Ever tried to buy a stock at 2 am after hearing a breaking news story? You find the traditional stock markets closed. That’s frustrating. NYSE and NASDAQ only operate for about 6.5 hours a day, Monday through Friday. Global investors get locked out for most of the week. But then xStocks came along. These tokenized stock representations use blockchain technology. You can trade your favorite stocks 24/7 on networks like Solana and BNB Chain.

Backed Finance AG issues these xStocks. This Swiss-regulated company got bought out by Kraken. They back each token 1 for 1 with real-life securities. A regulated custodian holds everything securely. Traditional stock trading limits you to set hours of the day. Tokenized equities run on a decentralized blockchain that never takes a break. You can choose from over 60 tokenized stocks and ETFs. These include Tesla and Apple. xStocks represent the future of tokenized stocks. They’re bringing Wall Street right into the crypto world.

This guide breaks down how xStocks work. We’ll explain why you can trade them 24/7. You’ll learn what that means for global markets. Whether you’re a seasoned crypto investor or just curious about stock tokenization, this is the place to get informed. Make smart decisions about this digital asset class.

What are xStocks and How Do Tokenized Stocks Work?

xStocks are tokenized versions of real-world stocks and ETFs. Backed Finance issues them as SPL tokens on the Solana blockchain. They plan to expand to other networks too. Each xStock represents a token backed one-for-one by the real share or ETF. A licensed financial institution keeps these in a safe place. This tokenized version of stocks lets you trade them on crypto platforms.

Here’s how it works: You buy an xStock through a service like Swapzone, Kraken or Bybit. Backed Finance AG then secures the corresponding real stock in custody. The xStock price tracks the real share price in real time. You get all the price movements without needing a traditional brokerage account. It’s pretty cool.

Some key things about xStocks: You choose from over 60 different stocks and ETFs. You get instant settlement. No waiting for verification. You can start with a tiny amount of money. You always control your own crypto assets. They’re fully regulated too. You can trust they’ll be above board.

Why Traditional Stock Markets are Trapped in a 9 to 5 Routine

Traditional stock exchanges stick to a rigid schedule. This contrasts sharply with the freedom of tokenized stock trading. The NYSE & NASDAQ only open from 9:30 AM to 4:00 PM ET. That’s a pitiful 6.5 hours a day, five days a week. Those 9 to 5 hours exclude weekends. They exclude federal holidays. They exclude working hours when most people actually have time to trade.

What’s the reason behind this limited availability? Traditional stock markets need human supervisors. They need a centralized clearinghouse. They need complex settlement infrastructure. Someone has to validate every trade. Someone has to match it. The DTCC (the Depository Trust & Clearing Corporation) handles the final settlement. Settlement takes T+1 (one business day). This essentially locks your capital up for the next day.

Pre-market trading hours run from 4:00 AM to 9:30 AM ET. After-hours sessions run from 4:00 PM to 8:00 PM ET. But these come with downsides. Lower liquidity. Wider bid-ask spreads. Limited stock availability. International investors in Asia or Europe struggle to access the US stock market. It’s like trying to find a rainbow at the end of a rainbow.

Nasdaq recently requested from the SEC the right to open for 23 hours a day. They probably realized the crypto market demands more flexibility. But it’s still far from the 24/7 availability that blockchain-based tokenized equities already provide through on-chain trading.

How Blockchain Turns Trading of xStocks into a 24/7 Affair

The underlying infrastructure creates the main difference between traditional stocks and xStocks. Blockchain networks like Solana rely on nodes around the world. These nodes validate transactions day and night. No early closing bell. Zero end of trading hours. No lazy Saturdays. This is why you can trade xStocks non-stop.

Here’s the thing: When you trade xStocks using blockchain, you don’t need middlemen. No central exchange. No broker. There is no clearinghouse to impede your progress. Smart contracts handle trades peer to peer. Settlement happens on the spot (T+0). Traditional markets lock your cash away for a whole day after every single trade. Quite different.

The crypto market has operated non-stop since 2009. Build on the same blockchain rails that Bitcoin uses. The result is obvious: tokenized stocks get the same round-the-clock access. Whether it’s late at night in New York, midday in Singapore, or early morning in London, you can trade xStocks when it suits you. Use any crypto platform.

