all major sectors create a foundation that compounds reliably. You’re not getting 100% years, but you’re avoiding 50% drawdowns. The best etfs for wealth preservation prioritize capital safety over explosive growth.

Growth-focused portfolios lean toward QQQ and Bitcoin exposure. The Nasdaq 100’s technology concentration captures innovation trends in AI, cloud computing, and digital transformation. Bitcoin etfs add a non-correlated asset that can rally when traditional markets struggle with inflation or monetary debasement. Allocating 5-10% to crypto through regulated etfs gives upside exposure while keeping most capital in proven equity markets.

Inflation hedges split between gold and Bitcoin. GLD provides time-tested protection against currency devaluation with minimal leverage to equity market moves. Bitcoin offers a modern alternative–fixed supply, global accessibility, growing institutional adoption–but trades more like a risk asset than a safe haven. A diversified portfolio might hold 60% equities (VOO/QQQ split), 30% fixed income, 5% gold, and 5% Bitcoin, adjusting based on age and goals.

Final Thoughts

Crypto etfs like IBIT offer traditional investors regulated Bitcoin exposure with 0.25% fees through standard brokerage accounts, while S&P 500 funds like VOO provide stability at just 0.03%, Nasdaq’s QQQ targets tech growth at 0.18%, and gold etfs like GLD hedge inflation at 0.40%. Each serves different risk profiles–Bitcoin for speculation, S&P for steady growth, Nasdaq for technology leverage, gold for crisis protection.

For crypto investors seeking traditional market diversification or looking to convert between assets, Swapzone makes it simple to swap Bitcoin, exchange Ethereum, and move between 4,500+ cryptocurrencies without registration. Whether you’re converting BTC to USDT or building positions across different blockchain networks, the platform aggregates rates from 28+ partner services to get you the best deal.

Compare exchange rates and start your next crypto swap on Swapzone.