Ethereum vs Solana comparision: Cost Analysis & Which Is Faster?

- For a general comparison and analysis of the performance of the two blockchains, it is useful to read the article “Solana vs Ethereum: Which is Better in 2025?” by Backpack Exchange.

- A detailed explanation of the key differences and architecture of Ethereum and Solana can be found in the article Built In.

- Accurate metrics for throughput, block time, and performance are available on Chainspect.

- To understand Ethereum Layer 2 solutions, we recommend reviewing the materials provided by Swissborg Academy.

Introduction: Ethereum/Solana Performance Comparison

Ethereum Solana Performance Comparison: Cost Analysis & Which Is Faster? Every time we discuss them, this is a key question. Since Bitcoin, the blockchain space has come a long way and new platforms promise faster transactions and lower fees. Two giants rule the smart contract space today: Ethereum (ETH), the incumbent and Solana (SOL), the speedster. While Ethereum invented programmable blockchain and has the largest DeFi ecosystem, Solana came out with a revolutionary architecture that promises lightning fast transactions.

This fundamental difference in design philosophy creates an interesting performance showdown that affects millions of users every day. Ethereum takes a conservative, security-first approach with incremental scaling while Solana goes all in on raw performance through architecture. The choice between these two often determines if a project succeeds or fails especially for apps that need high throughput or low latency.

The SOL/ETH ratio has become a key metric for crypto traders to compare price performance between these Layer-1 blockchain platforms.

Performance

Why Performance Matters

Blockchain performance includes transaction activity, finality time, cost efficiency, network reliability and developer experience. These metrics directly impact user experience and determines which applications can realistically run on each platform. Blockchain throughput is a key factor for ecosystem growth and user growth across both networks.

Impact on User Experience

Performance matters because it affects everything from trading costs to application responsiveness. A slow blockchain creates frustrating user experiences and limits the types of applications developers can build. High gas fees can make small transactions economically unviable while network congestion can cause critical operations to fail. This directly impacts trading volume and on-chain engagement across decentralized exchanges (DEX).

Market Research and Trends

The performance debate gets even more important as cryptocurrency adoption grows and institutional investors look for scalable solutions. According to recent research by CoinGecko, the choice between Ethereum and Solana often comes down to specific use case requirements and risk tolerance. As noted in their 2025 research report, both platforms serve different niches in the evolving crypto market. Meanwhile, Nasdaq’s analysis highlights how performance considerations are increasingly influencing institutional adoption decisions especially during market downturn and risk-off sentiment.

Ethereum Performance Analysis

Ethereum 2.0 and Layer 2 Ecosystem

Ethereum’s approach to scaling is to build Layer 2 solutions on top of its secure base layer. The main Ethereum network processes around 15 transactions per second with 12 second block times. The transition to Proof of Stake improved energy efficiency by 99.95% but didn’t impact transaction throughput much, although it attracted more institutional investors looking for environmentally friendly digital assets.

Layer 2 solutions have changed the performance landscape of Ethereum and opened up new opportunities for crypto investment:

- Polygon (MATIC): 7,000+ TPS with fees under $0.10, supports

meme coins and DeFi protocols - Arbitrum: 4,000 TPS with fees $1-5, hosts large Total Value

Locked (TVL) - Optimism: 2,000 TPS with similar fees, protocol launches

- zkSync Era: 2,000+ TPS with fees $0.10-1.00, token launches

- StarkNet: Scaling through STARK proofs for complex computations,

artificial intelligence (AI) in blockchain applications

These solutions maintain Ethereum’s security guarantees while improving performance metrics. Ethereum’s upcoming roadmap includes sharding and other technical upgrades which will further improve base layer capacity and potentially boost investment returns.

Pros and Cons

Ethereum’s biggest strength is its battle tested security model and massive developer community. With over $50 billion in TVL across DeFi protocols, Ethereum has proven itself in extreme conditions. The platform has network effects, most DeFi protocols launch on Ethereum first and that creates massive market cap growth and retail momentum.

Ethereum ecosystem has strong developer activity and consistent protocol launches, good for complex financial applications. Active wallets are still growing despite competition and the network is the preferred platform for high value cryptocurrency applications and DEX.

But the fragmented Layer 2 landscape creates user experience challenges that can impact investor sentiment. Moving assets between layers requires bridge transactions that add complexity. Each Layer 2 has different trust assumptions and withdrawal periods. Gas fee volatility on the main chain is still a problem, with costs spiking to $50+ per transaction during congestion, creating market headwinds and price volatility that can affect overall returns.

Solana Performance Analysis.