DeFi integration takes this further. You can use xStocks as collateral in lending protocols. Lend them out to earn interest. Trade them on a decentralized exchange. Keep them in a liquidity pool that earns trading fees. Plug them into multiple DeFi applications. You can’t do that with traditional stock markets. With xStocks, the trading experience becomes seamless across your crypto and xStocks portfolios.

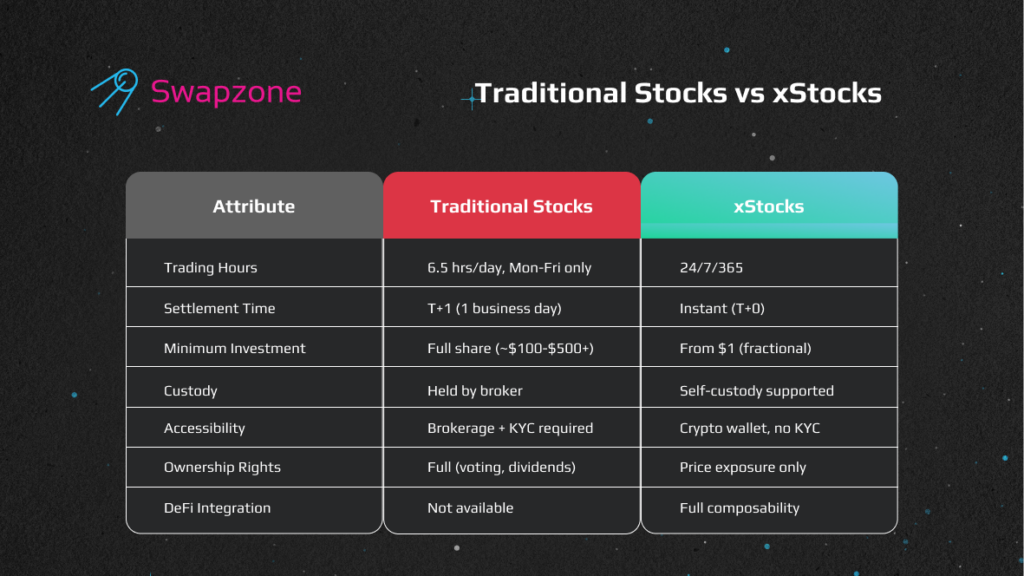

The Key Differences Between Traditional Stocks and Tokenized Equities

To understand when each asset type makes sense, you need to know the differences. Here’s a direct comparison of how xStocks operate versus traditional stocks:

Trading Hours: Traditional stocks only trade for around 6.5 hours every day, five days a week. Stock exchanges control all that time. xStocks trade 24 hours a day, seven days a week. Blockchain networks enable this.

Settlement Time: Traditional stocks take one business day to settle. Tokenized stocks settle instantly on-chain.

Ownership Rights: Traditional stocks give you shareholder rights. You can vote. You receive dividend checks. xStocks don’t give voting rights but provide price exposure. When you earn dividends in tokenized form, they usually go straight into your wallet. Tokenized stocks represent your economic interest, not actual ownership.

Minimum Investment: Traditional stocks often require you to buy whole shares. Want to buy Tesla? You’ll part with around $400 for one share. xStocks let you buy fractions of stock. Start with $1 worth.

Accessibility: Traditional stocks need a brokerage account. You go through KYC verification. You can buy tokenized asset options through crypto exchange platforms like Swapzone. Use stablecoins or other crypto. Access tokenized U.S equities from anywhere in the world.

Custody Options: Your broker holds traditional stocks safe. xStocks let you keep them in your own wallet. You have full control over your digital assets.

Who Issues xStocks and How Safe Are Tokenized Assets?

Backed Finance AG issues xStocks. This Swiss company launched in 2021. They chose Switzerland for its DLT legislation. The country introduced this the year before. It lets tokenized securities move as freely as cash.

Early last year, Kraken acquired Backed Finance. Kraken is one of the world’s biggest crypto exchanges. They brought xStocks under their umbrella. Now Kraken Pro users buy tokenized equities alongside traditional crypto assets. Kraken handles everything. They issue the tokenized stocks, facilitate trading and settle deals.

