Over 1.7 billion dollars in cryptocurrency went missing in 2023 – vanished forever because of hackers, phishing scams or users inadvertently locking themselves out. Most of these victims were just regular people who thought they’d taken solid precautions to keep their digital assets safe. When you own Bitcoin or any cryptocurrency, you’re essentially your own bank, so if something goes wrong there’s no one to turn to to reverse a dodgy transaction. The responsibility for keeping your crypto safe falls squarely on your shoulders.

This guide has some really important wallet security tips to keep your crypto from getting nicked by hackers and scammers. These aren’t just empty threats – these are real, actionable steps to reduce your risk dramatically. So let’s get down to the 7 things you need to know to keep your crypto investment safe.

Why Should You Really Care About Bitcoin and Crypto Security?

The way the crypto world works is pretty different from traditional finance. Once you’ve sent your Bitcoin off into the ether – there’s no “cancel” button. The blockchain doesn’t care if you got tricked into sending it to the wrong wallet or if you got hacked – the transaction is final.

This makes the crypto world a very attractive target for crooks. Phishing scams are becoming super sophisticated – fake websites that look identical to the real thing are popping up all the time. And crooks love exploiting security holes in DeFi protocols and social engineering people into revealing sensitive info about their wallets.

Take the FTX collapse in 2022 for example. Loads of users got locked out of their cash and learned the hard way that it really does say “not your keys, not your crypto” – if you don’t have control of the private key to your wallet then you don’t actually own that crypto.

Although this might all sound bleak the good news is that a huge number of crypto thefts are actually preventable. Hackers succeed because people make the same old predictable mistakes – using the same password across loads of platforms or storing the seed phrase for your wallet in a cloud document. By following some basic security best practices you can avoid becoming the next statistic.

Hot Wallets vs. Cold: What Do I Need to Know?

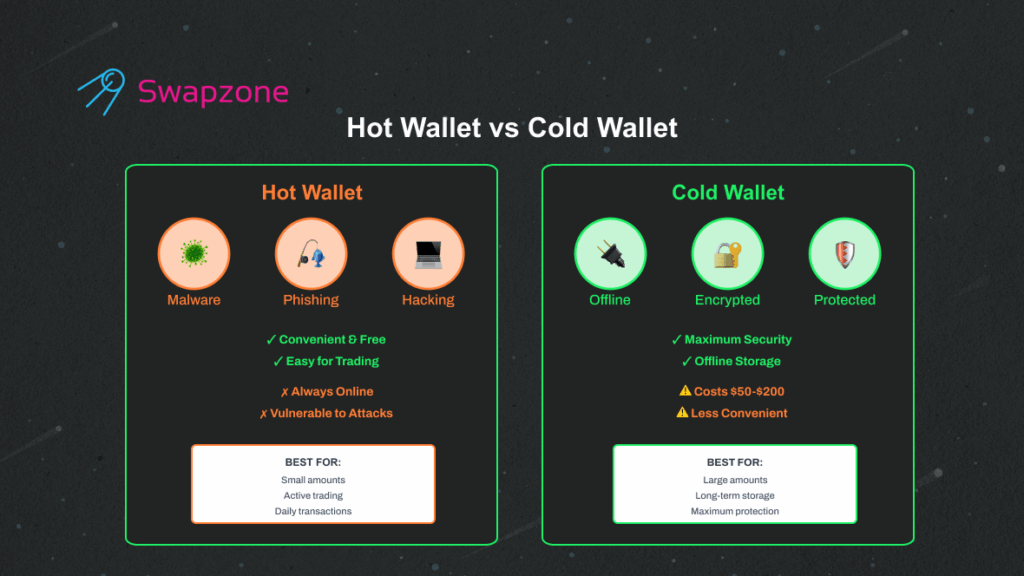

Before we dive into the nitty gritty security tips you need to know the difference between hot and cold wallets – it’s the foundation on which all your security best practices are built.

A hot wallet is just a software wallet that’s always connected to the net. Examples include MetaMask and Trust Wallet or just the mobile app for whatever exchange you’re using. These are super convenient for trading and quick transactions, but – let’s be real – they also come with loads of security threats. Malware can infect your device and steal your wallet details or phishing scams can trick you into connecting your wallet to some dodgy website that cleans your out.

