Want to invest in Microsoft and Meta stocks using cryptocurrency without opening a brokerage account? Tokenized stocks make it possible to buy shares of the world’s largest tech companies using USDT, trading 24/7 from anywhere in the world.

The simplest way to buy Microsoft and Meta tokenized shares with USDT is through Swapzone, which aggregates 45+ xStocks from 18 partner exchanges without requiring registration. Backed Finance issues MSFTx and METAx tokens on Solana’s blockchain with 1:1 backing by real shares held in Swiss-regulated custody since June 30, 2025. Current prices are approximately $503 for Microsoft xStock and $619 for Meta xStock, tradeable 24/7 with fractional ownership starting from $1.

This guide walks you through everything you need to know about buying Microsoft and Meta tokenized shares using USDT, from understanding what xStocks are to completing your first trade securely.

What Are Tokenized Stocks (xStocks)?

Tokenized stocks, also called xStocks, are blockchain-based tokens that represent real shares of publicly traded companies. Each xStock is an SPL token on Solana’s blockchain, backed 1:1 by actual company stock held in regulated custody by Backed Finance AG, a Swiss firm operating under the Swiss DLT Act since 2021.

When you buy a Microsoft xStock (MSFTx), Backed Finance holds one real Microsoft share in a bankruptcy-remote custody account to back your token. The same applies to Meta xStock (METAx) and 60+ other stocks and ETFs available through the platform. This separates xStocks from synthetic assets that merely track prices without holding actual equity.

Backed Finance launched xStocks on June 30, 2025. Household names like Microsoft, Meta, Apple, Tesla, and Nvidia became tradable on Solana. The tokens use Chainlink oracles for real-time price accuracy. Solana’s Token Extensions enable compliance features like automatic dividend reinvestment through rebasing.

How xStocks Work on Solana

Backed Finance purchases real shares through traditional brokers, deposits them with regulated custodians, and mints exactly one SPL token for each share held. This strict 1:1 ratio means 1 MSFTx equals 1 Microsoft share, and 1 METAx equals 1 Meta share. The blockchain enables instant settlement (T+0) instead of the traditional T+2 settlement period, with trades executed 24/7 including weekends.

Why Buy Microsoft and Meta Tokenized Shares?

Meta and Microsoft represent two of the largest software and technology companies in the world, making them attractive investment options for both traditional and crypto investors. MSFTXSOL (Microsoft tokenized stock) gives you exposure to the company’s cloud computing, enterprise software, and AI initiatives, while Meta xStock provides access to the social media giant behind Facebook, Instagram, and WhatsApp.

Microsoft Stock Tokenized (MSFT xStock)

Microsoft tokenized stock (MSFTx) currently trades around $503-505 USD with a market cap between $1.4M-$7.4M and 24-hour trading volume ranging from $3,579 to $99,400. The token tracks Microsoft Corporation’s real share price, giving you price exposure to one of the world’s most valuable tech companies without traditional brokerage requirements.

MSFTx is available on Solana as an SPL token with the contract address XspzcW1PRtgf6Wj92HCiZdjzKCyFekVD8P5Ueh3dRMX. You can purchase fractional amounts starting from just $1, making Microsoft shares accessible to investors with any budget.

Meta Stock Tokenized (META xStock)

Meta tokenized stock (METAx) trades around $619 USD with a 24-hour trading volume of approximately $18.4 million. The token exists as both Solana SPL and Ethereum ERC-20 tokens, providing cross-chain flexibility. Meta Platforms Inc. owns and operates Facebook, Instagram, Threads, WhatsApp, and develops VR/AR technologies through Reality Labs, giving token holders exposure to multiple revenue streams.

Microsoft and Meta xStock Price Today

The current Microsoft xStock price today sits at approximately $503.62 USD, tracking the real-time value of MSFT shares traded on traditional exchanges. Meta xStock price today is around $619.73 USD, mirroring META stock performance. These prices update continuously through Chainlink oracle feeds that verify data from multiple sources before updating on-chain values.

Unlike traditional stock markets limited to 9:30 AM-4:00 PM Eastern Time on weekdays, xStock prices remain active 24/7. This means you can react to breaking news at 3 AM Sunday or adjust your portfolio based on Asian market movements before US exchanges open Monday morning. The share price for both Microsoft and Meta xStocks reflects real market conditions even when Wall Street closes.

