Introduction

Cryptocurrency trading has become an exciting investment avenue for many. As more people look to digital currencies as a way to grow their personal wealth, understanding how to trade crypto is crucial. With blockchain technology at the core, crypto offers a decentralized method for transferring assets, providing a new dimension to financial markets. However, alongside the potential for high returns comes significant risk, and that’s why research and a well-prepared strategy are essential before diving into the crypto trading world. In this beginner’s guide, we’ll walk you through the steps of how to start trading crypto and the essential aspects to keep in mind to succeed.

What is Cryptocurrency and How Does It Work?

Cryptocurrencies are digital currencies that operate on decentralized networks using blockchain technology. Unlike traditional fiat money, these currencies are not controlled by any central authority, such as a bank or government. Instead, cryptocurrencies like Bitcoin and Ethereum run on a blockchain system, a public ledger that records all transactions across a network of computers. This ensures transparency and security.

Blockchain’s decentralized nature eliminates intermediaries and makes peer-to-peer transactions possible. Each crypto trade is validated through mining or other consensus mechanisms, ensuring that no one can alter the transaction data. The immutability of blockchain makes cryptocurrencies more secure, as any changes would require altering every record in the chain, a task that’s nearly impossible to accomplish. Cryptocurrencies, by design, offer low-cost and efficient alternatives to traditional banking systems and are used for a range of purposes—from purchasing goods to acting as an investment vehicle.

Types of Cryptocurrencies

With thousands of digital currencies in existence, the world of crypto trading offers various options for investors. The market capitalization of these cryptocurrencies varies, and understanding these different types can help you make more informed decisions when trading.

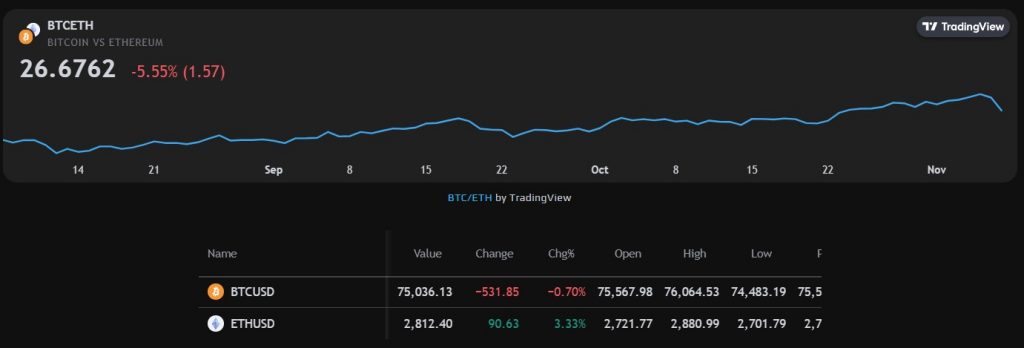

Bitcoin (BTC)

Bitcoin, the first cryptocurrency, operates on a blockchain and uses a proof-of-work consensus mechanism. Over the years, Bitcoin has seen significant value increases, making it a popular choice for long-term investment. As of now, Bitcoin remains the largest cryptocurrency by market cap. Many traders buy and sell Bitcoin frequently due to its popularity in the crypto community.

Ethereum (ETH)

Ethereum is often considered the leading altcoin. Unlike Bitcoin, Ethereum is more than just a digital currency. It’s a platform for decentralized applications (DApps) and smart contracts, which enable developers to create and execute software without centralized control. Ethereum’s blockchain has gained prominence for enabling innovations in the crypto space. Many crypto brokers offer Ethereum as a choice for day traders due to its liquidity.

Tether (USDT)

Tether is a stablecoin, meaning its value is pegged to the U.S. dollar, providing stability that many traders seek in a highly volatile market. For experienced traders and newcomers alike, Tether serves as a bridge between cryptocurrencies and fiat currency, allowing users to maintain liquidity and avoid drastic fluctuations. Tether is frequently used in crypto trades, as it enables traders to move funds between crypto exchange accounts without excessive management fees or extra fees. Many traders take advantage of Tether to protect their cash flow, making it easier to hold value in their crypto brokerage accounts without risking the unpredictability of other tokens. Thus, Tether is a useful tool for maintaining balance in personal finance and achieving specific investment goals in the cryptocurrency space.