Hot wallets are best for small amounts of cash that you’re using for trading or whatever – think of it like having a bit of cash in your pocket for random expenses. You wouldn’t carry your entire life savings in your wallet.

A cold wallet (hardware wallet) is a physical device that totally keeps your private key offline. Think Ledger or Trezor or some other security box. These devices sign off on transactions without exposing your key to the world. Even if your computer has malware on it your hardware wallet is safe.

The better hardware wallets have Secure Element chips – the same tech used in electronic passports and bank cards – and this gives them a level of hardware level encryption and physical tamper proofing.

| Feature | Hot Wallet | Cold Storage Wallet |

| Security Level | Moderate | Highest |

| Cost | Free | $50-$200 |

| Best For | Daily transactions | Long-term storage |

| Vulnerability | High to malware | Virtually immune |

7 Crypto Wallet Security Tips

Tip #1: Create a Separate Email for Crypto Accounts

Your main email is a security risk. Every newsletter signup or online account exposes that email to breaches. Hackers target people involved in crypto. If your email is in a breach, scammers will send convincing phishing emails appearing to be from Coinbase, Binance or other crypto exchanges.

Solution: Create a completely new email just for crypto. Use ProtonMail or another secure provider. Never share this email anywhere else. Don’t use it for shopping, social media or any other purpose.

The beauty of this approach? If your secret email receives any message claiming to be from a crypto platform, you’ll know it’s a phishing scam. This simple trick eliminates one of the most common attack vectors hackers use.

Update your email in your existing crypto exchange accounts now. It takes 5 minutes and will improve your security big time.

Tip #2: Never Store All Your Bitcoin on Exchanges

Exchanges are not banks. They’re trading platforms. When you leave cryptocurrency on an exchange, you’re abandoning the principle of self-custody. Exchanges use custodial wallets, meaning they have the private keys to your funds—not you.

This allows exchanges to freeze your account or restrict access for any reason. History proves this matters. Mt. Gox collapsed in 2014, losing 850,000 Bitcoin. QuadrigaCX went bankrupt in 2019, locking away $190 million. FTX imploded in 2022, trapping billions in user funds.

Use exchanges for exactly three purposes:

- On-ramping (converting fiat to crypto)

- Off-ramping (converting crypto to fiat)

- Swapping cryptocurrencies

Complete your transaction and withdraw funds to a wallet where you control the keys. The longer your crypto sits on an exchange, the more you’re gambling with your digital assets.

Always send a small test transaction first. Blockchain transactions are irreversible—if you accidentally send Bitcoin to the wrong wallet address, your funds are gone forever.

Tip #3: Invest in a Hardware Wallet for Long Term Storage

If you’re serious about crypto, a hardware wallet is non-negotiable. This is the single most important investment in your crypto security strategy.Hardware wallets generate your private key entirely within the device. These keys never appear on your computer screen or touch the internet. When you send cryptocurrency, you verify the transaction on the device’s screen and physically confirm it with a button press. Your private key signs the transaction without ever leaving the secure offline environment.

Options:

- Ledger Nano S Plus ($79) – Budget friendly, supports 5,500+ cryptocurrencies

- Ledger Nano X ($149) – Bluetooth connectivity, larger screen

- Trezor Model T ($219) – Touchscreen interface, open-source firmware

One important warning: always buy directly from the manufacturer’s official website. Never buy from Amazon, eBay or third-party resellers. Scammers have sold modified devices with compromised firmware.

Tip #4: Protect Your Seed Phrase Like the Master Key It Is

Your seed phrase (12 or 24 words) is the master key to your entire cryptocurrency holdings. These words can restore your wallet on any compatible device. Lose your seed phrase, lose your crypto. Forever.

Critical rules:

Never digitize your seed phrase. Don’t photograph it. Don’t save it in password managers, cloud storage, note-taking apps, or email. Digital copies create vulnerabilities hackers actively exploit.

Never share it with anyone. Legitimate companies will never ask for your seed phrase. Anyone requesting it is a scammer, no exceptions.

Store it on metal, not paper. Paper is vulnerable to fire, flooding, and deterioration. Metal seed phrase storage provides waterproof, fireproof (up to 1,400°F) protection. Products like Cryptosteel Capsule or Billfodl use 304 stainless steel and cost $50-150.

