Choosing between providing liquidity and taking directional trades can make or break your crypto portfolio. Both strategies offer profit potential, but they work in completely different ways. One lets you earn passively while you sleep. The other demands active attention and market prediction skills.

This guide explains everything you need to know about liquidity pools and long/short trading. You’ll learn how each strategy makes money, what risks you’re taking, and which one is best for your investment goals. We’ll also look into perpetual liquidity pools, which are a new type of hybrid that is changing how traders think about yield and leverage.

What liquidity pools are and how they make money

What is a pool of liquidity?

A liquidity pool is a smart contract that keeps extra crypto assets. Uniswap, PancakeSwap, and Curve are all decentralized exchanges (DEXs) that use these pools to work. These platforms don’t connect buyers and sellers directly; instead, they use Automated Market Makers (AMMs) to make trades easier.

When you put tokens into a pool, you let other people trade right away. You get trading fees in return. It’s decentralized finance (DeFi) at its core, which means that no one else has control over your money. In a non-custodial system, you become the liquidity provider (LP).

The Work of Liquidity Pools and Compensation

The constant product formula x * y = k works magic. When someone buys ETH from an ETH/USDC pool, they take ETH out and put USDC in. The pool uses price oracles to stop people from changing prices on purpose. It automatically changes prices based on the new ratio.

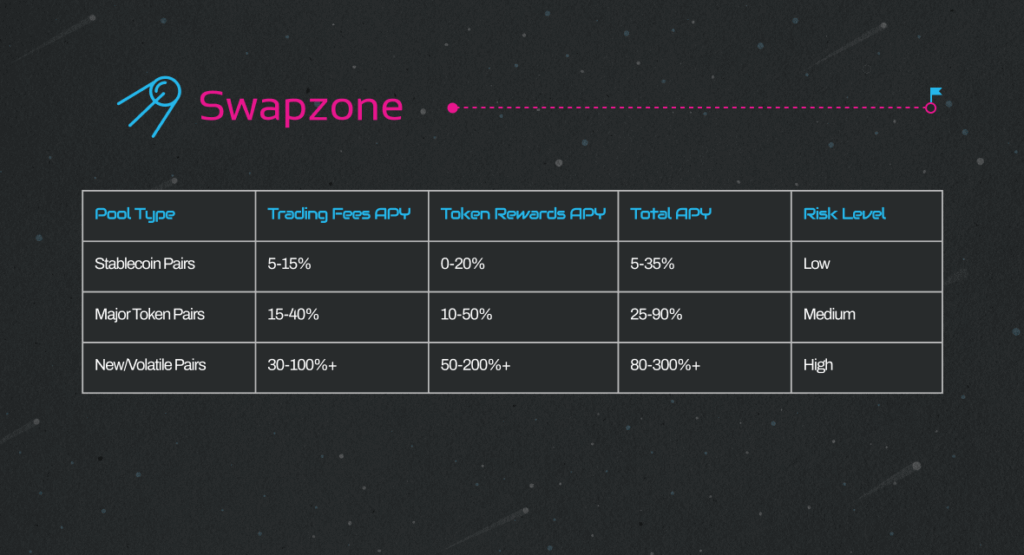

As an LP, yield farming gives you multiple ways to make money. Your base income comes from trading fees, which are usually 0.3% per swap. More fees come with more trading. Token rewards are one way that 20–50% APY from organic activitieslds. Some pools give you 20% to 50% APY from natural activity, while aggressive farming can give you 300% APY or more.

This is what realistic returns look like:

The Issue of Impermanent Loss

The hidden cost of providing liquidity is impermanent loss. It happens when the prices of tokens go up or down from where you put your money. The AMM automatically rebalances, which means you have less of the asset that has gone up in value.

A 50% change in price causes a loss of about 5.7% that won’t last. A price change of 2x means 5.7% gone. A change in price of 5x? That means a loss of 25.5%. It’s only “permanent” if you pull out. The loss goes away if prices go back up. If the cost of trading is more than the loss, you still make money overall.

Stablecoin pairs don’t have this problem very often because prices don’t change much. Use online calculators to figure out how much money you might lose if you don’t keep it.

Long/Short Trading Strategies in Crypto Markets

What Is Long/Short Trading in Crypto?

Taking a long position means buying crypto and betting on price increases. A short position is the opposite: you borrow tokens, sell them right away, and then buy them back later at a lower price. The difference is how much money you make.

Crypto trading goes on all the time, even when other markets would stop because of volatility. Trading with leverage makes everything bigger. With three times the leverage, a 10% change in price means a 30% gain or loss. Centralized exchanges (CEXs), such as Binance, let you borrow up to 125 times your money. Decentralized platforms like GMX and dYdX offer alternatives that don’t require custody.

Perpetual futures make trading easier by not having expiration dates. If you keep your collateral, you can hold leveraged positions for as long as you want. Payments every eight hours keep perpetual prices in line with spot markets.

