Summarize with AI

It’s not a secret that blockchain technology has brought us into a new era of digital finance. At the moment, the crypto industry is steadily rising to unprecedented levels. Currently, there are over 11,000 digital currency projects in the market. The cryptocurrency market cap is now at over $2 trillion and analysts expect it to continue at an upward trend. Therefore, it’s important that you understand that the economic models of some cryptocurrencies have helped fuel their growth. These cryptos are known as deflationary cryptocurrencies. So what are deflationary cryptocurrencies and how are they achieving growth? Stick around to find out the list of deflationary cryptocurrency to follow.

What is Deflationary Cryptocurrency?

A deflationary cryptocurrency is a cryptocurrency designed to reduce supply over time. In simpler terms, the cryptocurrency in question has a depreciating supply of coins. This means that the number of coins in circulation dwindles, therefore, ultimately boosting the value of each coin. As demand for the coin increases, so will the value. Apart from improving the value of the token, a deflationary token is designed in this manner to also prevent the market from being flooded with the token.

There are a lot of ways that deflationary tokens achieve their goals. However, the two main methods with what deflationary tokens get rid of coins include:

- Buy-back and Burn

In this method, the company managing the cryptocurrency project buys back crypto from the market and sends these tokens to a dead wallet address. By doing so, they reduce the overall supply of coins in the market. Therefore, if demand remains the same, the overall value of the coin increases.

- Burn on Transaction

This method involves the use of a smart contract embedded into the coin’s code. The smart contract specifies that on-chain transactions attract a tax of which a part is collected and burned. The burn happens automatically too. Therefore, the higher the trading volume, the more coins are removed from circulation.

Key features of deflationary cryptos

Above anything, deflationary crypto wishes to solve issues that have ever since plagued traditional finance. Therefore, in a way, they have a positive impact on the cryptocurrency sector. Some of the key features of deflationary crypto include:

- Profit Maximization

According to the law of supply and demand, a decrease in supply leads to an increase in demand. Deflationary tokens focus on reducing their supply in the market. This act increases their scarcity which in turn drives up their demand. The increase in demand ultimately drives up the coin’s value.

- Limited or Fixed Supply

The deflationary mechanism helps remove tokens from circulation instead of flooding the market with them. Furthermore, if coins were issued incorrectly or anything, the only way to rectify that mistake would be to burn the excess tokens and only remain with the number of tokens required.

List of deflationary cryptocurrency

Below is a deflationary tokens list comprised of cryptos that are popular in the market today. They include:

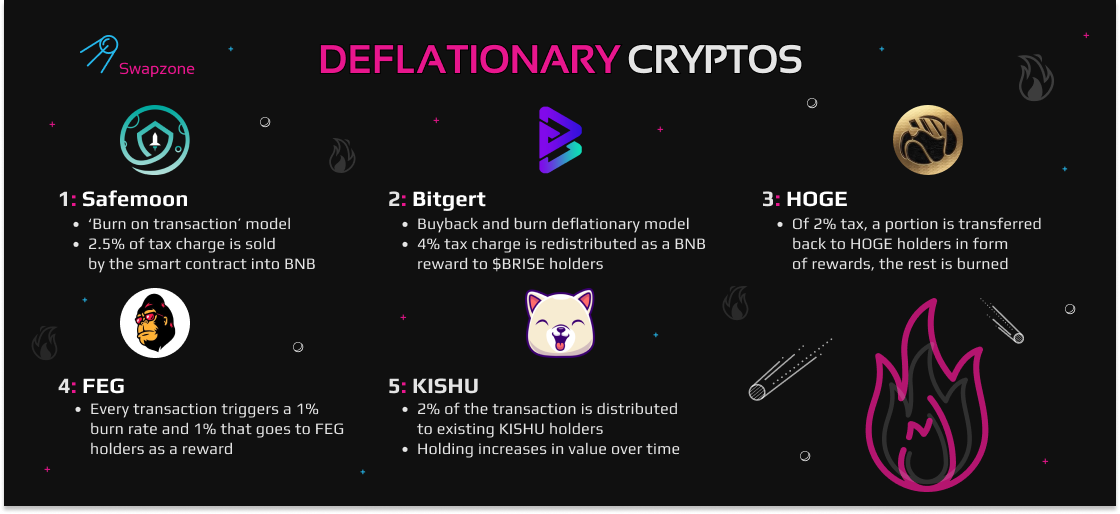

Safemoon

Safemoon is a perfect example of deflationary crypto created to solve the ‘farming’ rewards problem. Early stakers earn the highest APYs while newcomers barely earn as much. Safemoon solves this problem through the ‘burn on transaction’ model. Every Safemoon transaction attracts a 10% tax charge of which 2.5% is sold by the smart contract into BNB, otherwise known as burning.