Store your metal plate in a fireproof safe or bank safety deposit box. Never keep it with your hardware wallet device—if a burglar finds both, they have everything.

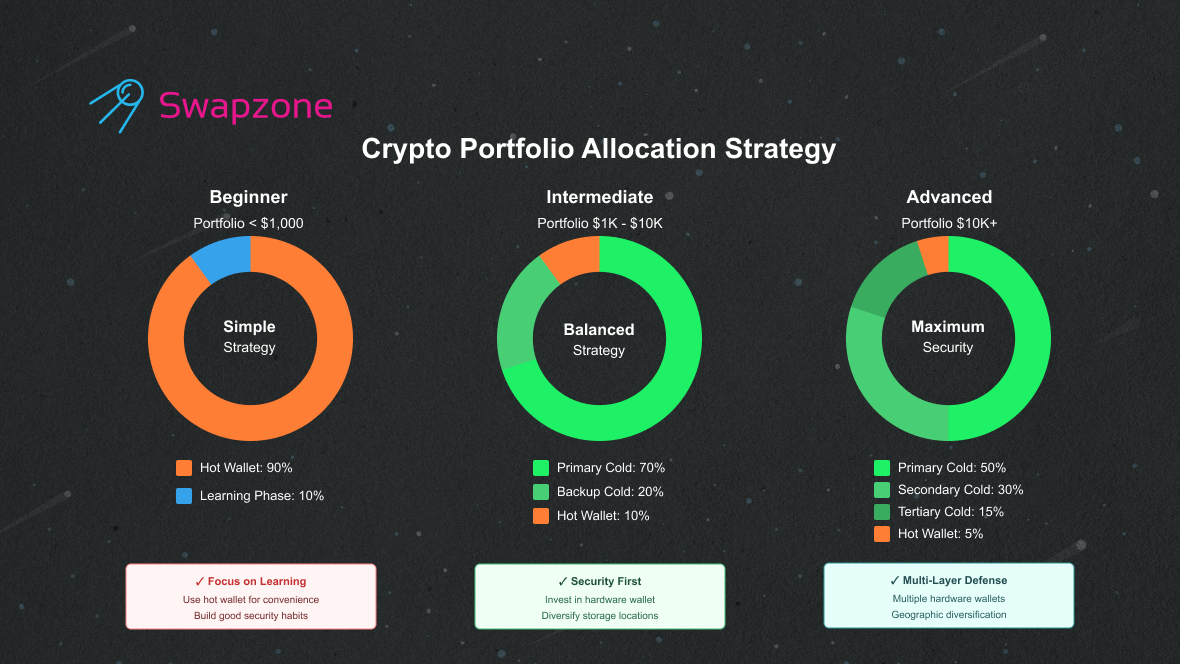

Tip #5: Diversify Crypto Across Multiple Wallets

Don’t keep all your eggs in one basket. Even with best practices, maintaining multiple wallets provides an extra layer of protection against catastrophic loss.

Recommended allocation:

For holdings of $5,000-$50,000:

- Primary cold wallet: 70%

- Secondary cold wallet: 20%

- Hot wallet: 10% for transactions

For holdings above $50,000:

- Primary cold wallet: 50%

- Secondary cold wallet: 30%

- Tertiary cold wallet: 15%

- Hot wallet: 5%

This strategy limits damage if one wallet is compromised. Your largest holding should stay in a cold storage wallet that never connects to websites.

Tip #6: Set Up Multiple Crypto Exchange Accounts

This seems counterintuitive after warning against exchange storage, but having verified accounts on 2-3 reputable platforms provides crucial flexibility. During bull runs and volatile periods, crypto exchanges get slammed with traffic. Servers crash. The crypto market moves fast, and being locked out means missing opportunities.

Additionally, exchanges sometimes freeze accounts for security reviews lasting days or weeks. A backup account ensures you’re never completely sidelined.

Recommended platforms: Coinbase, Kraken, Gemini, Binance.USCreate now, verify, link your bank. Then don’t store funds there—keep accounts ready to use. Store login credentials in a password manager.

Tip #7: Revoke Contract Approvals Regularly

This is the least understood but most dangerous crypto security vulnerability. When you interact with DeFi protocols or NFT marketplaces you grant smart contracts permission to access cryptocurrency in your wallet. Many contracts request infinite approval—perpetual access to drain your wallet.