Solana (SOL)

Solana is a highly efficient blockchain designed for decentralized finance (DeFi) applications and smart contracts. It uses a unique consensus mechanism that combines proof of stake and proof of history to enhance transaction speeds. Solana has become a popular choice for day traders looking to take advantage of its quick transaction times.

Binance Coin (BNB)

Originally launched by the Binance exchange, Binance Coin is now widely used for trading on the platform and can also be used for payments and bookings. It is another token with significant market potential, thanks to its utility within one of the largest crypto exchanges in the world.

Cryptocurrency Trading vs. Stock Trading

Cryptocurrency trading and stock trading share some similarities but also come with distinct differences. One major difference is the market hours. While stock exchanges have specific trading hours, the cryptocurrency market operates 24/7. This constant trading cycle can present both opportunities and risks, especially for day traders aiming to trade cryptocurrencies on the same day.

Unlike stocks, which often pay dividends, cryptocurrencies don’t offer this form of passive income. However, investors can generate returns through staking or lending crypto assets. Additionally, stock markets are regulated, while crypto markets are decentralized, meaning they operate without centralized oversight. While regulation offers a sense of security, the decentralized nature of crypto can create opportunities for higher profits and flexibility, but also higher risk.

How Cryptocurrency Trading Works

Cryptocurrency trading is a zero-sum game where buyers and sellers exchange digital assets. The price of a cryptocurrency is determined by supply and demand—when more people want to buy, the price goes up, and when more people want to sell, the price decreases. Traders execute their transactions on platforms called cryptocurrency exchanges. The volatility of the crypto market often leads to rapid price fluctuations, presenting both opportunities and challenges for traders.

Pros and Cons of Investing in Cryptocurrency

Pros

- High Potential Returns: Cryptocurrency investments can offer substantial returns, especially in emerging markets and high-growth sectors.

- Portfolio Diversification: Digital assets provide an opportunity to diversify beyond traditional stocks and bonds, adding a new asset class to an investment portfolio.

- 24/7 Market Access: Cryptocurrency markets never close, allowing investors to trade anytime, regardless of standard market hours.

- Decentralized Assets: Unlike fiat currencies and other centralized assets, cryptocurrencies operate on decentralized networks, allowing greater independence and control over assets.

- Opportunities for Active Trading: Crypto markets are ideal for swing trading and day trading due to their frequent price fluctuations, offering chances for short-term profit.

- Low Barriers to Entry: Cryptocurrency platforms often allow trading with smaller amounts of capital, making it accessible to a wide range of investors.

Cons

- High Volatility: Cryptocurrencies are highly volatile, with sudden price changes that can lead to significant gains but also major losses.

- Lack of Regulation: The decentralized nature of crypto markets means they are mostly unregulated, increasing risks related to fraud and market manipulation.

- Financial Risks for Individuals: Without careful management, using personal funds like a bank account to trade in crypto could disrupt financial stability due to high market volatility.

- Sustainability Issues: Not all crypto projects are sustainable; many have limited long-term viability, requiring careful research to avoid high-risk investments.

- Complex Technology: Understanding blockchain technology and cryptocurrency mechanics can be challenging, which can lead to misinformed decisions.

- Strong Risk Tolerance Required: Given the unpredictable nature of crypto markets, investing in crypto requires a high tolerance for risk and a clear investment strategy to manage potential losses effectively.

How to Start Trading Cryptocurrency: Step-by-Step Guide

Ready to dive into cryptocurrency trading? Here’s a step-by-step guide to help you get started with Swapzone.

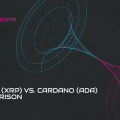

Step 1: Choose and Access a Crypto Exchange through Swapzone

To trade cryptocurrency on Swapzone, begin by comparing exchange options available on the platform. Swapzone provides a comprehensive list of crypto exchanges without requiring you to create multiple accounts across different exchanges. Simply select the best exchange rate for the trading pair you need.

