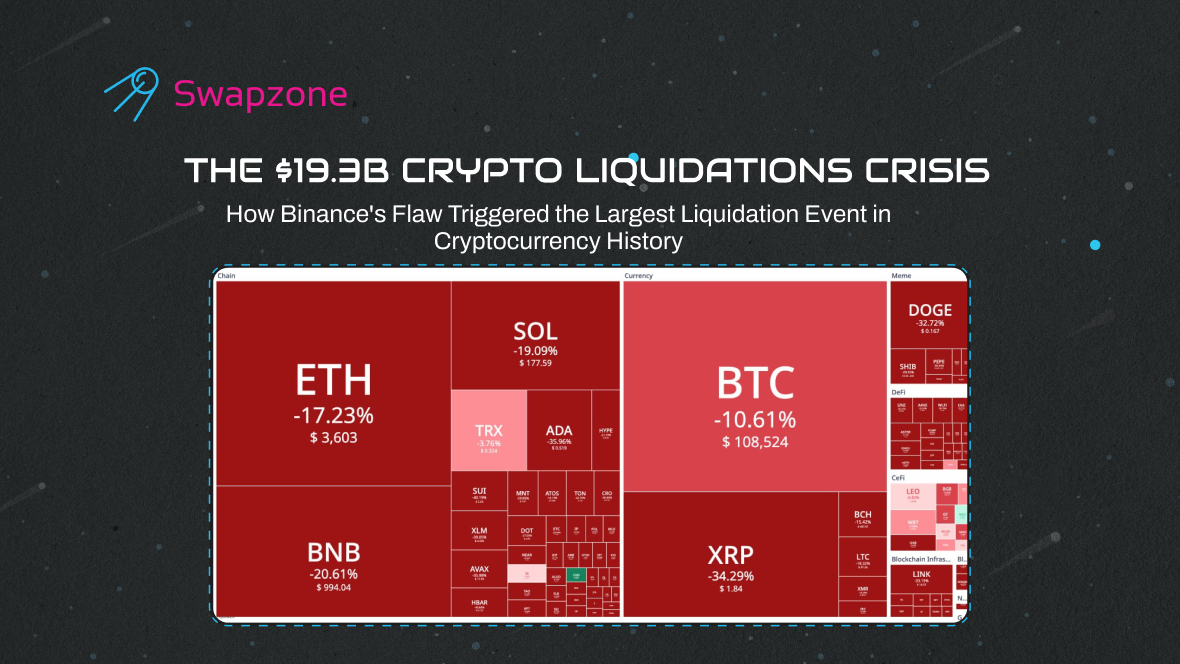

The $19.3B Crypto Liquidations Crisis: How Binance’s Flaw Triggered the Largest Liquidation Event in Cryptocurrency History

October 11, 2025 will haunt crypto traders for years. While most of us slept, the cryptocurrency market experienced a catastrophic collapse—the 19.3 billion liquidations wiped out leveraged positions across global…