How to Buy Microsoft xStock with USDT on Swapzone

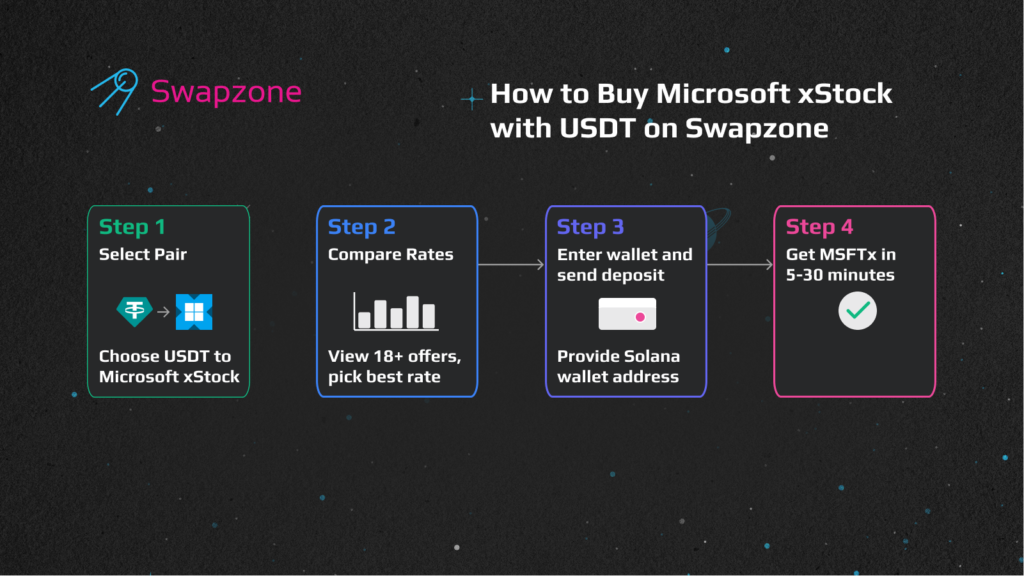

Buying Microsoft shares with USDT on Swapzone takes just minutes and requires no account registration or KYC verification. The platform aggregates rates from 18+ exchange partners, ensuring you get competitive conversion rates for your crypto-to-stock swap.

Step 1: Visit Swapzone and Select Your Pair

Navigate to Swapzone and select USDT as your sending currency. Choose Microsoft tokenized stock (xStock) as the currency you want to receive. Enter the amount of USDT you want to spend or the amount of MSFTx you want to buy.

Step 2: Compare Rates and Choose Best Offer

Swapzone displays multiple offers from partner exchanges with different rates, processing speeds, and service ratings. Sort by “Best Rate” to find the most favorable USDT to MSFTx conversion. Each offer shows the exact amount of Microsoft xStock you’ll receive, estimated processing time (typically 5-30 minutes), and any network fees.

One user shared their experience: “I’m new to cryptocurrency, and I’m always frightened by the choice of services. I really liked that everything is in one place here, and you can choose from familiar names and compare prices between them. The exchange took place fast and without any problems.”

Step 3: Enter Wallet Address and Complete Swap

Provide your Solana wallet address where you want to receive MSFTx tokens. You’ll need a Solana-compatible wallet like Phantom or Solflare to hold your tokenized stock. Swapzone generates a deposit address for your USDT payment. Send the exact USDT amount to this address using your preferred wallet.

Step 4: Receive Your Microsoft xStock

The exchange processes your transaction, and you’ll receive MSFTx tokens directly to your Solana wallet within 5-30 minutes on average. The entire process happens without registration, and you maintain complete self-custody of your tokenized Microsoft shares throughout.

How to Buy Meta xStock with USDT on Swapzone

The process for buying Meta tokenized stock with USDT mirrors the Microsoft purchase steps. Visit Swapzone, select USDT as your payment method, and choose Meta tokenized stock (xStock) as your receiving asset. The platform compares exchange rates across multiple providers to help you find the best deal.

Meta xStock supports fractional ownership, meaning you can invest $10, $50, or $100 worth rather than buying a full share worth $619. This accessibility makes investing in Meta shares possible for crypto holders with smaller budgets. After comparing rates and selecting your preferred exchange partner, deposit funds to the provided address and receive METAx tokens directly to your Solana wallet.

Benefits of Investing in Microsoft and Meta Tokenized Shares

Tokenized stocks offer several advantages over traditional share purchasing methods, particularly for crypto-native investors and global users without access to US brokerage accounts.

24/7 Trading and Global Access

Traditional stock markets close at 4 PM Eastern time and remain shut on weekends. Microsoft and Meta xStocks trade continuously, allowing you to buy Microsoft or trade Meta shares at midnight Saturday or adjust positions during European market hours. This constant liquidity means you can react immediately to earnings reports, product launches, or market news regardless of time zones.

Fractional Ownership and Low Entry Barrier

While a single Berkshire Hathaway stock costs hundreds of thousands of dollars, xStocks enable fractional ownership from $1. You can build a diversified portfolio with small amounts of Microsoft, Meta, Apple, and Alphabet without laying out thousands in capital. This democratizes access to blue-chip equities for investors worldwide, whether you’re depositing $5 or $5,000.