Security is tight. Real securities back each token 1:1. Regulated custodians lock them away safely. Regular audits verify reserve holdings. Chainlink ensures price feeds stay accurate. Swiss regulators oversee operations. Since xStocks launched in June 2025, they’ve processed $10 billion in combined exchange and on-chain volume. This demonstrates strong demand for tokenized stock exposure.

According to RWA.xyz, the tokenized stock market currently sits at $656 million in regulated public stocks. Backed Finance controls a reasonable chunk of that market share. McKinsey predicts the tokenized asset market could hit $2 trillion by 2030. That would be a big deal for tokenized stocks.

Popular Tokenized Stocks and ETFs Available on Solana

Whether you’re bullish on a stock like high-priced stocks or want diversified exposure through ETFs, xStocks offer access to major U.S. equities. Here are popular tokenized options you can trade xStocks through Swapzone:

Tech Giants: Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Alphabet/Google (GOOGL), Meta (META), Broadcom, Oracle, Intel

Crypto-Adjacent Equities: MicroStrategy (MSTR), Coinbase (COIN), Tesla (TSLA), Circle

Financial Services: Goldman Sachs (GS), JPMorgan Chase (JPM), Visa (V), Berkshire Hathaway

ETFs for Diversified Exposure: S&P 500 ETF, Nasdaq ETF, Gold ETF, Vanguard ETF

Consumer & Healthcare: McDonald’s (MCD), Coca-Cola (KO), Netflix (NFLX), Johnson & Johnson (JNJ), Eli Lilly (LLY), Home Depot, PepsiCo

The Right Fit for You? Understanding the Rise of Tokenized Stocks

xStocks work well for certain investors. Those who can’t stomach leaving the crypto space for traditional stocks benefit most. You can now hold Tesla stock alongside your Bitcoin in the same wallet. You never switch ecosystems. International investors who struggle to access US brokerage accounts will appreciate xStocks. They offer a way to access tokenized U.S equities without geospatial restrictions. Tokenized stocks provide unprecedented flexibility.

DeFi enthusiasts know the potential of tokenized stocks goes beyond ownership. You can use them as collateral. Liquidate them into other on-chain assets. If you like riding the bleeding edge of programmable finance, you’ll love how xStocks let you combine crypto and stock option positions in the same portfolio.

But like anything in crypto, trade-offs exist. You don’t vote on company decisions. You don’t hold direct shareholder status. Regulatory uncertainty remains. Unfortunately, xStocks aren’t available to US residents right now. Liquidity can be dodgy sometimes, especially for larger positions. If you withdraw tokens to a self-hosted wallet, you must watch custody security closely.

Right now, the future of tokenized stocks looks mainstream. Exchanges like Kraken and Backed, Bybit, and Robinhood EU jump into the fray. They offer their own tokenized versions of major equity. Traditional infrastructure providers like Nasdaq push extended trading hours. They want in on the Solana action. Institutions come on board. They recognize blockchain settlement benefits. Some platforms explore tokenized stock options. They’re even looking at options contracts on these tokenized stocks. Crypto options weekly platforms expand into tokenized equity exposure. Infrastructure for tokenized markets grows. Some eligible Kraken users can already access xStocks options platforms.

Making 24/7 Trades with Swapzone – The Future Is Now

The gap between real stocks and crypto narrows daily. xStocks drive that shift forward. They bring tokenized versions of major US equities to the blockchain.

You can trade 24/7.

Get instant settlement.

Access global markets that traditional stock markets can’t match.

Whether you’re looking at tech giants, crypto-adjacent equities, or ETFs, tokenized assets represent a game-changer for global markets.

Swapzone lets you buy xStocks 24/7, no matter what. Use their aggregator to compare rates across services. No KYC forms required. Trade stocks. Hold your tokens in your own wallet. Join the future of tokenized stocks. The stock market that never closes already exists. xStocks are issued by Backed Finance and powered by blockchain. This is what the tokenization of stocks looks like. Unlike traditional stock markets, xStocks can be traded anytime. They show how real-world stocks evolve. xStocks are tokenized representations that make tokenized trading accessible. They demonstrate what tokenized stocks offer the crypto world. xStocks give you exposure without broker limitations. xStocks are fully integrated into DeFi. This expanded into tokenized securities with stocks on solana leading the way. You can trade a dollar’s worth of stock or more. The digital future waits, ready to roll.