Summarize with AI

While the crypto space started with complete anonymity, in recent times crypto exchanges have become centralized now more than ever. This means exchanges now have detailed know-your-customer procedures before and after signing up.

Now, there is a place for KYC rules, as procedures like these nip crimes like money laundering in the bud. However, there are millions of crypto users who want to be anonymous without any interest in these ills. Besides, isn’t that the point of cryptocurrencies, decentralization?

This article will explore what KYC is and the top secure crypto exchanges without any requirements for it.

What is KYC?

Cryptocurrency and financial service providers use KYC to censor users on their platforms. It stands for “Know Your Customer” or “Know Your Client”.

KYC involves asking potential users for basic personal information before granting access to the service. Some providers also require users to go through a more detailed verification process before granting access.

These service providers include exchanges and platforms that sometimes need to know who their customers are.

Nevertheless, some crypto exchanges do not require any verification before allowing people to use their services.

It is a good reason, especially in crypto trading, where transactions are worth a lot of money, that some customers want to remain anonymous.

Why might someone want to avoid KYC in crypto?

Crypto exchanges without KYC are a significant part of the decentralized ecosystem. They provide services to numerous traders and additionally come with some significant benefits:

- Absolute decentralization

- Anonymity of transactions

- Data privacy

- Hiding and protection of Identities

With basic knowledge of what no KYC crypto exchanges can offer, we can go on to discuss some major exchanges that provide services without verification.

What is an Instant Exchange?

Instant crypto exchange refers to a seamless and efficient process of converting one cryptocurrency into another without the need for intermediaries or third-party involvement. This type of exchange enables users to swiftly swap their digital assets, such as Bitcoin, for other cryptocurrencies at real-time market rates.

One significant advantage of instant exchanges is their ability to provide immediate access to a vast array of trading pairs, allowing traders to capitalize on price fluctuations in the highly volatile cryptocurrency market. Moreover, with instant exchanges like those supporting non-KYC (Know Your Customer) policies, users can conveniently conduct transactions without having to disclose personal information or undergo time-consuming verification processes. However, it is important to note that this convenience comes with certain drawbacks. Due to the rapid nature of these exchanges, there may be higher fees compared to traditional platforms.

Additionally, some instant exchanges may lack robust security measures which could expose users’ funds and sensitive data to potential risks and hacks. Therefore, individuals should carefully weigh the pros and cons before engaging in instant crypto exchanges

What is a CEX Exchange?

A traditional (CEX) crypto exchange refers to a centralized platform where users can trade various cryptocurrencies, including the most popular one, Bitcoin. These exchanges act as intermediaries between buyers and sellers, providing order books that display current market prices for different digital assets. CEX platforms typically require users to complete a Know Your Customer (KYC) process, where they have to submit personal identification documents and sometimes undergo identity verification procedures. This helps ensure compliance with Anti-Money Laundering (AML) regulations and prevents illicit activities within the system. On the positive side, traditional crypto exchanges offer ease of use by providing user-friendly interfaces and convenient features like instant buy/sell options.

Moreover, due to their liquidity pools formed by many traders on the platform, CEXs usually offer competitive prices for Bitcoin or other cryptocurrencies. However, some drawbacks exist in this type of exchange model as well. Since funds are stored on these centralized platforms rather than directly controlled by individual users themselves through private keys in cold wallets or hardware devices, there is an inherent risk of potential security breaches or hacks targeting these central points of vulnerability. Additionally, KYC requirements might pose privacy concerns for those who wish to maintain anonymity while trading digital currencies.

What are key differences between CEX and Instant Exchange?

When comparing CEX crypto exchanges to instant exchanges, several key differences arise. Firstly, the concept of an exchange remains central in both platforms; however, their methodologies diverge significantly. CEX exchanges operate as centralized platforms where users can buy and sell cryptocurrencies based on prevailing market prices. On the other hand, instant exchanges facilitate immediate conversions between different cryptocurrencies at predetermined rates. Secondly the price bitcoin offered on CEX crypto exchanges is typically determined by supply and demand dynamics within the platform itself or influenced by external factors such as global economic conditions or regulatory developments.

