Introduction

Ethereum mining has been a foundational process in the cryptocurrency ecosystem, rewarding miners with ETH for solving complex mathematical problems and validating transactions. As Ethereum evolves, its transition from mining to staking has reshaped the way its blockchain operates. This beginner’s guide from Swapzone provides an in-depth look at Ethereum mining, its role in cryptocurrency, and how it has given way to staking. Whether you’re interested in mining ETH or understanding its staking system, this comprehensive guide will walk you through Ethereum’s consensus mechanisms and their historical and future significance.

Key Takeaways

Ethereum mining initially depended on the proof-of-work consensus mechanism, where miners validated transactions and secured the network. However, The Merge marked Ethereum’s transition to proof-of-stake, fundamentally altering its operation. This article explores the previous mining process, factors influencing profitability, essential safety measures, and step-by-step mining instructions. It also introduces Ethereum’s staking system and highlights alternative cryptocurrencies available for mining in 2024, ensuring a complete understanding of Ethereum’s evolution and ongoing opportunities.

Understanding Ethereum Mining

Cryptocurrency mining, particularly Ethereum mining, has played a crucial role in maintaining the Ethereum blockchain. At its core, mining involves solving complex mathematical problems using a computational process to validate transactions and secure the network. This process, known as proof-of-work (PoW), not only ensures blockchain integrity but also rewards miners with newly created Ether tokens.

Miners compete to solve cryptographic puzzles using hash functions, which transform transaction data into fixed-length strings. The first miner to find the correct solution validates the block and adds it to the blockchain, receiving ETH as a reward. The difficulty of these puzzles adjusts dynamically to regulate the time it takes to mine each block, maintaining the system’s consistency.

Historically, mining was vital to Ethereum’s ecosystem, safeguarding transactions and creating profits for miners. It required specialized hardware and significant energy consumption, but it also brought financial incentives. While Ethereum has since transitioned to proof-of-stake with The Merge, mining continues to be an essential concept for understanding the network’s origins and mechanics.

Despite the evolution, Ethereum mining remains a prime example of how cryptocurrency mining works, showcasing the balance between securing a decentralized network and generating profits for participants.

What Is Ethereum Mining?

Ethereum mining refers to the computational process where miners validate and record transactions on the Ethereum blockchain. By solving complex mathematical calculations, miners maintain network security and are rewarded with ETH, ensuring both blockchain integrity and participant incentives.

How Was the Process of Mining Ethereum?

Ethereum mining primarily relied on GPUs to solve complex mathematical problems for transaction validation. Miners used specialized hardware to perform these computations, ensuring network security and earning ETH rewards for successfully adding validated transactions to the blockchain.

Why Should You Mine Ethereum?

Mining Ethereum was historically profitable, providing a source of passive income while enhancing network security. It allowed individuals to acquire Ether without direct investment, making it an appealing entry point into cryptocurrency. Additionally, miners often discovered alternative uses for their rigs, such as using the heat generated by mining operations to warm spaces, adding a practical layer of efficiency to their setup. This combination of financial rewards and innovative applications made Ethereum mining a versatile and valuable endeavor.

The Future of Ethereum Mining: Transition to Proof-of-Stake

The introduction of Ethereum 2.0 and The Merge marked the shift from mining to a proof-of-stake model, significantly reducing energy consumption and improving scalability. This transition deprecates traditional mining, as validators now secure the network by staking Ether. While mining is no longer viable on the Ethereum mainnet, miners have sought alternatives, including other Proof-of-Work cryptocurrencies or Ethereum forks. Those with existing hardware still have opportunities to recoup their investments before the complete phasing out of mining.

Ethereum Mining Profitability

Ethereum mining profitability has always depended on multiple factors, including electricity costs, hardware investment, and mining difficulty. To calculate potential returns, miners often rely on mining calculators that incorporate key variables such as hash rate, electricity consumption, and cryptocurrency prices. The basic profitability formula factors in rewards earned minus operational expenses. Efficient hardware and maximizing hash rate are crucial to offset electricity costs and boost returns. However, fluctuating cryptocurrency prices and changes in mining difficulty introduce significant volatility, impacting ROI. Additionally, the substantial upfront investment in mining rigs and energy-efficient equipment poses a financial challenge. Understanding these elements is critical for anyone considering mining as a viable option, offering a realistic perspective on the economic aspects of Ethereum mining.