Well-known strategies for long and short crypto trading

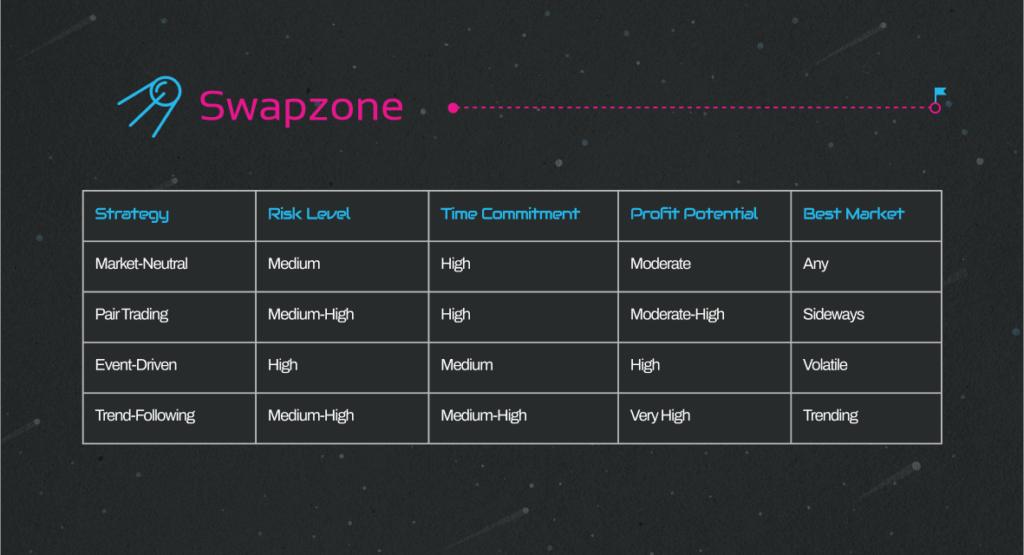

A market-neutral strategy means having the same amount of long and short positions in different assets. You’re betting on how well one thing will do compared to another while also protecting yourself against the overall direction of the market. Pair trading takes advantage of temporary breaks in the normal correlation between assets.

Event-driven trading takes advantage of things like protocol upgrades, token unlocks, and new exchange listings. To ride momentum, trend-following strategies use technical analysis tools like moving averages, the Relative Strength Index (RSI), and support and resistance levels.

Hedging Strategy Example

You hold 10 ETH worth $20,000 but worry about short-term volatility. Open a 5x leveraged short on 2 ETH ($4,000 position, $800 collateral)..

IIf ETH drops 20%, your holdings lose $4,000, but your short gains $4,000.If ETH goes up 20%, your short loses $4,000 and your holdings gain $4,000. This shows how portfolio hedging works: keeping upside exposure while protecting against downside risk.

Perpetual Liquidity Pools: The Hybrid Innovation.

Perpetual liquidity pools mix the mechanics of perpetual futures with the traditional way of providing liquidity. These pools do more than just let you change places; they also give you collateral for positions that are leveraged.

With GLP tokens, GMX pioneered this. Your assets go into the pool. Traders use this liquidity to borrow money for leveraged trades. You make money from trading fees, payments for funding, and rewards from the platform. Your liquidity supports leveraged trades, which create many sources of income.

The main difference between this and regular pools is that you’re going against all the traders. Liquidations can be good for you. Funding rates become big sources of income. When traders lose money, their collateral often goes to the pool.

Risks are higher: there are more worries about smart contract security. Liquidations of positions can go both ways—big changes in the market can hurt pool returns. The complexity requires constant monitoring of the pool’s makeup and the mood of the traders.