Architectural Advantages

Solana went the other way, building a monolithic Layer-1 blockchain from scratch for high throughput. Proof of History consensus creates a verifiable timeline, so transactions can be processed in parallel without consensus bottlenecks. That’s why Solana has a price and market cap.

Key architectural innovations:

- Proof of History: Cryptographic timestamps using

verifiable delay functions for global time synchronization

- Gulf Stream: Enables mempool-less transaction forwarding by

pushing transactions to validators before finality, improves transaction count - Turbine: Optimizes block propagation using a gossip protocol

that breaks data into smaller packets - Parallel Processing: Executes non-conflicting transactions

simultaneously using the Sealevel virtual machine, improves throughput - Cloudbreak: Horizontally scales account databases across

multiple SSDs for faster state access

This all allows Solana to process thousands of transactions in parallel, and get fast performance without external scaling solutions. The efficiency has attracted institutional investors and contributed to memecoin mania during peak periods of on-chain activity.

Real World Performance

In real world conditions Solana shows impressive performance numbers that appeal to both retail momentum and institutional investors. The network processes 2,000-4,000 transactions per second in normal conditions, and peak testing shows it can do over 65,000 TPS. Average transaction cost is around $0.00025, making micro-transactions economically viable and supporting memecoin mania.

Block time is 400ms, transaction finality is around 6.4 seconds. This makes Solana very good for high frequency applications like algorithmic trading, gaming and DEX where speed directly impacts user experience. The low cost has enabled token launches including popular meme coins and various digital assets.

But this performance comes with trade-offs that can impact investor sentiment. The network requires powerful validator hardware, which creates higher barriers to entry and potentially reduces decentralization. Network outages, while less frequent, have occurred during periods of extreme congestion, sometimes triggered by capital rotation.

Comparative Analysis of Blockchain Network Performance

Technical Performance Metrics

Throughput (TPS): Solana has the highest performance with 2,000-4,000 TPS. Ethereum Layer 2 solutions blow the base layer out of the water with 52,000 TPS while the original Ethereum Layer 1 is capped at 15 TPS.

Transaction Costs: Solana has the cheapest fees at $0.00025 per transaction. Ethereum Layer 2 solutions are moderate at $0.10-5.00, which is way cheaper than base Ethereum Layer 1 where fees are $5-50+.

Block Processing Speed: Solana wins with a block time of 400ms. Ethereum Layer 2 solutions have blocks in 1-2 seconds, while Ethereum Layer 1 has a 12 second block.

Finality Time: Solana has fast finality at 6.4 seconds. Ethereum Layer 2 has finality in 1-2 minutes, while Ethereum Layer 1 takes 12+ minutes for a transaction to be confirmed.

Energy Consumption: All three have low energy per transaction: Ethereum uses energy efficient Proof of Stake, Layer 2 solutions inherit this, and Solana is also very low energy.

Validator Requirements: Ethereum Layer 1 requires a 32 ETH stake to participate in validation. Layer 2 solutions inherit security from the main network. Solana has high hardware requirements for running validators.

Market Impact and Trade-offs

The Ethereum vs Solana comparison shows some interesting trade-offs that affect both the decisions investors make in Bitcoin and how well the prices do. Ethereum’s Layer 2 solutions can handle as much or more traffic than Solana’s, and they are safe since they are connected to Ethereum’s security model. The market cap and transaction volume are increasing up since Solana works better and costs a lot less for most things.

Use Case Applications

Depending on what they need and how investors feel about them, certain apps work better on some platforms than others. Many DeFi protocols are worth a lot of money, like as Ethereum’s security and liquidity. On the other hand, gaming and social apps prefer Solana’s speed and low prices. More and more professional traders are using Solana, a decentralized exchange (DEX), to instantly trade digital assets. On the other side institutional investors prefer Ethereum because it has history of performance especially when the market is having problems or when they are trying to figure out how to deploy their Strategic Crypto Reserve.

Frequently Asked Questions

Is Solana really faster than Ethereum?

Yes, Solana is usually faster than Ethereum’s base layer. Ethereum can do 15 TPS with 12 second blocks. Solana can do 2,000 to 4,000 TPS with blocks that process in less than a second. Ethereum’s Layer 2 solutions can be as fast or even faster than Solana’s but they still use Ethereum’s security model.

Which blockchain charges less to send money?

Solana has the lowest average transaction fee of $0.00025. When the Ethereum main chain is busy, it can cost $5 to $50 or more to send money. Prices drop to between $0.10 and $5.00 with Layer 2 solutions, though. Solana’s cost structure is appropriate for little trades and transactions that happen often.

How reliable are these networks?

Ethereum has been solid since it went to Proof of Stake. No major outages in the last few years. Solana has gone down a few times but less often now that the network is bigger. Nasdaq looked at both and institutions think a lot about how reliable they are when deciding to use them.