Essential Components for Ethereum Mining

8 GPU GTX 1060 Ethereum Mining Rig | Source: unitexmart

To mine Ethereum, you need the following components:

- Mining hardware: GPUs, ASICs, or FPGAs

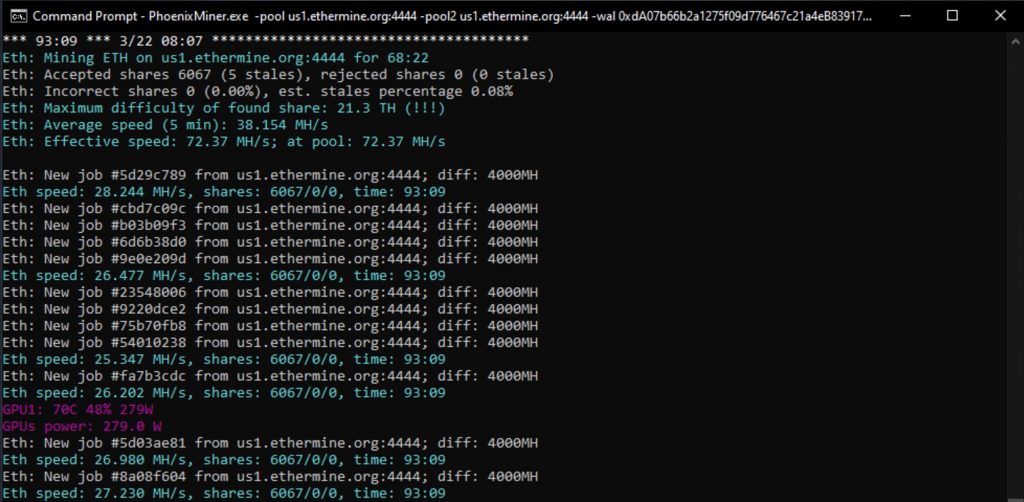

- Mining software: Tools such as Claymore or PhoenixMiner

- Ethereum wallet: Secure options like MetaMask or Ledger Nano S

- Internet connection: Stable and high-speed

- Mining pool: Optional but beneficial, especially for beginners

These essential elements create a basic setup for successful Ethereum mining, ensuring smooth operation and security. Mining pools, in particular, offer an opportunity for new miners to join forces and increase their chances of earning rewards.

Step-by-Step Guide to Mining Ethereum

Step 1: Creating an Ethereum-Based Crypto Wallet

The first step in Ethereum mining is creating a secure wallet to store your rewards. Popular options include hardware wallets like Trezor One and Ledger Nano S, as well as software wallets like MetaMask, Exodus, and Mist. Ensure your wallet is properly synchronized for secure and smooth transactions.

Step 2: Selecting Your Mining Hardware

When selecting mining hardware, consider your budget, mining goals, and the type of mining you want to pursue. GPUs are popular among hobbyists due to their flexibility and lower initial cost, but ASIC miners offer significantly higher efficiency and performance for serious miners. FPGA mining is another option that balances performance and energy efficiency. Additionally, take into account factors like electricity costs, cooling systems, and the longevity of your hardware. ASICs are often more efficient for Ethereum mining, but for most hobbyists, GPUs remain the most sensible choice due to their lower upfront investment and flexibility in use.

Step 3: Choosing Your Mining Strategy

When choosing a mining strategy, consider your budget, investment goals, and risk tolerance.

- Pool mining: Joining a mining pool provides steady rewards by pooling resources with other miners, reducing the risk of irregular payouts.

- Solo mining: This option offers the potential for greater profits, but the risk is higher, as you must solve blocks on your own without support from other miners.

- Cloud mining: With cloud mining, you pay for remote mining services, avoiding the need for hardware and maintenance costs. However, it can be less profitable and involves trusting third-party services.

Each strategy has its pros and cons, so choose the one that aligns best with your mining goals and available resources.

Step 4: Installing Mining Software

Download and install mining software such as Claymore, PhoenixMiner, Gminer, or Ethminer. Ensure that the software is compatible with both your operating system (Windows or Linux) and mining hardware for optimal performance. Choosing the right software is crucial for maximizing efficiency and ensuring smooth operation of your mining setup.