In contrast, instant exchanges often employ algorithms that calculate conversion rates across various decentralized trading platforms to provide competitive prices for users seeking swift transactions. Another notable distinction pertains to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. While KYC verification processes are commonly implemented in both types of exchange platforms due to regulatory obligations, some instant exchange services may offer anonymous transactions up to certain limits whereas most reputable CEX crypto exchanges enforce more stringent AML measures for user identification and transaction tracking purposes.

These contrasting elements showcase how each type of exchange caters to varying needs of cryptocurrency traders in terms of convenience, liquidity options, pricing mechanisms, and compliance protocols.

TOP – 5 crypto exchanges without KYC

Here’s a list of our top 5 crypto exchanges without KYC

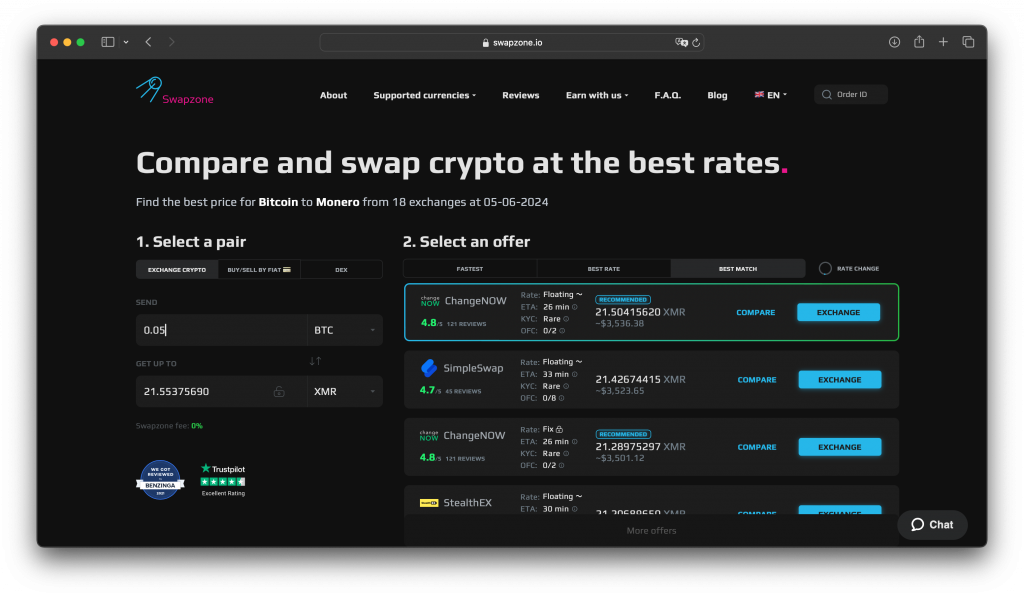

Swapzone – instant crypto exchange aggregator

Swapzone is at the top of our list with its easy-to-use and quick access system. Like all other no-KYC crypto exchanges, the platform gives access to new users without a verification process. No account creation is needed; nothing but just straight-to-the-point transactions.

Its clean simple interface both on mobile and desktop also makes it a very good choice for beginners as well as experts looking for uncluttered transactions.

Additionally, the exchange facilitates on-the-spot trading with its offer of about 300 assets ready to be swapped. Swapzone’s robust aggregating feature means users get a comprehensive price analysis and estimates for the tokens they want to trade.

While many exchanges are also limited in several countries, Swapzone.io isn’t. The non-custodial exchange supports the use of its service in several countries and might be a respite for territories with delicate KYC laws.

All in all, swapzone.io is one of the best no KYC crypto exchanges out there. It balances out on all fronts and delivers its promised result.

1. ChangeNow

ChangeNOW is a popular non-custodial cryptocurrency exchange service that allows users to quickly and seamlessly swap between a wide range of cryptocurrencies without the need for creating an account. The platform offers a fast and easy way to exchange digital assets, providing competitive rates and low fees compared to traditional exchanges. Users can make transactions without the hassle of registration, making it convenient for both experienced traders and beginners alike.

One of the key features of ChangeNOW is its user-friendly interface, which simplifies the exchange process for users of all levels. The service is designed to be intuitive and efficient, guiding users through each step of the transaction smoothly. Additionally, ChangeNOW boasts a high level of security, ensuring that users’ funds and personal information are protected at all times. With its emphasis on transparency and security, ChangeNOW has earned a reputation as a trustworthy platform in the cryptocurrency community.

