Summarize with AI

• The crypto world is in chaos. $2.17 billion stolen in just 6 months of 2025 Crypto Crime Mid‑Year | Changelly

• A user had 10 BTC frozen for almost a year after initiating what should have been a simple swap |

r/ledgerwallet

• Old allegations from BitcoinTalk forums from 2017 show similar patterns. A user claimed Changelly held GBYTE tokens during a Byteball snapshot period and collected the distribution rewards meant for the original sender before completing the delayed transfer.

Introduction: Choose a Safe Crypto Exchange

Millions of Changelly Users Are in Danger. The crypto world is in chaos. $2.17 billion stolen in just 6 months of 2025 – and that’s only what we know about. From AI-powered scams to crypto exchange security breaches targeting millions of users.

Changelly users and millions of other crypto traders are facing threats that weren’t there two years ago. New attacks emerge daily for instant exchanges, major platforms, and wallets. This crypto exchange security guide reveals the hidden risks in today’s crypto ecosystem keeping you away from crypto from scams.

Higher stakes than ever. In an industry where personal wallet compromises account for 23.35% of stolen funds, understanding these threats is essential.

2025 Crypto Exchange Security Crisis: The Perfect Storm

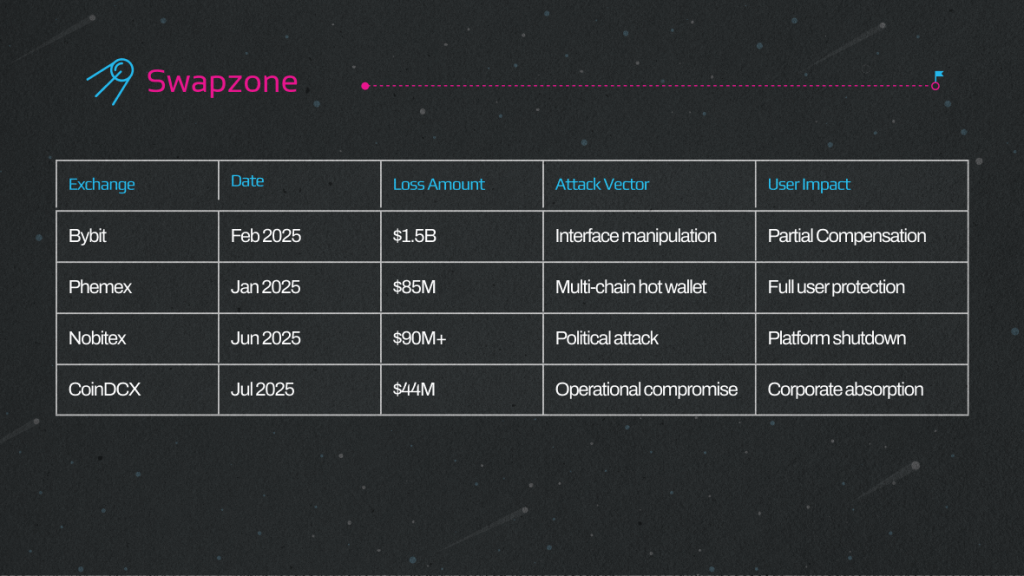

Unprecedented exchange hacks

The crypto industry had its bloodiest first half in 2025. According to crime statistics, multiple catastrophic incidents showed how evolving attack methods can compromise even the most secure platforms.

In February, Bybit’s $1.5 billion nightmare changed the way people think about crypto security. The attack wasn’t a normal coding exploit; instead, hackers used “blind signing” methods to change the user interface while keeping the security in place. Operators saw legitimate transfer screens while the platform secretly redirected 401,000 ETH to attacker wallets. The FBI later attributed this sophisticated operation to North Korea’s Lazarus Group, showing how state-sponsored cybercriminals now target crypto infrastructure with military-grade precision.

Phemex lost $85 million when hackers compromised hot wallets across 16 different blockchains simultaneously. The Singapore-based exchange detected the breach within hours and implemented emergency protocols, but the damage was already done. Their careful recovery process, which started with Ethereum withdrawals and then moved on to Bitcoin and other networks, showed that they knew how to respond to an incident and how quickly modern attacks can spread across many systems.

The Nobitex attack in Iran was a new kind of political crypto warfare. Hackers in Israel burned more than $90 million in stolen money and sent it to addresses with messages against the government. This wasn’t stealing for money; it was economic warfare that looked like cybercrime.