Step 5: Collecting Your Rewards

After successfully mining Ethereum blocks, synchronize your mining rewards with your wallet. In pool mining, rewards are distributed based on your contribution to the pool, while solo miners retain the entire reward. It’s essential to ensure your wallet is properly set up and synchronized to securely receive and manage your earnings. Regular wallet management helps maintain the safety and efficiency of your rewards collection process.

Optimizing Your Ethereum Mining Operation

To maximize your hash rate, optimize GPU settings and regularly update your drivers. Joining a mining pool can boost efficiency by combining resources. Additionally, reduce operational costs by managing power consumption and ensuring proper hardware maintenance. These strategies help enhance mining performance, increase profitability, and extend the life of your equipment.

Time Frame for Mining Ethereum

The time needed to mine 1 ETH varies based on your hardware, hash rate, and whether you’re mining solo or in a pool. The mining difficulty and your specific setup will influence the time required, so expect different results depending on these factors.

The State of Ethereum Mining in 2024

Ethereum mining in 2024 has evolved following the switch to Proof of Stake. Miners are now focusing on Proof of Work forks or exploring alternative cryptocurrencies. Despite Ethereum’s transition, mining remains relevant as miners adapt to new opportunities and technologies.

Introduction to Ethereum Staking

Staking has replaced mining as Ethereum’s primary validation mechanism. Validators lock up their ETH in a Proof of Stake system, earning rewards while securing the network and validating transactions.

Proof of Stake vs. Proof of Work

Proof of Stake (PoS) and Proof of Work (PoW) represent two distinct consensus mechanisms for blockchain transaction validation. In PoS, validators are selected based on the cryptocurrency they commit as a stake, promoting energy efficiency and scalability. Conversely, PoW relies on miners competing to solve complex computational problems, which is energy-intensive and less sustainable. PoS offers clear advantages, including reduced environmental impact and enhanced scalability, making it a preferred choice for modern blockchains. Ethereum’s transition to PoS underscores the model’s benefits in addressing scalability and sustainability challenges. This comparison highlights the fundamental differences between PoS and PoW, providing insights into why PoS is increasingly favored in the blockchain ecosystem.

Alternative Cryptocurrencies for Mining

For those seeking viable alternatives, these options still use Proof of Work:

Bitcoin (BTC) Mining

Bitcoin mining requires ASICs and utilizes the SHA-256 algorithm, offering high competition but lucrative rewards.

Litecoin (LTC) Mining

Litecoin employs the Scrypt algorithm, suitable for ASICs and GPUs, making it versatile for miners.

Dogecoin (DOGE) Mining

Dogecoin, based on the Scrypt algorithm, supports GPU and ASIC mining, appealing to those seeking low-cost alternatives.

Monero (XMR) Mining

Monero uses the RandomX algorithm, optimized for CPU mining, providing accessibility for those without high-end hardware.

Ethereum Classic (ETC) Mining

Ethereum Classic maintains Proof of Work, offering a familiar option for former Ethereum miners using GPU hardware.

You can always exchange any of these cryptocurrencies on swapzone.io

Conclusion

Mining Ethereum today requires careful planning, from selecting hardware to optimizing operations. While mining ETH directly has shifted to staking, alternatives like Ethereum Classic remain viable. Stay informed about evolving technologies and staking opportunities to remain active in the Ethereum ecosystem.

FAQs

How long does it take to mine 1 Ethereum?

The timeframe depends on hardware, hash rate, and mining strategy. Pool mining is faster but splits rewards.

Is it still profitable to mine Ethereum?

Direct ETH mining is no longer viable. Alternatives or PoW forks can still yield profits with efficient setups.

Is it possible to mine Ethereum?

No, it is no longer possible to mine Ethereum (ETH). As of September 2022, Ethereum transitioned from the Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS) in an upgrade known as The Merge. This change eliminated mining and replaced it with staking, where validators secure the network by locking up ETH instead of using computational power.

However, if you’re looking for alternatives, Ethereum Classic (ETC)—a separate blockchain that continues to operate on PoW—remains mineable using similar hardware, such as GPUs. Other PoW cryptocurrencies like Bitcoin, Litecoin, and Monero also offer mining opportunities.

Can I mine Ethereum for free?

Mining requires hardware, software, and electricity, so “free” mining is not possible. Staking offers a lower-cost entry alternative.