Bitcoin on the Ethereum Blockchain? What is Wrapped Bitcoin (WBTC)?

Cryptocurrencies have made a name for themselves over the last decade. Hundreds and thousands of crypto tokens are traded every minute. Today, there are different concepts and branches that are linked with traditional cryptocurrencies. One such extension goes by the name of wrapped tokens. Many of you might be unaware of the term, however, this article will shed more light on the most common example of wrapped tokens, Wrapped BTC.

Wrapped tokens are much popular these days mainly because of their innovative purposes and use. These wrapped tokens as Wrapped Bitcoin and many others have made stakeholders and investors realize the importance of wrapping. It is a prime example of why this procedure is beneficial to all. To put it simply, the concept of making WBTC surfaced when developers thought to increase the functionality and usability of Bitcoins. The Wrapped Bitcoin tokens resultantly brought more organized financial services for Bitcoin holders. Tokenization has been successful in combining the best of both worlds by bringing value and liquidation making a crypto more DeFi-friendly.

Why is Bitcoin on the Ethereum blockchain?

The whole idea of the creation of WBTC was to create a representation of Bitcoin on the Ethereum Blockchain. Being on the Ethereum blockchain, in turn, allowed Bitcoin holders to enter the Ethereum ecosystem of exclusive wallets, smart contracts, Dapps, games, and much more. There has been a stir in the market as WBTC has given Bitcoin users a way to gain access to lending and borrowing networks without the actual involvement of their Bitcoin assets.

Considerably by being on the Ethereum blockchain Bitcoin is able to take part in the growing decentralized finance community to earn profits on digital gold. Even Defi users have been largely interested in the tokenized Bitcoin. The overall value of Ethereum is much less than Bitcoin therefore by bringing Bitcoin into the Ethereum network there is a boost in liquidity. It also provides a much desired and needed connection between the top two cryptocurrencies.

To put it into simple words WBTC integrates the liquidity of Bitcoin into the Ethereum ecosystem. Many of the decentralized apps affiliated with the Ethereum blockchain requires the use of collaterals. Some apps may require you to lock one type of crypto asset to buy other types of crypto assets. Bringing in Bitcoin on Ethereum creates more sources for collaterals. Furthermore, as wrapped tokens exist on the Ethereum blockchain and not directly on Bitcoin the transaction process with WBTC is much faster and cost-friendly. Therefore, issuing more feasibility and accessibility to users.

What is Wrapped Bitcoin (WBTC)?

