Summarize with AI

Estimated reading time: 11 minutes

The yield farming vs staking debate is one every crypto investor faces when looking to put idle assets to work. Both strategies let you earn passive income from crypto without actively trading, but they work very differently under the hood – and choosing the wrong one for your situation can cost you.

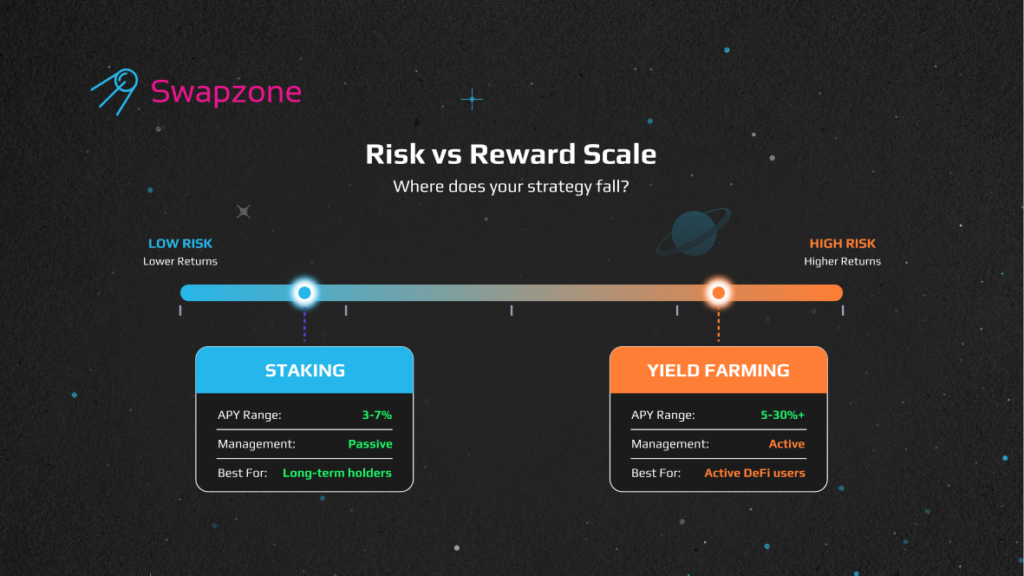

Staking is the process of locking your tokens to support a Proof-of-Stake blockchain, typically earning 3-7% annual percentage yield. Yield farming involves providing liquidity to decentralized finance protocols for potentially higher returns – anywhere from 5% to 30% or more – but with added complexity and risk. Understanding yield farming and staking is the first step toward picking the right approach for your portfolio.

This guide breaks down staking vs yield farming vs liquidity mining, explains the key differences between yield farming and staking, and helps you decide which strategy matches your risk tolerance and goals. Whether you want steady, predictable returns or you’re chasing higher yields, knowing how yield farming and staking offer different risk-reward profiles will save you from costly mistakes.

Table of contents

- What Is Staking and How Does It Work?

- What Is Yield Farming and How Does It Differ?

- Staking vs Yield Farming vs Liquidity Mining: Key Differences

- Benefits of Staking vs Benefits of Yield Farming

- Risks of Staking vs Risks of Yield Farming

- Which Strategy Is Right for You?

- Getting Started with Staking Through Swapzone

What Is Staking and How Does It Work?

Staking is the process of holding cryptocurrency in a staking wallet or smart contract to support a blockchain network’s operations. When you stake crypto, you’re essentially putting up collateral that helps validate transactions and secure the network. In return, you earn staking rewards paid out in the same token you staked.

Staking involves locking your tokens for a set period, during which they remain inaccessible. This lock-up can range from a few days to several weeks depending on the staking protocol you choose. The goal of staking isn’t just earning rewards – staking allows users to participate in network governance and contribute to blockchain security.

Here’s what staking looks like in practice: Ethereum currently offers around 3-4% APY for validators, while Solana stakers can earn 4-7% APY, and Cardano delivers 3-5% APY with no minimum lock-up requirement. These numbers fluctuate based on network activity and the total amount staked across the ecosystem.

Staking is relatively straightforward compared to other DeFi strategies. You select a staking pool or run your own validator node, deposit your tokens, and start earning. Platforms like Ankr, P2P, and CoinRabbit make staking accessible even for beginners who don’t want to deal with technical setup.

Staking involves holding your crypto asset in a designated protocol rather than leaving it idle in your wallet. Unlike yield farming, staking is often a “set and forget” approach – once you’ve delegated your tokens, rewards accumulate automatically without constant management.

For a deeper breakdown of how staking works across different blockchains, check out our guide on what is crypto staking.

What Is Yield Farming and How Does It Differ?