The Personal Wallet Massacre: Individual Users Under Attack

Exchange hacks make the news, but individual users are in even more danger. In 2025, personal wallet hacks made up 24% of all crypto thefts, with $1.71 billion stolen from individual accounts in just six months.

The most dangerous individual threat of the year was the JSCEAL malware. This JavaScript-based attack got past regular antivirus software by hiding in real ads and fake wallet apps. More than 10 million people around the world had their private keys stolen before security companies could act.

The malware was spread to users on all platforms, from people who used Changelly for quick swaps to traders on major exchanges. The victims only found out their wallets were empty after they tried to make a purchase, at which point it was too late to get their money back.

Phishing campaigns powered by AI can now make exact copies of real platforms. Scammers use deepfakes to pretend to be people you trust, voice cloning to copy customer support calls, and advanced social engineering to get private keys and seed phrases from people who don’t know what they’re doing.

Changelly User Stories: What People Have Done

High-Stakes Frozen Funds: When Swaps Go Wrong

Recent user experiences show concerning patterns with Changelly and similar instant swap services. A detailed case study from Reddit where a user had 10 BTC frozen for almost a year after initiating what should have been a simple swap.

The user attempted to swap BTC for USDT through Changelly’s integration with the Trezor wallet. After sending the Bitcoin, processing stalled indefinitely. Despite completing full KYC verification and providing all requested documents, the user was told by Changelly that technical teams were “looking into the matter”.

The Reddit community responded with widespread awareness of the issue:

“I cannot understand how you can be smart enough to own 10 BTC and at the same time be stupid enough to use Changelly to swap them. I’m relatively new to crypto, and one of the first things I learn is to never use Changelly.” – Reddit user myk31

Another user shared similar experience with smaller amount:

“July 12 I initiated a BTC→USDT swap via the Exodus Wallet using the integrated Changelly service. The swap failed (marked ‘FAILED’ in-app) but Changelly kept the 2 BTC.

Later they asked for $2,500 operational fees.”Old allegations from BitcoinTalk forums from 2017 show similar patterns. A user claimed Changelly held GBYTE tokens during a Byteball snapshot period and collected the distribution rewards meant for the original sender before completing the delayed transfer.

Common complaints:

- Long processing times for high value transactions with no timeline

- Post-transaction KYC requirements not disclosed upfront

- Extra fees to complete supposedly “failed” swaps

- Support responses that promise to investigate but no concrete steps

No human support during critical situations

Understanding the Business Reality Behind Delays

These crypto exchange security challenges affect all platforms

Changelly operates in a complex regulatory environment where compliance requirements often clash with user expectations of instant processing. Our risk management systems flag transactions that exceed certain thresholds or show unusual patterns.

Regulatory compliance forces all crypto exchanges – including instant swap services – to implement enhanced due diligence procedures. Large transactions, privacy coin conversions, and transfers to sanctioned regions trigger mandatory review processes that can take weeks or even months.

Market volatility makes instant swaps even more complicated. Initial rate quotes become invalid when the prices of cryptocurrencies change quickly during processing. While traditional exchanges use order books, instant swaps absorb losses or delay completion until the market stabilizes.

The instant swap services liquidity provider model requires external partners. If these providers have compliance or technical issues, downstream platforms experience delays that appear to users as platform failures.

7 Crypto Exchange Security Strategies to Keep Your Crypto Safe

Strategy 1: Reduce Exchange Exposure

No crypto exchange or swap service should store large amounts for too long. Even platforms with perfect security records can be hit by regulatory action, internal fraud, or advanced attacks.

The “hot potato” method treats exchange balances like hot potatoes: get in, make your trade, and get out. Professional traders follow strict rules:

- Only put in money that you plan to trade in the next 24 to 48 hours.

- Take your money out right after you finish your transactions.

- Keep your balances at zero on platforms between trading sessions.

- Use more than one platform to spread risk across different systems.

Dollar-cost averaging (DCA) lowers the risk of timing and the risk of exchange. Instead of making big trades all at once, break them up into smaller pieces that happen over time. This way, you limit the amount of money you could lose if one platform fails.

Strategy 2: Learn the Basics of Cold Storage

The only way to keep yourself safe from most crypto threats is to use a hardware wallet. Ledger and Trezor devices keep private keys offline, so they can’t be hacked like software wallets can be.