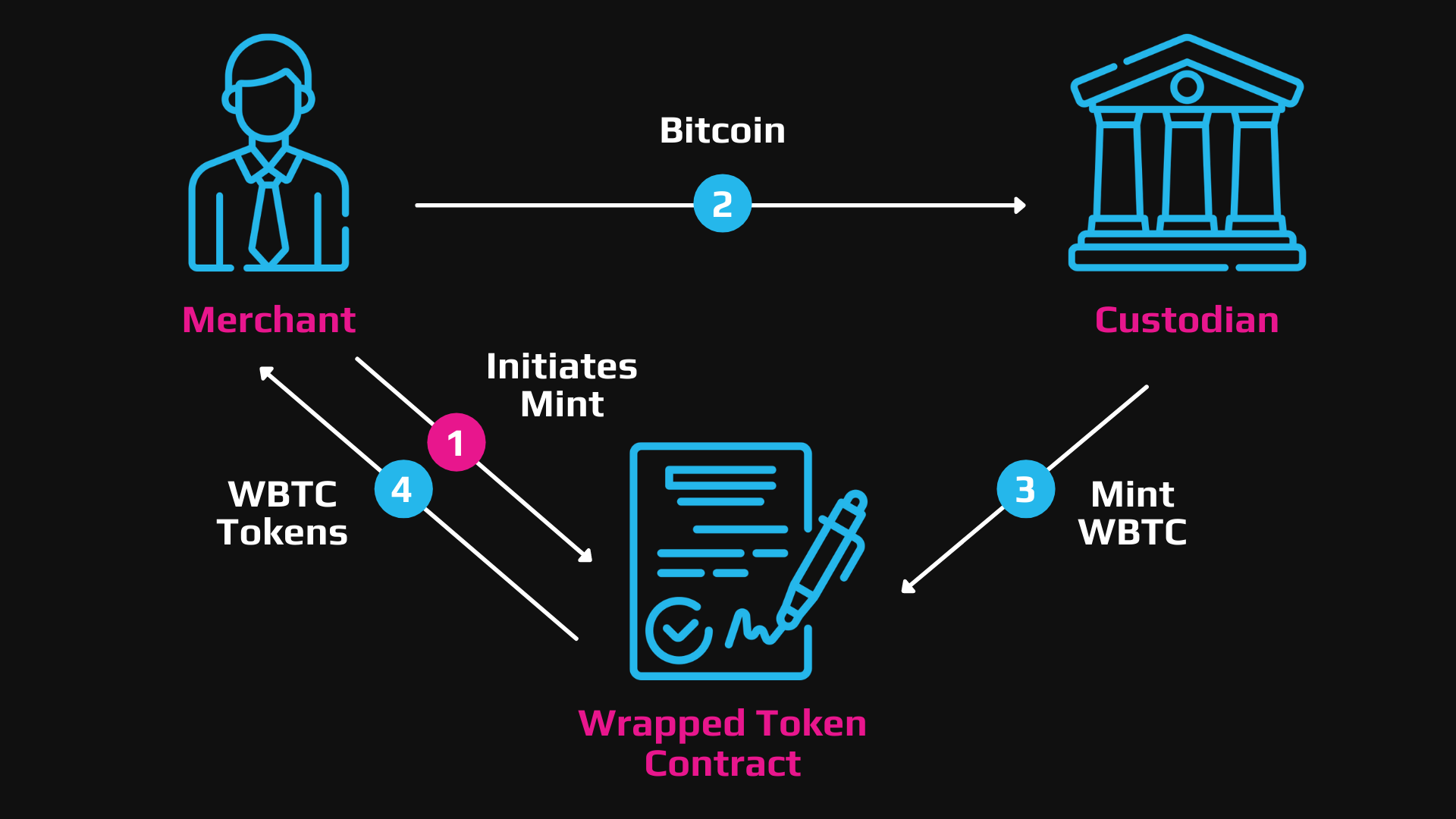

Wrapped Bitcoin more commonly known as WBTC is an ERC-20 token. It is used to represent Bitcoin on the Ethereum blockchain. It integrates Bitcoin with the Ethereum ecosystem and network. With the help of a WBTC partner, 1 Bitcoin can be converted into 1 WBTC and 1 WBTC can be converted into 1 Bitcoin. In other words, it can also be termed as a financial instrument that has bridged the gap between Ethereum and Bitcoin. Traders, institutions, and Dapps can work on the Ethereum network while maintaining exposure to Bitcoin. This provides diversification to the crypto community.

It is a direct source to bring Bitcoins' price value into play and combine it with Ethereum programmability. Wrapped BTC is managed by an organization mainly working under the banner of DeFi, consisting of up to 30 members. The organization called the WBTC DAO aims at providing more sophisticated financial services. Up till this date, there are about 900 WBTC in use these days. The transparency of the 1:1 ratio is ensured by the “proof of reserve” system between minted WBTC tokens and Bitcoin stored by the holders.

A WBTC allows its holders to use it as collateral for getting crypto-backed loans. They may also utilize it to earn interest in decentralized pools that provide loans or to earn liquidity mining or farming revenues. Moreover, it can be used to margin trades on decentralized exchanges. The profits can be used to start new businesses or can be engaged in different investment strategies such as yield farming.

History of WBTC

Wrapped Bitcoin is a recent invention, falling back to only 2019. In the same year, it was launched on the Ethereum blockchain as well. It is a pioneer in its field as being the only token released up to date that is backed by Bitcoin in the ratio 1:1. It was invented by a group of organizations and developers in order to pave the way for interaction between different blockchains. The concept behind this invention was mainly focused to simplify the complicated features of the crypto market.

The major players in the collaborative project were BitGo, Ren, Dharma, Kyber, Compound, MakerDAO, and Set Protocol. The project is now controlled by a decentralized Autonomous Organization called the WBTC DAO. It is also responsible for the whole mechanism and network of WBTC on Ethereum Blockchain.

How to get WBTC on Swapzone?

Many people face hurdles while pursuing WBTC on an exchange. However, Swapzone provides the most convenient and reliable pathway to acquire WBTC. By following only a few steps, the users of Swapone can easily get WBTC. These steps are number below for the ease of the readers.

- Go to Swapzone.io to get your work started.

- Select the cryptocurrency that you would like to exchange, a coin or a token.

- Specify the total amount you are going to transfer.

- Select WBTC in the Get Up To section.

- Review the offers on the screen. You will find multiple offers with the best rate listed at the top. You can also see how many minutes it would take for you to complete the exchange.

- Confirm the offer you wish to utilize and then enter the wallet to receive WBTC.

- List the address that will take the currency you are exchanging.

- Wait for the deposit to be processed by the exchange service and the exchange to be done.

- Do not forget to rate the exchange partner, so we can gather more information on the exchanges for future users.