Summarize with AI

The crypto market is entering a transformative phase as 2026 approaches. After reaching new all-time high levels in 2025, digital assets are now positioned for continued institutional adoption and mainstream integration. This comprehensive crypto forecast 2026 examines the key trends shaping Bitcoin, Ethereum, Solana, and the broader cryptocurrency ecosystem in the coming year. Furthermore, we analyze expert predictions from leading financial institutions to help you understand what lies ahead.

2026 Crypto Market Outlook: Dawn of the Institutional Era

According to Bitwise, a leading crypto asset manager with over $15 billion in client assets, 2026 will mark the beginning of a sustained bull market driven by institutional maturity and regulatory clarity. The firm released its 10 crypto predictions for the year ahead, forecasting that Bitcoin could break the traditional four-year cycle and set new all-time highs throughout 2026. Additionally, Bitwise expects this cycle to differ significantly from previous ones due to ETF-driven demand.

Grayscale’s 2026 Digital Asset Outlook echoes this bullish sentiment, projecting that Bitcoin’s price will likely reach a new all-time high in the first half of the year. Moreover, the forecast suggests the end of the so-called four-year cycle theory, as ETFs and slower-moving portfolio allocation play a bigger role in price dynamics. As a result, investors may need to reconsider traditional crypto market timing strategies.

Bitcoin Could Reach $170,000: Analyst Forecasts

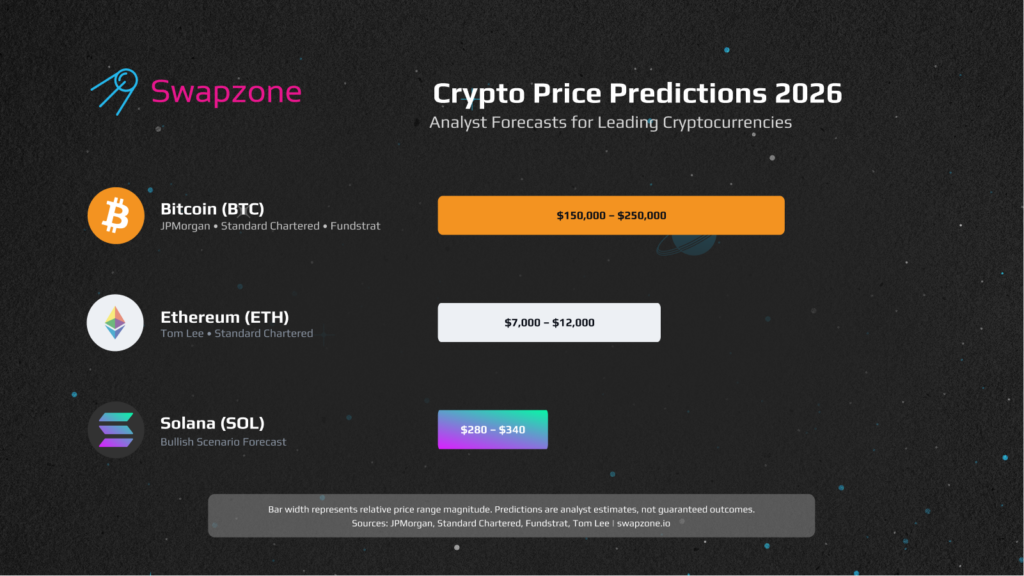

JPMorgan analysts have called $94,000 a production-cost floor for Bitcoin and forecast the asset could reach approximately $170,000 in 2026. Their prediction relies on Bitcoin’s volatility ratio narrowing relative to gold’s $28.3 trillion market cap. Similarly, Standard Chartered analysts project comparable price targets, citing the demand for bitcoin from institutional investors and ETF absorption.

Tom Lee of Fundstrat forecasts Bitcoin could surge between $100,000 and $150,000 by year-end, with some estimates reaching $200,000 to $250,000. Currently, Bitcoin is trading near $87,000 after experiencing fluctuation from its all-time high above $126,000 in 2025. Nevertheless, the price of bitcoin may stabilize as the current bull market matures and institutional demand continues to grow.

The bitcoin halving effect from 2024 continues to create scarcity-driven supply pressure. With approximately 166,000 BTC in new issuance expected in 2026, ETFs are forecasted to purchase more than 100% of this supply, thereby creating massive buy-side pressure. Consequently, this represents a significant source of new demand that could push bitcoin may higher in 2026.

Strategic Bitcoin Reserve and Institutional Adoption

The U.S. Strategic Bitcoin Reserve has catalyzed institutional adoption by formalizing Bitcoin’s role alongside gold and foreign currency reserves. Specifically, the BITCOIN Act proposes acquiring 1 million BTC over five years, potentially removing supply overhang from government auctions. In addition, state-level initiatives in New Hampshire, Texas, and other regions are further legitimizing buying bitcoin as a reserve asset.