If a site you connected to gets compromised months later, hackers can drain your funds using existing contract approvals. You don’t need to visit the site again or sign anything new. Scammers also create fake sites for airdrops or yield farming. You connect your wallet and unknowingly sign a malicious approval.

Hardware wallets don’t protect against this. Signing contract approvals is a normal function. Your device can’t tell if a contract is malicious.

The solution: Use revoke.cash to audit and revoke contract approvals regularly. At least monthly. You’ll pay standard blockchain transaction fees but this cost is nothing compared to having your wallet drained.

Pro tip: Create a separate “burner” hot wallet for interacting with new protocols. Keep only small amounts there. Never connect your main cold storage wallet to websites.

Advanced Security Tips to Protect Your Crypto Holdings

Make Two-Factor Authentication (2FA) A Habit

Two-factor authentication adds another layer of security on top of passwords. Even if hackers somehow get their hands on your password through phishing emails or fake websites, they won’t be able to get into your account without the second factor.

For 2FA, ditch SMS – it’s just too vulnerable to SIM swapping attacks where a scammer convinces your mobile provider to transfer your number to them. Instead, use authenticator apps like Google Authenticator or Authy.

When you turn on 2FA, store those backup codes securely somewhere. If you lose access to your authenticator app, those codes are your only lifeline, so make sure they’re safe.

Use a Top-Notch Password Manager

Using the same password for multiple sites is a huge risk. If one site gets hacked and your password gets leaked, scammers will try that same password on all your other accounts – which could be just as sensitive.

That’s where a password manager comes in. These tools generate and store unique, super-strong passwords for every single account you’ve got. Some of the best options out there are Bitwarden (free and open-source), 1Password, and KeePass.

For especially sensitive crypto accounts, create a password that’s truly random – think 30+ characters with a mix of upper and lower case letters, numbers, and symbols. Just one note of caution: never, ever store your seed phrase in your password manager – seed phrases should stay offline.

Stay Vigilant Against Phishing Scams

Phishing attacks targeting crypto holders have gotten ridiculously sophisticated. Scammers are creating fake websites that look almost identical to the real thing using tricky domain names, and they’re crafting super convincing emails that try to create a sense of urgency.

Watch out for these phishing tactics:

- Fake customer support on Twitter, Discord, Telegram, and all the usual social media channels

- Look-alike domains (e.g. coinbаse.com using Cyrillic characters to throw you off the scent)

- Scams promising free airdrops in exchange for a password or private key

- Emails that try to create a sense of panic and get you to act fast

Protection is simple:

- Always type in URLs manually instead of clicking on links

- Don’t click links in emails – even if they look legit

- Before connecting your wallet to any website, double-check the URL (and triple-check if it still looks off)

- If something feels off, it probably is – so take 30 seconds to verify legitimacy

Common Security Blunders to Avoid

Don’t be that guy who brags about their crypto holdings on social media – that’s just an open invitation to scammers. Keep your crypto investments to yourself and don’t post screenshots of your portfolio or discuss specific amounts.

Using one wallet for everything is a recipe for disaster – it mixes your life savings with riskier DeFi experimentation. For heaven’s sake, segregate your holdings so you can contain the damage if something goes wrong.

Don’t fall for fake support asking for your seed phrase. No legit company is ever going to ask you for that, your private key, or your password.

Not testing recovery before disaster strikes – test your seed phrase by restoring a wallet while you still have access. Confirm your backup works, just in case.

Your Personal Security Plan to Keep Your Crypto Safe

Security isn’t a one-size-fits-all solution. Your needs depend on how much cryptocurrency you hold – so here are some tailored tips:

Beginners (under $1,000):

- Get a dedicated email for all your crypto accounts

- Enable 2FA using Google Authenticator – it’s easy and effective

- Use a reputable hot wallet like MetaMask

- Write down your seed phrase and store it safely (don’t even think about storing it online)

Intermediate users ($1,000-$10,000):

- Invest in a hardware wallet (Ledger or Trezor is a great place to start)

- Upgrade to metal seed phrase storage for that extra layer of security

- Transfer most of your holdings to a cold wallet – they’re way safer

- Set up separate accounts on two exchanges – don’t put all your eggs in one basket