Important things to do with a hardware wallet:

- Don’t type seed phrases into devices that are connected to the internet.

- Verify all addresses on the device screen before confirming transactions

- Keep several copies of your recovery phrases in different places around the world.

- Update firmware regularly to protect against newly discovered vulnerabilities.

- Before putting away large amounts of money, try recovery procedures with small amounts.

- Multi-sig stops big holdings from having a single point of failure. These need more than one private key to sign transactions, so you won’t lose if one key is stolen.

Strategy 3: Test Transaction Rules.

Before putting a lot of money into a new platform or service, always test it out with a small amount. This simple practice could have saved most of the frozen fund situations with Changelly and other swap services.

Steps for testing protocol:

- To make sure the platform works, start with small amounts of money.

- Make sure the times for processing checks meet your needs.

- Send non-urgent requests to test customer service

- Check the whole withdrawal process from beginning to end.

- Make a note of everything for later.

Strategy 4: Recognize AI-Powered Scams

Scammers can use deepfakes to make fake video endorsements from people you trust. These fake promotions often try to get people who use certain platforms, like Changelly, to invest in fake opportunities.

Ways to find things:

- Verify claims from multiple sources before acting.

- Find unnatural facial movements or audio sync issues.

- Check official social media for real messages.

- Never authorize transactions via video or audio.

Voice-cloning scams imitate familiar voices to steal private keys or authorize transfers. Use multiple channels to verify unusual requests before responding.

Strategy 5: Pick Platforms Based on How Much Risk You Can Handle

Coinbase Pro and Kraken are examples of high-security platforms that offer more protection but less convenience. Instant swap services put speed and ease of use first, but they have fewer options when things go wrong.

Criteria for choosing a platform:

- Rules in your country

- Insurance for platform-side failures

- Customer service and how long it takes to respond

- Safety checks and openness

- Reviews from users from last month

Spread out your investments across different platforms to avoid having one point of failure. Instead of putting everything on one platform, use different services for different things.

Strategy 6: Keep an eye on Advanced

Alerts in real time can help you find problems before they get too bad. Set up alerts for:

- All attempts to withdraw via email and text

- Logins from new devices or places

- Changes in balance above certain levels

- Failed transaction attempts that could suggest a breach

You can check the status of a transaction without using platform interfaces with blockchain monitoring tools. Use block explorers to make sure that the money went where it was supposed to.

Strategy 7: Make a plan for emergencies

Keep a record of everything as soon as things go wrong. Screenshots, transaction IDs, and records of communication will be very important for getting things back on track.

List of emergency contacts:

- Multi-channel platform customer support

- Regulatory bodies for the platform

- Cryptocurrency dispute lawyers

- Cybersecurity firms offering recovery

Legal preparation matters more than most think. Learn about class action lawsuits, consumer protection laws, and cryptocurrency dispute lawyers before you need them.

The Future of Crypto Exchange Security

Coming Threats

Quantum computing is threatening the foundations of current cryptography. While full scale quantum attacks are years away, platforms need to start preparing for post-quantum security now.

Regulatory uncertainty is creating compliance costs that smaller platforms can’t afford. Users will see more consolidation as smaller services like some instant swap platforms are facing increasing operational pressures.

AI powered attacks will make current detection methods obsolete in months. The cat and mouse game between scammers and security systems is accelerating as both sides get more sophisticated.

Making Informed Decisions in a Uncertain World

No platform is 100% secure – including Changelly, major exchanges or any other service provider. The crypto ecosystem is by nature a user responsibility for your financial security.

Risk assessment frameworks help you evaluate the trade off between convenience and security:

- Transaction size relative to your total portfolio

- Platform track record and transparent communication during issues

- Regulatory standing and compliance history

- Technical security and audit results

- Community reputation and user feedback patterns

The bottom line: Millions of crypto users are facing real threats from evolving scam tactics and platform vulnerabilities. Whether you use Changelly, major exchanges or any other service, proper security practices is not optional – it’s mandatory to survive in this hostile digital world.

Success requires multiple layers of protection: cold storage for long term holdings, platform selection, transaction testing protocols and emergency response preparation. The crypto revolution will continue but only prepared users will survive with their wealth intact.Your crypto is in your hands. The threats are real, the stakes are high and the responsibility is yours. Choose wisely. Proper crypto exchange security practices aren’t optional!