Institutional investors now view Bitcoin as a store of value commodity competing with traditional stocks and bonds. According to Grayscale, 86% of institutional investors either own Bitcoin or plan to allocate in 2026. For instance, BlackRock’s iShares Bitcoin Trust holds over 662,000 BTC, while MicroStrategy has accumulated roughly 660,000 BTC, demonstrating strong institutional demand.

Wealth management platforms are opening access to crypto assets for high-risk tolerance clients. Meanwhile, half of Ivy League endowments are expected to invest in cryptocurrencies by 2026, signaling broader acceptance among financial services institutions.

Top Cryptocurrency Forecast: Ethereum and Solana

Ethereum: Network Upgrades and ETH Price Targets

Ethereum reached a new all-time high near $4,955 in 2025, driven by network upgrades including Pectra and Fusaka that improved scalability. As a result, Standard Chartered analysts forecast a bullish 2026 target of $12,000 for ETH, assuming these upgrades enable faster, cheaper transactions on the smart contract platform.

Tom Lee expects Ethereum hitting $7,000 to $9,000 by early 2026 as stablecoins and tokenization by firms like BlackRock and Robinhood expand on the network. Furthermore, the leading crypto asset manager Bitwise predicts ETFs will purchase more than 100% of new Ethereum supply, with approximately 960,000 ETH valued at $3 billion entering the market.

Some analyst projections suggest ETH could trade higher in 2026 if regulatory clarity materializes through the CLARITY Act. Ethereum’s built-in fee-burning mechanism and DeFi growth underpin the bull case. However, layer-2 solutions siphoning value remain a potential headwind that investors should monitor.

Solana: High Throughput and Institutional Interest

Solana is another top cryptocurrency pick for 2026, prized for high throughput and low fees. Notably, the blockchain’s on-chain revenue increased 186% year-over-year in 2025. Moreover, Solana ETFs attracted $476 million in inflows over 19 consecutive days, demonstrating strong institutional confidence.

The planned Firedancer validator engine is designed to boost throughput in 2026. In a bullish scenario, Solana could reach $280-$340 by late 2026. Additionally, Standard Chartered projects the vast majority of tokenized real-world assets activity will occur on Ethereum and Solana due to their reliability and network effects.

10 Crypto Trends Shaping the 2026 Crypto Market

Stablecoins: The Foundation for Digital Currency Growth

Stablecoins are becoming part of the global payment network, with issuance exceeding $300 billion in 2025. According to McKinsey, stablecoin transactions could overtake traditional ones within 10 years, projecting the market to grow to $2 trillion by 2028. Furthermore, the GENIUS Act established clear regulatory framework for stablecoin issuance in the U.S.

Traditional giants like Visa, Stripe, and PayPal are now using stablecoins for settlement. Interestingly, Bitwise predicts stablecoins will be blamed for destabilizing an emerging market currency in 2026, highlighting their growing influence in global finance. Treasury-backed stablecoins and regional digital currency projects are also expected to emerge.

Tokenization of Real-World Assets: The $2 Trillion Opportunity

Asset tokenization has grown from $2.9 billion in 2022 to over $35 billion today, with Standard Chartered projecting $2 trillion by 2028. Currently, tokenized treasuries (~$7.3 billion) and private credit (~$17 billion) dominate the market. Major institutions including BlackRock, JPMorgan, and others are actively building in this sector.

Real-world tokenization enables fractional ownership of traditionally illiquid asset class investments including real estate, commodities, and stocks. Throughout 2026, tokenized assets can be traded on decentralized exchanges, potentially disrupting traditional stock exchanges. Therefore, this represents a fundamental shift toward blockchain as the settlement layer for real economic output.

Prediction Markets: The Supercycle Begins

Prediction markets have become one of the hottest crypto offerings, with Polymarket and Kalshi leading the category’s $2.9 billion market cap. Robinhood CEO Vlad Tenev describes a ‘prediction market supercycle’ with volumes potentially reaching trillions of contracts annually. This trend is expected to accelerate in the coming year.

Bitwise predicts Polymarket open interest will set a new all-time high, surpassing 2024 election levels. The platform is expected to launch a POLY token in 2026 with governance features and user rewards. Meanwhile, Kalshi has partnered with CNN and obtained CFTC licensing, thereby legitimizing decentralize prediction trading.

DeFi and Perpetual DEX Growth

Perpetual decentralized exchanges have grown from 1% of global perpetual trading in 2022 to 4-6% by 2025. Hyperliquid leads with sub-second finality, processing billions in daily trading volume and generating over $1.3 billion in annualized revenue. Consequently, on-chain vault assets under management are forecasted to double.