Bitgert

Bitgert is a hyper-deflationary token that burned 549 trillion $BRISE tokens worth $1 Million within the first 22 days after launch. The project utilizes the buyback and burn deflationary model to reduce the overall supply in circulation. Every transaction on the network invites a 4% tax charge which is redistributed as a BNB reward to $BRISE holders.

HOGE

HOGE is a deflationary token, based across 5 different blockchains that has a 2% tax on every transaction. Of this 2% tax, a portion of it is transferred back to HOGE holders in form of rewards and the rest is burned. Unlike Bitcoin, HOGE cannot be mined or created. The current circulation of HOGE is all there is and it decreases with every transaction. Therefore, the more the transaction volume, the more the rewards and the faster the burns.

FEG

FEG, otherwise known as Feed Every Gorilla, is a hyper-deflationary token that operates on both the Ethereum (ERC20) network and the Binance Smart Chain (BEP-20) network. The token has a current supply of 42 quadrillion tokens. Although the supply is high, there is a continuous burn of tokens on both the Ethereum and Binance Smart Chain networks. Every transaction triggers a 1% burn rate. Simultaneously, FEG holders are rewarded with 1% on every transaction.

KISHU

KISHU is an Ethereum-based dog-meme cryptocurrency. The maximum supply of KISHU tokens is at 100 quadrillions with a circulation supply of 100,000,000 billion. It is also fully decentralized and owned by its community. For every transaction, 2% of the transaction is distributed to existing KISHU holders. Therefore, their holding increases in value over time.

Get Deflationary Crypto On Swapzone

Getting deflationary crypto on Swapzone is pretty simple. Below is a step-by-step procedure on how to get your hands on any coin from the list of deflationary cryptocurrency:

Step 1. Visit Swapzone and select any crypto from our list of deflationary tokens. Ensure you know the exact amount of tokens you want to buy.

Step 2. Swapzone will pull up all the best exchange offers for you.

Step 3. Input the number of the deflationary token of your choice, select the cryptocurrency exchange that suits you by clicking on the “exchange” button.

Step 4. Input the address where you want to receive the deflationary crypto.

Step 5. There is also an option for a refund address, which is the address where the asset you are swapping for the deflationary token will be refunded.

Step 6. Click on the “proceed to exchange” button to carry out the exchange. Wait a few minutes for the exchange to finalize.

Step 7. Take your time for leaving a review and rate the exchange. We care about making it better and would love to hear about your experience.

FAQ About Deflationary Crypto

Is Bitcoin Deflationary?

The answer is both yes and no depending on the definition of deflationary crypto you are working with. Deflationary crypto requires that the coin’s supply decreases. Bitcoin doesn’t meet this criterion of deflationary crypto. In a real sense, Bitcoin mining adds 6.25 BTC to the overall supply after every single block.

However, at the same time, Bitcoin has a fixed supply of 21 million coins with more than 18 million of them in circulation at the moment. By the year 2140, the last block of Bitcoin will be mined, after which miners will not be able to mine any new coins. No one genuinely knows what will happen after the last Bitcoin has been mined.

Is Ethereum Deflationary?

At the moment, Ethereum is not deflationary. However, market analysts are convinced that this is something that will happen soon. The London Hard Fork upgrade introduced a new base fee update that the network would burn after every transaction. However, Ethereum would only be deflationary if the amount of burned ETH exceeded the 2 ETH block reward. That means that more ETH would have to get burned than rewarded.

Inflationary vs Deflationary Crypto

As we can see from the above sections, Bitcoin is deflationary and Ethereum is inflationary. With that said, here are a few more differences between deflationary and inflationary crypto.

|

Deflationary Crypto |

Inflationary Crypto |

|

The purpose of deflationary crypto is to limit supply and increase the overall value of a coin |

The purpose of inflationary crypto is to sustain value and encourage network participation |

|

Deflationary crypto works by decreasing the overall supply of the coin over time |

Inflationary cryptocurrencies increase in supply over time |

|

Usually has a fixed or limited supply of coins |

Inflationary cryptocurrencies have an infinite supply of coins |

|

New units cannot be made at any time. |

New units of crypto can be made at any time. |

|

Fixed or limited supply of new coins causes the overall value to increase with time |

The more coin units in supply, the more likely they will be worthless |

Is Deflationary Crypto Safer Than Inflationary?

Trying to determine which model between the two is safe is difficult as both models have their advantages and disadvantages. At the moment, deflationary crypto may seem safer since its value is expected to rise as the supply rate decreases and eventually comes to a stop.