- Review contract approvals every month – you don’t want to miss something important

For serious holders ($10,000+):

- Get multiple hardware wallets – redundancy is key

- Diversify your storage across wallets – you never know when something might go wrong

- Store metal seed phrase backups in multiple locations – just in case

- Set up a separate burner wallet for riskier interactions – keep your main holdings safe

- Review contract approvals weekly – it’s a good habit to get into

- Consider using multi-signature wallets – that extra layer of security can’t hurt

Emergency Procedures: What To Do When Things Go Off The Rails

Wht to do if your wallet gets compromised:

- Get all of your funds across to a brand new wallet with a fresh seed phrase ASAP

- Head on over to revoke.cash and check for any dodgy contract approvals

- Run a scan on your devices for any malware that might have snuck in

- Change all the passwords related to this incident

- Make sure you have 2FA switched on for all the crypto accounts you use

Steps if you lose access:

- Track down that backup of your seed phrase

- Either buy a new wallet or download some wallet software

- Enter the seed phrase in exactly the right order to get your wallet up and running again

- If you think your seed phrase might be in trouble, get all your funds transferred to a new wallet before anything else

If you fall victim to a scam:

Blockchain transactions are basically un-reversible – sorry to say it, but your cash is probably gone for good. Make a note of what happened, report to the FBI’s IC3 and the FTC, let the platform involved know, and warn others by sharing your experience – most people who get scammed never get their money back, and that’s why prevention’s so key

Frequently Asked Questions

Can someone nick my Bitcoin from a cold wallet?

Cold wallets are pretty safe from online hackers because your private key is offline, but don’t get too cocky – they’re not 100% immune to dodgy contract approvals. If you hook up your cold wallet to a dodgy website and sign some dodgy transaction, scammers might be able to get their hands on your cash. A lot of experts reckon it’s just not worth the risk, so don’t connect your main cold storage wallet to any websites.

How much does crypto security cost?

Getting started is going to set you back around $150-400 – that’s a hardware wallet ($50-150), a fancy safe for storing your seed phrase ($50-100), and a fire-proof safe ($50-100) and all that jazz. And let’s be real, that’s a tiny fraction of the cash you could end up losing if you get scammed.

What’s the safest crypto wallet?

For long-term storage, look at using a hardware wallet from Ledger or Trezor that’s got a Secure Element chip in it – that’s your best bet for keeping the bad guys out. For daily transactions and smaller amounts though, you might want to stick with something like MetaMask – it’s a self-custodial hot wallet that gets the job done just fine. But at the end of the day, the safest wallet is the one you use correctly – even with a fancy hardware wallet, if you store your seed phrase digitally you’re still at risk

Can I get my Bitcoin back without my seed phrase?

Sorry to say it, but No. Your seed phrase is the only way to get your cash back – no amount of begging or expertise can get it back for you without it. That’s just how blockchain works, unfortunately. If you lose your seed phrase, you lose your cash – that’s why keeping an eye on your seed phrase is literally the most important thing when it comes to keeping your crypto safe

Protect Your Digital Assets – Today is a Good Time to Get Serious

Protecting your digital assets isnt rocket science, but it does need some genuine effort. You dont have to sort everything out at once, just pick one or two things to focus on right now. Start by setting up a dedicated email, turning on two-factor auth or ordering a proper hardware wallet – that’s a good place to begin.

The thing is, in the crypto space, you are the absolute master of your own destiny – and that means you’re the one ultimately responsible for your own funds. That might feel like a weight on your shoulders, but its also incredibly empowering. Your financial future is in your hands.

The crypto markets will continue to swing wildly up and down, but the fundamentals of security never change. You really do need to treat your digital assets right – and that means keeping your seed phrase safe, storing your coins in cold storage, using a hardware wallet and being on the lookout for phishing scams. These are the security best practices that will keep your digital assets safe, no matter what the crypto market throws at them

Don’t wait for disaster to strike before getting your security act together – implement these tips now, while you still have control over your funds. The crypto space has a lot to offer, but if you cant keep your funds safe from all the various security threats that are out there, what’s the point? Your Bitcoin (or whatever coin you own) deserves serious protection – and now you know exactly how to give it to it. So, let’s get serious about security – take a secure approach, stay safe, and never compromise on keeping your assets secure.