Crypto projects like dYdX, GMX, and Jupiter Perps are competing with centralized exchanges on execution quality and liquidity depth. Their 2026 roadmap includes cross-chain trading and expansion into real-world assets. As such, perpetual DEXs represent one of the strongest long-term narratives in decentralize finance.

Exchange-Traded Products: 100+ ETFs Expected

More than 100 crypto-linked exchange-traded funds are expected to launch in the U.S. in 2026, following SEC’s issuance of new listing standards. To date, spot Bitcoin ETFs have attracted over $125 billion in net inflows, while global Bitcoin ETF assets under management surged to $179.5 billion.

The Motley Fool Stock Advisor analyst team and other investment research firms are increasingly covering crypto alongside traditional investments. In particular, crypto equities are projected to outperform tech stock performance, with the Bitwise Crypto Innovators 30 Index rocketing 585% over three years.

Crypto and AI: Convergence of Technologies

Crypto and AI convergence is accelerating as blockchain projects integrate machine learning. Leading this trend, Bittensor, Fetch.ai, and The Graph are pioneering AI-powered token development. At the same time, Bitcoin miners are pivoting toward AI infrastructure as post-halving economics squeeze margins.

Tether CEO Paolo Ardoino warns of AI bubble risk affecting crypto markets in 2026. While AI investments drive capital toward tech, the integration of AI agents with DeFi protocols could nonetheless enhance automation and risk scoring across the global crypto ecosystem.

Crypto Market Structure and Regulatory Clarity

The coming year could bring crypto market structure legislation putting legal uncertainty to rest. Currently, the CLARITY Act passed the House but awaits Senate action. Once enacted, market structure legislation would define which digital assets count as securities and introduce clearer exchange regulations.

The EU’s MiCA regulatory framework provides structured pathways for institutional investors. Similarly, Japan’s FSA plans to introduce a crypto bill by 2026 and approve the first yen-backed stablecoin. These developments signal that believe are the 10 best positioned markets for global crypto adoption.

Quantum Computing: A Red Herring for 2026?

Grayscale dismisses quantum computing as a near-term threat, calling it a ‘red herring’ unlikely to affect crypto valuations in 2026. Expert estimates suggest a quantum computer powerful enough to crack Bitcoin’s cryptography is unlikely before 2030 at the earliest. Therefore, investors should focus on more immediate catalysts.

Research on quantum-resistant cryptography will accelerate based on market developments. Major blockchains including Aptos and Solana are already testing post-quantum protections. Notably, Michael Saylor argues quantum computing will ultimately ‘harden’ Bitcoin rather than threaten it.

Crypto Forecast 2026: Investment Considerations

This crypto forecast 2026 analysis suggests markets are entering a new era defined by institutional maturity. Bitcoin is transitioning from speculative asset to strategic allocation tool. By the end of 2026, Bitcoin could be trading significantly higher if macro conditions align with institutional adoption trends.

Key catalysts include Federal Reserve policy shifts, regulatory clarity, and continued ETF inflows. A more accommodative macro environment would benefit risk assets like crypto. For example, Brazil’s Itaú Unibanco advises 1-3% portfolio allocation to Bitcoin for investors seeking currency hedges.

While price could experience volatility, the structural drivers-regulatory progress, institutional adoption, and macroeconomic diversification-position digital assets for continued growth. In essence, 2024 laid the groundwork, 2025 validated the thesis, and 2026 may deliver the breakout that transforms crypto from alternative investment to mainstream asset class.

Conclusion: The Dawn of Institutional Crypto

This crypto forecast 2026 reveals a market at an inflection point. Bitcoin, Ethereum, and leading cryptocurrencies are positioned for new highs as institutional demand, regulatory clarity, and technological innovation converge. From tokenization to prediction markets to perpetual DEXs, the crypto ecosystem is maturing rapidly.

For investors with appropriate high risk tolerance, 2026 offers compelling opportunities across the digital asset landscape. The transformation from fringe experiment to institutional asset class continues, with the track record of recent years validating crypto’s role in diversified portfolios. Ultimately, thorough research and risk management remain essential when navigating this evolving market.

Sources

Bitwise: The Year Ahead – 10 Crypto Predictions for 2026

BeInCrypto: Bitcoin, Ethereum, and XRP Price Prediction for 2026

The Motley Fool: 3 Predictions for Crypto in 2026

24/7 Wall St: Crypto Market 2026 Predictions

Nasdaq: 4 Predictions for Bitcoin in 2026

Standard Chartered: Tokenized RWAs to Reach $2 Trillion by 2028

Decrypt: Quantum Computing Unlikely to Impact Bitcoin in 2026

Cointelegraph: Prediction Markets – Robinhood’s Fastest Growing Segment

The Block: Best Decentralized Exchanges for Trading Perpetual Futures