Liquidity Pool vs Long/Short: Direct Comparison

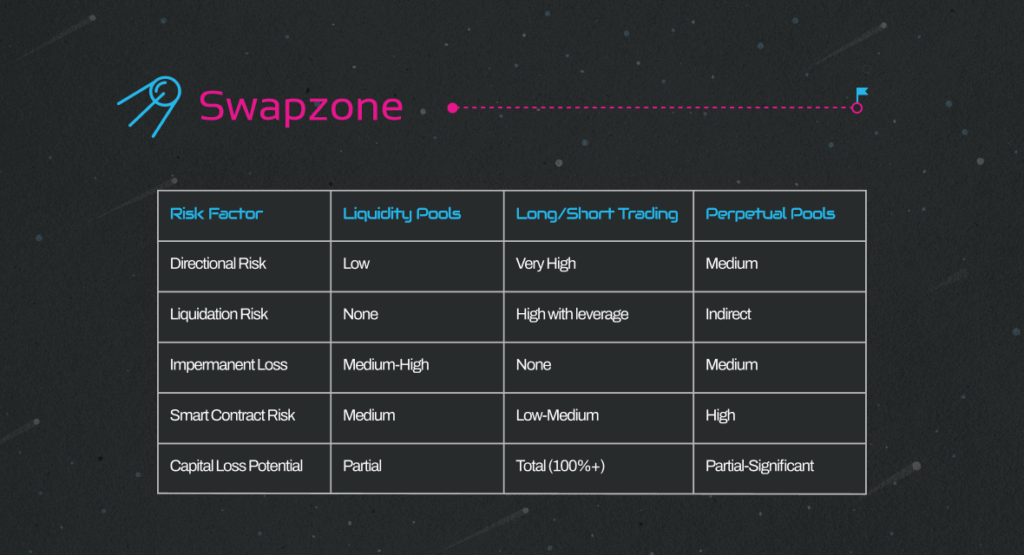

Risk Profiles Side-by-Side

A Comparison of Profit Mechanisms.

Liquidity providers earn from trading volume regardless of price direction. A daily fee of 1% adds up quickly. Because the cryptocurrency market is open 24 hours a day, seven days a week, fees never stop.

Long/short traders need correct predictions. When right, gains can be spectacular—a 10x leveraged trade on a 20% move yields 200% returns. Market conditions determine which shines. Sideways action favors LPs. Strong trends favor skilled traders.

Time requirements differ dramatically. Yield farming demands maybe 2-3 hours monthly. You need to spend at least 1 to 2 hours every day looking at charts, keeping an eye on funding rates, and changing your positions when you trade on margin.

What investment strategy is best for you?

Choose Liquidity Pools If You:

- Want steady, predictable income without market timing

- Choose stability over big gains.

- Don’t have time to trade actively

- Value tax situations that are easy to understand

- Do long-term crypto investors want their holdings to work harder?

Pick Long/Short Trading If You:

- Know how to do technical analysis and what indicators mean

- Can handle a possible total loss of capital

- Have time to check in every day

- Have control over your feelings and don’t trade for revenge.

- Want to make as much money as possible

Keep in mind that 70% to 90% of leveraged traders lose money. You can only go forward if you’re ready for that.

The Hybrid Portfolio Method

Sample $10,000 allocation:

- $7,000 in stable liquidity pools

- $2,000 for directional trading

- $1,000 in perpetual pools

This provides stable base income while allowing tactical trading. Your liquidity pool earnings pay for trading experiments without putting your main capital at risk. Rebalance quarterly based on performance and market conditions.

Common Mistakes That Cost Money

Liquidity Pool Pitfalls

Yield chasing destroys capital fast. That 2,000% APY pool is printing worthless tokens. Focus on sustainable yields from audited protocols. Check smart contract audits religiously—one exploit drains pools completely. Ignoring trading volume means minimal fees that won’t offset impermanent loss.

Long/Short Trading Blunders

Overleveraging liquidates you fastest. Start with 2x maximum leverage. Trading without stop losses is gambling. Set them immediately after opening positions. Revenge trading after losses compounds mistakes—step away and return with a clear head. Ignoring funding rates on perpetual swaps bleeds accounts slowly at 10%+ annually.

Real-World Results: Case Studies

Liquidity Pool Success

Sarah provided $10,000 to a Curve stablecoin pool for six months. Results: $285 in trading fees, $420 in token rewards, -$12 in impermanent loss, and -$45 in gas fees. Net profit: $648, which is a 12.96% return. Lesson: Stablecoin pools give you steady returns with little risk of losing money.

Long/Short Trading Example.

In November 2024, Marcus bought a lot of BTC for $67,000 with 3x leverage. Position: $3,000 in charge of $9,000. Leave at $89,000 in three weeks. Price rise: 32.8%. Return on leverage: 98.4%. After fees: $2,712 (90.4% return). Pattern, discipline, and profit-taking are success factors.

Conclusion: 2025 Liquidity Pool vs Long/Short

No strategy is “better” overall. Choose based on risk tolerance, time, and investment goals.

Liquidity pools generate passive income in sideways markets with little effort. Excellent for long-term capital efficiency holders.

Trading long and short does well when trends are strong, has no limit on gains, and is good for people who are good at timing the market. Requires active participation but pays well for skill.

Perpetual liquidity pools connect both worlds by giving you passive income and trading exposure. They are complicated, but they show the way forward for DeFi that doesn’t waste money.

Most sophisticated investors use both strategically. They maintain liquidity positions for steady income while taking tactical trades during high-conviction opportunities. This optimizes risk-adjusted returns across market conditions.

Use both strategies on a small scale at first. Put $100 to $500 into pools that have been shown to work. Open small leveraged positions to learn how things work. Keep track of everything for three to six months. You’ll discover which fits your personality.

The cryptocurrency market rewards people who are ready and willing to learn new things. You should fully understand the risks of passive liquidity provision, active trading, or a combination of the two. Your money and future self will thank you.

Are you ready to begin? Choose a strategy, put some money into it that you can afford to lose, and start learning by doing. The best way to learn real trading skills is to put your own money on the line.