Yield farming involves depositing your crypto assets into liquidity pools or providing liquidity to DeFi protocols in exchange for rewards. Also known as yield farming or liquidity mining in some contexts, this strategy turns your idle tokens into working capital that facilitates transactions on DeFi platforms.

When you become a yield farmer, you supply liquidity to decentralized exchanges like Uniswap, Aave, or Curve. These platforms use your deposited tokens to enable trading, lending, or borrowing for other users. In return, yield farmers earn additional cryptocurrency by providing liquidity – typically a share of transaction fees plus bonus token incentives.

The mechanics work like this: you deposit assets into a liquidity pool (say, an ETH-USDC pair), and the DeFi protocol issues LP tokens representing your share. Yield farmers can earn rewards from multiple sources: trading fees from users swapping tokens in the liquidity pool, interest from borrowers on lending platforms, and governance token distributions from the protocol itself.

Yield farming can offer significantly higher returns compared to staking. While staking rewards hover around 3-7% APY, yield farming platforms regularly advertise 10-30% APY, with some volatile pools reaching triple digits during high-demand periods. Aave, for example, offers 6-10% APY on stablecoin lending, while concentrated liquidity positions on Uniswap V3 can generate double-digit returns for active managers.

However, yield farming provides these higher returns alongside proportionally higher risks. Yield farming involves active decision-making – monitoring pool performance, tracking reward rates, and potentially moving your assets between DeFi platforms to chase better yields. This is where the “farming” metaphor comes from: yield farmers constantly cultivate their positions to maximize output.

Yield farming and liquidity mining are closely related concepts. Liquidity mining specifically refers to earning governance tokens as rewards for providing liquidity to decentralized exchanges. Liquidity mining offers the highest returns during a protocol’s early growth phase when teams distribute tokens aggressively to attract capital. Once a platform matures, mining offers the highest returns drop as token emissions decrease.

Staking vs Yield Farming vs Liquidity Mining: Key Differences

The differences between yield farming and staking come down to five main factors: purpose, returns, risk, complexity, and flexibility.

Purpose and Mechanism

Staking supports blockchain infrastructure. When you stake, your tokens help validate transactions on Proof-of-Stake networks like Ethereum, Solana, or Cardano. You’re essentially voting with your capital on which validators should process blocks.

Yield farming supplies liquidity to DeFi protocol operations. Your deposited crypto enables other users to trade, borrow, or lend without relying on centralized intermediaries. Providing liquidity to the pool creates the market depth that makes decentralized exchanges functional.

Returns: Lower vs Higher Potential

Staking offers lower returns compared to yield farming – that’s the trade-off for stability. Typical staking rewards range from 3% to 7% APY depending on the network. Returns compared to yield farming are more predictable because they’re tied to fixed emission schedules rather than market dynamics.

Yield farming offers higher returns, often 10-30% APY on established platforms, with newer DeFi protocols sometimes advertising 100%+ rates to attract early liquidity. Yield farming offers higher potential for returns, but those rates fluctuate based on trading volume, token prices, and competition from other liquidity providers.

Risk Profile

Risks of staking are relatively contained. The main concerns include slashing penalties (losing a portion of your stake if your validator misbehaves), lock-up periods that prevent you from selling during market downturns, and general market volatility affecting your token’s value. Risks associated with staking are lower because you’re not exposed to the same smart contract complexity as DeFi protocols.

Risks of yield farming are more substantial. Impermanent loss occurs when the tokens in the liquidity pool change in relative value – you could end up with less dollar value than if you’d simply held the assets. Smart contract vulnerabilities can result in complete loss of funds if a DeFi platform gets exploited. Farming carries a higher risk profile overall because you’re trusting complex code with your capital.

Complexity

Staking is generally considered the simpler option. Staking requires selecting a validator or staking pool, delegating your tokens, and waiting for rewards. Most of the process is passive.

Yield farming may require constant attention. Successful yield farmers monitor APY changes across multiple platforms, calculate impermanent loss exposure, harvest and reinvest rewards, and rebalance positions as market conditions shift. Yield farming is similar to yield mining in this respect – both demand ongoing management to optimize returns.

Flexibility and Lock-ups

Staking involves locking your tokens, sometimes for weeks or months. During this unbonding period, you cannot access your crypto asset regardless of market conditions.

Unlike yield farming, staking doesn’t let you quickly move capital to better opportunities. Yield farmers can typically withdraw their assets from liquidity pools at any time (though gas fees make frequent moves expensive). This flexibility is a key benefit of yield farming for investors who want to stay agile.

Benefits of Staking vs Benefits of Yield Farming

Both yield farming and staking offer ways to generate passive income from your crypto holdings, but the benefits of staking versus the benefits of yield farming appeal to different investor profiles.