Which one should developers choose?

It all depends on what you need. Ethereum has the most devs, most tools and most valuable apps. Solana is good for consumer apps that need fast and cheap transactions. Many projects are multi-chain these days, they deploy on both to get the most visibility.

Additional Investment and Market Questions

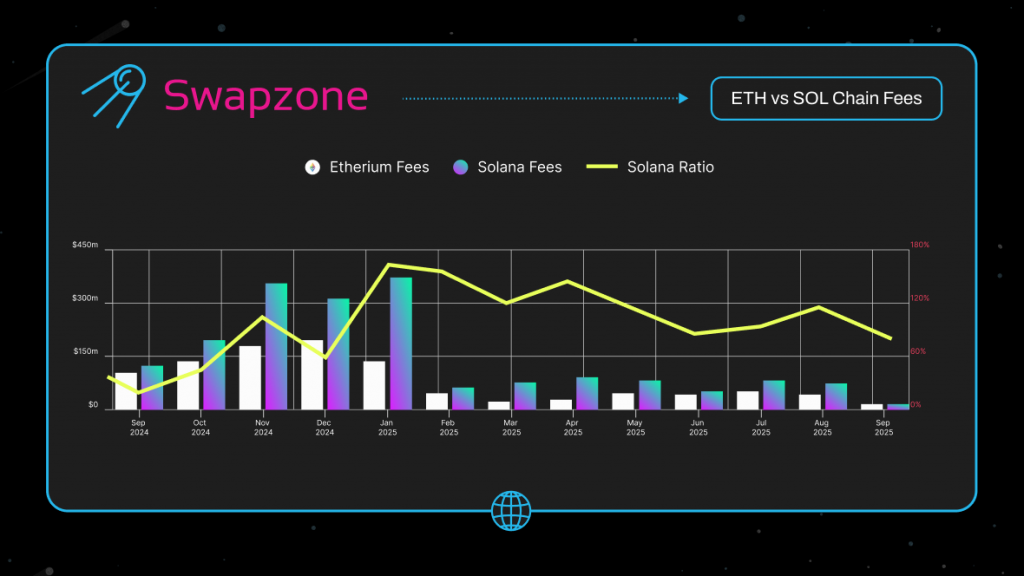

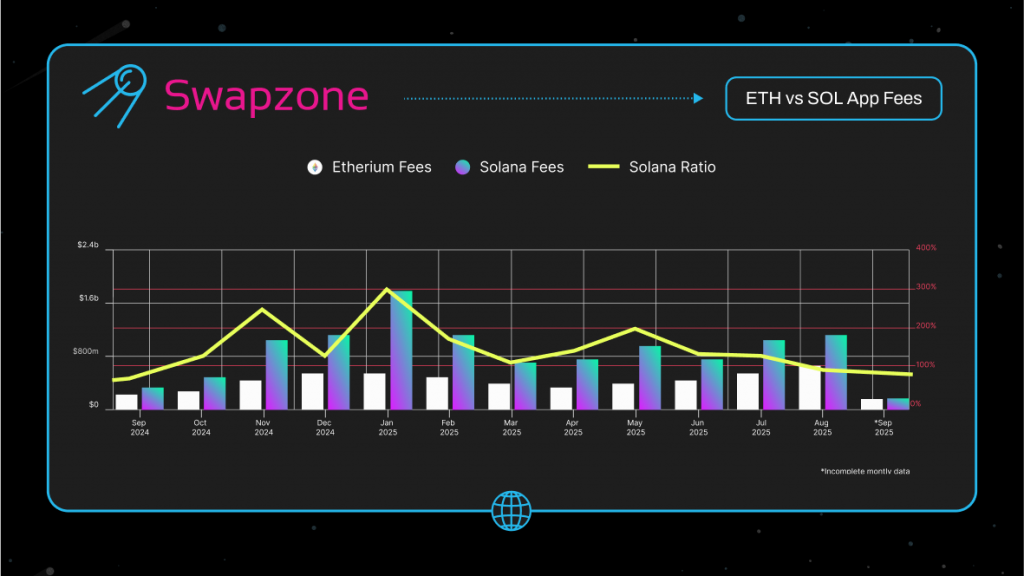

ETH-SOL comparison chart

While this article provides detailed performance metrics for ETH and SOL, a chart would show Solana leading in transaction speed (2,000-4,000 TPS vs 15 TPS), cost efficiency ($0.00025 vs $5-50+), and block time (400ms vs 12 seconds). Ethereum excels in security, TVL ($50+ billion) and ecosystem maturity. The Ethereum vs Solana comparison section above has all the data points for such a chart.