Instant Settlement and DeFi Integration

Blockchain transactions settle instantly compared to traditional T+2 settlement periods. You can swap your Microsoft shares for other crypto assets, use them as collateral in DeFi protocols like Kamino Finance, or provide liquidity on Raydium to earn trading fees. These possibilities don’t exist in traditional brokerages where your assets remain locked in custodial accounts.

Are Microsoft and Meta xStocks Safe to Buy?

Backed Finance operates under strict Swiss DLT Act regulations and EU MiFID II directives, providing a compliant framework for tokenized securities. The company holds all underlying Microsoft and Meta shares in bankruptcy-remote custody accounts at regulated financial institutions, protecting token holders even if Backed Finance faces financial trouble.

Chainlink’s Proof of Reserve system allows anyone to verify that tokens maintain 1:1 backing with real shares. This transparency and regulatory compliance make xStocks more secure than unregulated synthetic assets. However, smart contracts can contain bugs despite audits, and you’re responsible for managing your own private keys securely.

The US Securities and Exchange Commission clarified in July 2025 that tokenized securities remain securities requiring the same regulatory treatment as traditional stocks. Currently, xStocks aren’t available to US residents, Canadians, or UK citizens due to regulatory restrictions in those jurisdictions.

Risks and Considerations When Buying Tokenized Stocks

While tokenized stocks offer exciting possibilities, they carry specific risks that investors should understand before buying. You don’t receive voting rights or shareholder privileges with xStocks–your exposure is purely tied to stock price movements. Dividends are automatically reinvested through rebasing rather than paid in cash, which may have different tax implications depending on your jurisdiction.

Price depegging can occur when US markets close but xStocks continue trading 24/7, creating temporary discrepancies between tokenized and traditional share prices. Regulatory changes could force delisting or impose new compliance requirements. Additionally, smaller tokenized stocks may have limited liquidity, causing wider spreads and slippage on larger trades.

Other Platforms to Buy Microsoft and Meta Tokenized Stocks

Beyond Swapzone’s aggregator model, several platforms offer direct access to Microsoft and Meta xStocks. Kraken launched 60 xStocks on July 1, 2025, with 24/5 trading through their centralized exchange platform. They require KYC verification and block users from the US, Canada, and UK, but provide a familiar interface for traditional crypto traders.

Bybit offers both centralized spot trading and decentralized access through their platform, with plans to support dividend trading in the future. For fully decentralized options, Solana DEXes like Jupiter and Raydium let you swap xStocks and stablecoins directly on the blockchain without identity verification. Kamino Finance provides lending markets where you can borrow against your Microsoft or Meta xStock holdings as collateral.

Frequently Asked Questions

Can I Trade Microsoft and Meta xStocks 24/7?

Yes, both Microsoft and Meta tokenized stocks trade 24 hours a day, 7 days a week on blockchain platforms. Unlike traditional exchanges that close at 4 PM Eastern and stay shut on weekends, xStocks remain actively tradeable at all times.

Do I Need KYC to Buy xStocks on Swapzone?

No, Swapzone doesn’t require KYC verification or account registration. You can swap USDT for Microsoft or Meta xStocks anonymously by simply providing a Solana wallet address to receive your tokens. However, some centralized platforms like Kraken and Bybit do require identity verification.

What’s the Minimum Investment for Tokenized Stocks?

You can start buying tokenized stocks with as little as $1 thanks to fractional ownership. Whether you want to invest $5 in Microsoft or $50 in Meta, blockchain technology enables precise fractional amounts that traditional brokerages don’t support.

Can I Convert My xStocks Back to USDT?

Absolutely. Swapzone supports bidirectional swaps, allowing you to convert Microsoft or Meta xStocks back to USDT, Bitcoin, Ethereum, or other cryptocurrencies whenever you want. The same aggregator model helps you find the best rates for selling your tokenized shares.

Are Tokenized Stocks the Same as Owning Real Shares?

Not exactly. While xStocks provide price exposure to real Microsoft and Meta shares through 1:1 backing, you don’t receive voting rights, proxy materials, or direct ownership of the underlying equity. You’re technically a token holder with a claim to the value of the stock held in custody by Backed Finance.

Start Buying Microsoft and Meta Shares with USDT Today

Buying Microsoft and Meta tokenized shares with USDT opens access to blue-chip tech stocks without the barriers of traditional finance. Swapzone makes the process simple by aggregating 45+ xStocks across 18+ exchange partners, all without requiring registration or KYC compliance.

With 24/7 trading, fractional ownership from $1, and instant settlement, tokenized stocks represent a major innovation in how global investors access equity markets. Whether you’re crypto-native or exploring blockchain-based investing for the first time, Microsoft and Meta xStocks offer familiar assets with cutting-edge accessibility.

Ready to get started? Visit Swapzone to compare rates and buy your first Microsoft or Meta tokenized shares using USDT today. The future of stock trading is here, and it runs on the blockchain.