Step 2: Fund Your Wallet

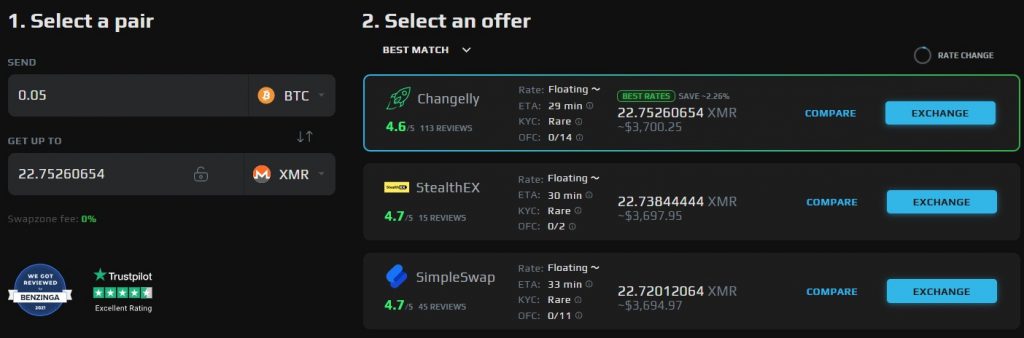

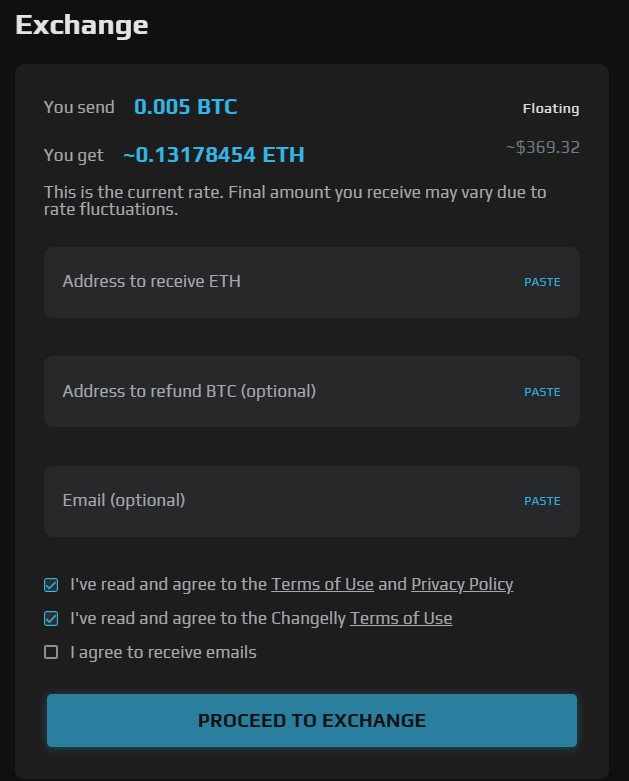

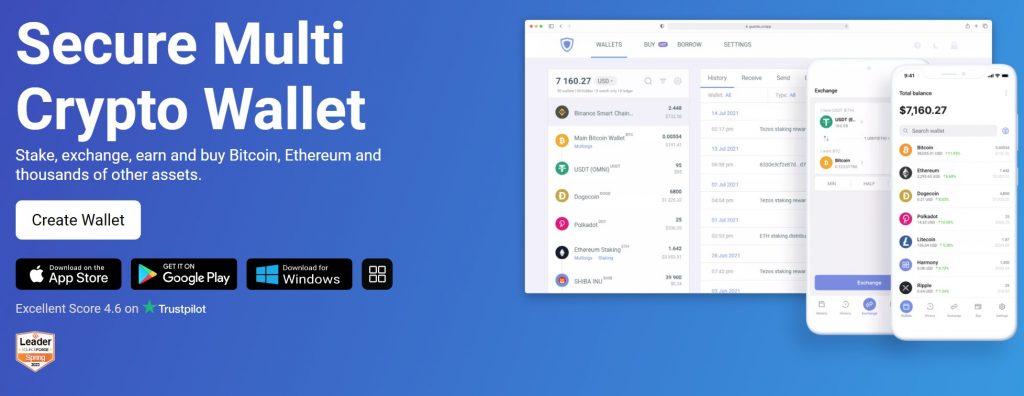

The image shows one of the possible digital wallets to choose from — Guarda.