Why is Solana better than Ethereum?

Solana has several advantages: much faster transaction processing (2,000-4,000 TPS vs 15 TPS), much lower cost ($0.00025 vs $5-50+ on mainnet), faster finality (6.4 seconds vs 12+ minutes), and 400ms block times vs 12 seconds. Solana’s monolithic architecture eliminates the complexity of bridging between layers that Ethereum users face with Layer 2 solutions.

Is Solana based on Ethereum?

No, Solana is not based on Ethereum. As stated in the article, Solana was built as “a monolithic Layer-1 blockchain from scratch for high throughput”. Solana uses its own architecture including Proof of History consensus, Gulf Stream, Turbine and parallel processing through the Sealevel virtual machine – completely different from Ethereum’s architecture.

Is ETH or SOL a better investment?

Both serve different investment niches. Ethereum is stability with $50+ billion TVL, institutional adoption and battle tested security – good during market uncertainty. Solana is growth through better performance and lower cost – good for retail momentum and memecoin activity. It depends on risk tolerance and market conditions.

Can Sol beat Ethereum

Rather than one beating the other the article suggests “the market is okay with a future with multiple chains”. Both excel in different areas – Ethereum in security and institutional applications, Solana in consumer apps that need speed and low cost. Many successful projects now deploy on both to get the most visibility and functionality.

Is Sol an Eth killer?

Solana is not an “ETH killer” according to this article. It says “Neither Ethereum nor Solana is better. It’s not about which one is better; it’s about how both do well in different situations.” Each platform serves different use cases rather than competing for full market replacement.

Can Solana reach 5000$ today?

The article doesn’t provide specific price targets for Solana to reach $5000. While it talks about factors affecting solana price like performance advantages, institutional adoption and market dynamics, it focuses on technical analysis rather than specific price targets or timeframes for such valuations.

Will Solana become bigger than Ethereum?

The article suggests a multi-chain future rather than size based competition. It says “both will still be useful in the future, each in its own way.” Ethereum leads in TVL and institutional adoption, Solana in transaction volume and cost efficiency. Growth depends on different metrics and use case adoption.

Is Solana good investment in 2025?

The article mentions 2025 context through research reports and says Solana’s stability has improved and its ecosystem is growing. Recent improvements have “allayed early concerns about reliability, making Solana more useful for business and allowing its ecosystem to grow and its pricing to rise.” But it emphasizes to evaluate specific needs rather than giving direct investment advice.

Should I swap Ethereum for Solana?

The article doesn’t recommend direct swap but says “the question isn’t whether to use Ethereum or Solana; it’s how to get the most out of both platforms.” Many successful projects use multiple chains. The decision should be based on specific requirements: Ethereum for security and DeFi, Solana for consumer apps and cost efficiency.

Conclusion and Recommendations

The Multi-Chain Reality

Neither Ethereum nor Solana is better. It’s not about which one is better; it’s about how both do well in different situations and meet different needs in the blockchain ecosystem which is always changing. The Ethereum vs Solana comparison shows there are trade-offs between security, decentralization and performance that come from different ways of thinking about building a Layer-1 blockchain.

Ethereum’s Strengths

Ethereum’s multi-layered design makes it the most secure and flexible blockchain. This makes it perfect for high value DeFi protocols, institutional investor apps and projects that need to be 100% trustable.The platform has an established ecosystem and history so it’s the safest for apps that need the most protection, especially when prices are unknown and the economy is troubled.

Solana’s Advantages

Solana is one piece so it will always work at low prices. This is good for gaming, social apps, payments and other things that need a lot of small transactions. Recent improvements have allayed early concerns about reliability, making Solana more useful for business and allowing its ecosystem to grow and its pricing to rise.

Strategic Recommendations

Instead of a winner-takes-all situation, the market is okay with a multi-chain future. Many successful projects now use more than one chain. This means they can help more people and do more things. The question isn’t whether to use Ethereum or Solana; it’s how to get the most out of both platforms to obtain the best returns on your investments and crypto investing ideas.

Developer Considerations

You should seriously think about what you need if you are a developer who has to choose a platform. Ethereum has the most depth and the most Total Value Locked (TVL) of any blockchain. This makes it the greatest place to create DeFi protocols or use composability to its fullest. If you’re making apps for consumers where user experience and cost-effectiveness are the most important things, Solana has a lot of great features that can help you gain more users and keep them interested on-chain.

Future Outlook

As the crypto business grows up, things like how well it fits into the ecosystem, how clear the regulations are, and how long it will last are becoming more important than just how well it works. As the world gets more sophisticated and there are more than one blockchain, it’s probable that both systems will still be useful in the future, each in its own way.