Benefits of Staking

Staking is often the right choice for long-term holders who prioritize security over maximum returns. Staking offers predictable income – you know roughly what percentage you’ll earn each year, making it easier to plan your portfolio growth. The simplified approach means staking is also less time-intensive than active DeFi strategies.

Staking is better for risk-averse investors because your tokens remain in your control (or delegated to validators you’ve vetted) rather than sitting in complex smart contracts. Staking is also a way to support blockchain networks you believe in while earning rewards for your contribution.

The benefits of liquidity mining can supplement staking returns when platforms distribute bonus tokens, but pure staking remains the most accessible way to earn passive income without DeFi complexity.

Benefits of Yield Farming

The primary benefit of yield farming is higher earning potential. Yield farming can generate returns that far exceed traditional staking rates, especially during bull markets when trading volumes spike and protocols compete for liquidity.

Yield farming provides flexibility since most pools don’t enforce lock-up periods. You can deposit and withdraw at will, chasing the best rates across platforms. This liquidity is valuable if you anticipate needing access to your funds or want to react quickly to market changes.

Yield farming and staking offer complementary benefits. Some investors split their portfolio – staking their assets in established networks for steady returns while allocating a smaller percentage to higher-risk yield farming strategies. This balanced approach can provide a passive income stream from staking while capturing upside from DeFi opportunities.

Risks of Staking vs Risks of Yield Farming

No passive income strategy is risk-free. Understanding the specific dangers of each approach helps you make informed decisions.

Risks of Staking

Market volatility remains the biggest staking risk. If the token you’ve staked drops 50% in price, your staking rewards won’t compensate for the loss. Staking means locking your assets, so you can’t sell during a crash if your tokens are in an unbonding period.

Slashing is another risk on Proof-of-Stake networks. If your chosen validator acts maliciously or experiences extended downtime, you could lose a portion of your staked tokens as a penalty. Choosing reputable staking protocols with strong track records mitigates this risk.

Risks of Yield Farming

Impermanent loss is the signature risk of providing liquidity to DeFi platforms. When you deposit two tokens into a liquidity pool, price divergence between them can leave you worse off than simply holding. In extreme cases, impermanent loss can wipe out months of farming returns.

Smart contract risk is ever-present in DeFi. Even audited platforms have been exploited – bugs in code can drain entire liquidity pools or providing liquidity positions overnight. Yield farming involves trusting protocols with your capital, and that trust isn’t always rewarded.

Liquidity mining can offset some risks by distributing governance tokens that appreciate in value, but this depends on the token maintaining its price – many DeFi tokens have collapsed 90%+ from their peaks.

Compared to staking, yield farming demands more due diligence. You need to evaluate smart contract security, understand tokenomics, and monitor your positions regularly.

Which Strategy Is Right for You?

The staking vs yield farming decision depends on your investment goals, risk tolerance, and how much time you want to spend managing your crypto.

Choose Staking If:

- You prefer predictable, steady returns over chasing maximum yields

- You’re a long-term holder who doesn’t need immediate access to funds

- You want a hands-off approach with minimal ongoing management

- You prioritize security and simplicity over optimization

- You’re new to DeFi and want to start with something straightforward

Staking is generally the safer choice for most investors. The lower returns compared to yield farming are offset by reduced complexity and risk exposure.

Choose Yield Farming If:

- You have higher risk tolerance and can stomach potential losses

- You’re willing to actively manage positions and track multiple platforms

- You understand DeFi mechanics including impermanent loss calculations

- You have enough capital that gas fees don’t eat into your returns

- You’re comfortable evaluating smart contract security

Yield farming offers higher potential rewards, but only for those who put in the work to manage their strategies effectively.

The Hybrid Approach

Many experienced investors use both strategies. They stake the majority of their holdings in established networks for reliable passive income, while allocating a smaller “degen” portion to high-yield farming opportunities. This way, yield farming and staking work together – stable foundation plus growth potential.

Getting Started with Staking Through Swapzone

Ready to stake crypto and start earning passive income? The first step is acquiring the right tokens. Whether you want to stake ETH, SOL, ADA, or any other Proof-of-Stake asset, you’ll need a convenient way to swap into your preferred staking token.

Swapzone’s staking section aggregates the best staking offers from trusted partners, letting you compare rates and find optimal returns without jumping between multiple platforms. Instead of manually researching dozens of staking protocols, you can see APY rates, lock-up terms, and provider reputations in one place.

The process is simple: swap your existing crypto into staking-ready tokens through Swapzone’s exchange aggregator (comparing rates across 20+ services), then connect with verified staking partners to start earning rewards. No registration required, no hidden fees – just straightforward access to passive income from crypto.

Whether staking is better for your situation or you’re ready to explore DeFi further, having the right tokens in your wallet is step one. Swapzone helps you get there efficiently, so you can focus on what matters: growing your portfolio through yield farming and staking strategies that match your goals.