Once you’ve chosen an exchange on Swapzone, ensure your wallet is funded. Most users fund their crypto wallets by purchasing coins through various payment methods such as bank transfers, credit or debit cards, or wire transfers. Check the associated deposit times and fees with each method to avoid extra charges.

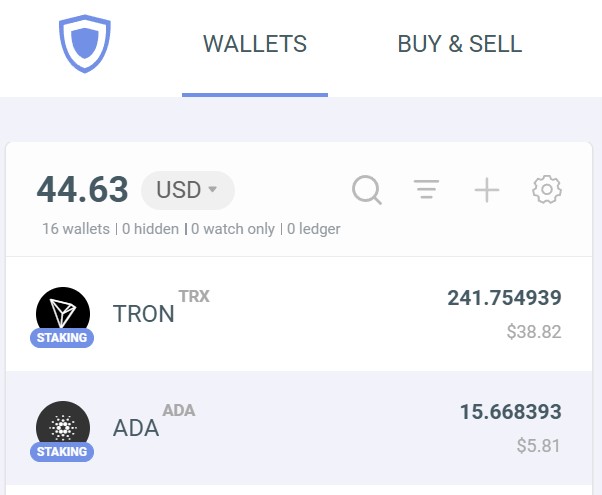

Step 3: Select a Cryptocurrency to Trade

After funding, choose a cryptocurrency to trade. Popular coins like Bitcoin and Ethereum are highly liquid and generally more stable, making them common choices for beginners. Smaller altcoins may carry more risk but offer greater potential returns.

Step 4: Develop a Trading Strategy

Before executing trades, establish a trading strategy. Whether it’s active day trading or long-term holding, choose a strategy that aligns with your goals and risk tolerance. Swapzone’s exchange comparisons can support frequent or occasional trades by helping you find the best rates quickly.

Step 5: Make Your Trade

Once you’re ready, execute your trade by selecting a trading pair (e.g., BTC/USDT) and the best rate available. Swapzone enables market orders, allowing you to buy or sell crypto at the current market price. With Swapzone, you don’t need extensive capital to start trading thanks to the flexibility of fractional cryptocurrency purchases.

Step 6: Secure Your Cryptocurrency

Security is crucial when holding crypto assets. After trading on Swapzone, move your digital assets to a secure wallet. For optimal security, use hardware wallets, which keep your assets offline and protect them from online threats. For added security, enable two-factor authentication in all wallets and exchanges.

Swapzone simplifies crypto trading by helping users find the best rates, avoid multiple registrations, and stay informed—all in a secure and convenient interface.

Advanced Cryptocurrency Trading Concepts

Advanced cryptocurrency trading concepts encompass sophisticated market analysis techniques and trading strategies. This section introduces these concepts, providing a foundation for the detailed trading methods that follow.

Technical Analysis in Crypto Trading

Technical analysis (TA) in cryptocurrency trading focuses on interpreting past market data, primarily price and volume, to project future price movements. TA is essential for traders looking to make data-driven decisions and enhance trading outcomes.

Market Structure and Cycles

Market cycles in cryptocurrency trading consist of four primary phases: accumulation, markup, distribution, and decline. For example, Bitcoin frequently follows these phases, moving through periods of growth and contraction. This section also highlights the emotional responses that often accompany each stage of the cycle, presenting the “Psychology of a Market Cycle” chart, which illustrates investor sentiment shifts, such as optimism, euphoria, fear, and capitulation, that occur in response to market changes.