Furthermore, ChangeNOW prides itself on its 24/7 customer support team, ready to assist users with any questions or issues they may encounter during the exchange process. Whether users have inquiries about specific transactions or need help navigating the platform, the dedicated support team is always available to provide prompt and helpful assistance. Overall, ChangeNOW offers a reliable and user-centric service for those looking to exchange cryptocurrencies quickly and securely.

2. LetsExchange

LetsExchange is somewhat considered more of a cryptocurrency store than an actual exchange. The platform offers its users its services without limits. It facilitates trading between two different cryptocurrencies and doesn’t support fiat.

Notably, the crypto platform doesn’t have an upper limit for its trades. It allows any amount to be traded, just like other non-KYC platforms.

Additionally, it is non-custodial, encrypts user data, and boasts of a solid security system. It also has a detailed design system that utilizes SmartRate technology to provide users with the best trading rates. Finally, the exchange has headquarters in Seychelles, Canada, and Lithuania.

3. Changelly

Changelly is another popular cryptocurrency exchange service that allows users to quickly and easily swap between a variety of digital assets. Changelly is a non-custodial platform that does not require users to create an account in order to make transactions. This feature appeals to users seeking a fast and convenient way to exchange cryptocurrencies without the need for lengthy registration processes.

One of the standout features of Changelly is its wide selection of supported cryptocurrencies, offering users access to a diverse range of digital assets for trading. The platform also prides itself on providing competitive rates and low fees for transactions, making it an attractive option for users looking to exchange cryptocurrencies at a fair price. Additionally, Changelly’s interface is user-friendly and intuitive, catering to users of all experience levels.

Changelly places a strong emphasis on customer satisfaction, offering a dedicated support team available 24/7 to assist users with any inquiries or issues they may have. Whether users need help with a specific transaction or have general questions about the platform, the support team is responsive and knowledgeable. With its focus on accessibility, variety of supported cryptocurrencies, and commitment to customer service, Changelly is a trusted choice for cryptocurrency enthusiasts looking to exchange digital assets swiftly and securely.

4. StealthEX

StealthEX is a popular non-custodial cryptocurrency exchange platform that stands out for its focus on privacy and security. The platform allows users to swap cryptocurrencies quickly and anonymously without the need to register an account. This feature appeals to users who prioritize anonymity and value their privacy when conducting transactions in the digital asset space.

One of the unique aspects of StealthEX is its emphasis on providing users with a seamless and hassle-free exchange experience. The platform offers a simple and intuitive interface that guides users through the transaction process smoothly, making it easy for both experienced traders and beginners to use. Additionally, StealthEX prides itself on offering competitive exchange rates and low fees, ensuring that users can make trades at a reasonable cost.

In terms of security, StealthEX prioritizes the protection of users’ funds and personal information, implementing robust security measures to safeguard against potential threats. The platform also offers 24/7 customer support to assist users with any inquiries or issues they may encounter during the exchange process. With its commitment to privacy, user-friendly interface, competitive rates, and strong security features, StealthEX is a reliable choice for individuals looking for a secure and private way to exchange cryptocurrencies.

5. SimpleSwap

This Marshall Islands-based platform SimpleSwap supports over 300 tokens, along with on-ramp exchanges. The company launched in 2018 and has been steadily improving since then.

Just like all other non-KYC crypto platforms, it allows you to use its services without verification. Additionally, there are no minimum deposit restrictions, nor does the platform charge for a withdrawal.

The native token $SWAP generally powers the exchange’s ecosystem and is usually offered as a cashback reward for registered customers who use the platform. However, the platform doesn’t support United States users and isn’t exactly decentralized. Another downside is its lack of automation and some advanced trading tools.

The Bottom Line: Choosing the best No-KYC Crypto Exchange

In conclusion, all these no-KYC platforms can meet the basic needs of any cryptocurrency trader. However, the sheer number of options available could cause inevitable confusion. In choosing the best suit for you, you might want to check out exchanges that check out on all fronts. Non-custodial exchanges like Swapzone.io thrive well in this regard.

To get started with your first transaction on Swapzone, click here.