Support and Resistance

Support and resistance are key concepts in technical analysis, representing price levels that function as trading zones. For example, Bitcoin’s price may encounter a resistance level acting as a ceiling or a support level acting as a floor. Traders monitor these levels to make strategic decisions, using support and resistance as indicators of potential trend reversals or continuations. New levels often develop when price trends break through established barriers.

Trendlines

Trendlines are a crucial tool in identifying market trends by linking a series of support or resistance levels. By drawing trendlines, traders can recognize overarching market movements and better understand market momentum. The reliability of a trendline increases as it’s tested repeatedly, enabling traders to incorporate these trends into their trading strategies.

Moving Averages

Moving averages help smooth out price fluctuations over specific timeframes, highlighting long-term trends and serving as dynamic support or resistance levels. Different timeframes for moving averages, such as 50-day or 200-day averages, allow traders to gauge trend strength and potential entry or exit points. Moving averages are widely used to identify trend directions and anticipate price levels.

Chart Patterns

Candlestick charts are a fundamental tool for visualizing price action in cryptocurrency trading. Each candlestick represents an opening, closing, high, and low price over a specified period. By interpreting these patterns, traders gain insights into market sentiment and potential trend shifts, allowing for more informed trading decisions based on price action.

Fundamental Analysis in Crypto Trading

Fundamental analysis in crypto trading helps traders assess the intrinsic value and long-term potential of a cryptocurrency by evaluating a range of key factors. One of the most critical considerations is the development team behind the project. A skilled, transparent, and reputable team can inspire confidence among investors, indicating that the project has the necessary talent to overcome technical challenges and grow sustainably. Equally important is community support; a strong and engaged community often drives a project’s adoption and provides a stable base of active users.

Other vital aspects include technical specifications and infrastructure. These elements define the efficiency, security, and scalability of the cryptocurrency, which can impact its performance and utility. Liquidity, or the ease of trading a cryptocurrency without causing significant price changes, is another essential factor; high liquidity typically signals a lower risk for investors. Additionally, onchain analysis—studying blockchain metrics like transaction volume and active addresses—can offer insights into the network’s actual usage and demand trends. By evaluating these elements, fundamental analysis provides a comprehensive view of a cryptocurrency’s potential and helps investors make well-informed trading decisions.

Risk Management in Crypto Trading

Risk management is a critical aspect of cryptocurrency trading, given the market’s inherent volatility. To mitigate risks, traders should prioritize building solid knowledge of the market and stay informed about ongoing trends. Continuous research into market developments helps in making smarter investment decisions. It’s also essential to set appropriate risk tolerance levels, ensuring that you only invest what you’re willing to lose. Diversification plays a key role in reducing exposure to any single asset, helping to spread risk across different cryptocurrencies or other investments. Aligning your crypto investments with broader financial goals is equally important, as it ensures your trading strategy fits within your overall financial plan. By combining these approaches—knowledge, awareness, research, risk tolerance, and diversification—traders can effectively manage risks and safeguard their investments in the unpredictable crypto market.

Conclusion: Getting Started with Cryptocurrency Trading

Crypto trading can be a complex and highly risky endeavor, but with the right strategy and mindset, it can also be profitable. Take the time to understand the risks, manage your investments wisely, and continuously learn. With patience and research, you can confidently start trading crypto and make the most out of this exciting market

FAQs

How do you trade crypto for beginners?

To start trading crypto as a beginner, create an account on a cryptocurrency exchange, fund your account, select a cryptocurrency to trade, and follow a well-defined strategy.

How does a crypto trade work?

In a crypto trade, you buy or sell cryptocurrencies through a trading platform. The price of cryptocurrencies is determined by supply and demand, with traders executing transactions on exchanges.

What’s the best crypto to trade in 2024?

Popular cryptocurrencies such as Bitcoin and Ethereum have consistent demand, while emerging projects might offer higher rewards and risks. It’s essential to research market trends for the latest information.

Can I make money trading crypto?

Yes, it’s possible to make money through crypto trading, but it’s also highly risky. Successful trading requires understanding the market, strategy, and proper risk management.