Summarize with AI

Crypto staking is an innovative way for cryptocurrency holders to earn passive income by locking their assets in support of a blockchain network. By participating in the staking process, crypto holders can earn rewards, typically in the form of additional tokens. Staking emerged with Peercoin and gained significant traction, especially after the Ethereum Merge, when Ethereum transitioned to a Proof of Stake model. Much like depositing cash in a high-yield savings account, staking offers attractive rewards but comes with higher risks. In this article, we will explain the fundamentals of staking crypto and its potential as an investment strategy.

What Is Cryptocurrency Staking?

Cryptocurrency staking is the process of locking up digital assets in a proof-of-stake (PoS) network to support transaction validation and secure the blockchain. By participating in this stake system, users help maintain the integrity of the blockchain, where staked tokens are used to verify transactions and validate new blocks. In return for their participation, crypto users earn staking rewards, typically paid in the same cryptocurrency they have staked.

Validators stake their tokens to play a key role in validating transactions and adding blocks to the blockchain. They are chosen based on the amount of crypto they have staked — the more tokens they hold, the higher their chances of being selected. This decentralized process, powered by the proof of stake mechanism, ensures no single entity controls the network, promoting security and transparency.

Popular cryptocurrencies like Ethereum, Cardano, and Polkadot use staking to validate transactions and maintain security. Crypto investors can start staking on crypto exchanges or staking services, where they can earn rewards over time. Staking involves risks, including staking period ends, liquidity restrictions, and crypto price fluctuations. Always conduct your own research before committing to staking crypto and ensure the staking yields align with your investment goals.

Proof of Stake (PoS) vs Proof of Work (PoW)

Proof of Stake (PoS) and Proof of Work (PoW) are both consensus mechanisms used by cryptocurrencies to validate transactions and secure blockchain networks, but they operate in fundamentally different ways.

In a PoW system, miners compete to solve complex mathematical problems to verify transactions and create new blocks. This process requires significant computing power, leading to high energy consumption. Bitcoin, the most well-known cryptocurrency, uses the proof of work model as its consensus mechanism.

In contrast, PoS relies on validators stake their digital assets to participate in the transaction verification process. The probability of being selected to validate a block is proportional to the amount of staked cryptocurrency. PoS is far more energy-efficient than PoW, as it doesn’t require intensive computational resources to process transactions.

Thanks to its energy efficiency, many blockchain projects, including Ethereum, transitioned to PoS following the Ethereum Merge. PoS offers not only a more sustainable option but also higher staking rewards, making it an increasingly popular choice for crypto investors looking for passive income. Unlike PoW, PoS offers staking services that allow users to earn staking rewards without the environmental impact of traditional mining.

The Role of Validators and Delegators in Staking

In the staking process, validators and delegators play essential roles in maintaining the blockchain network and earning staking rewards. Validators are responsible for validating transactions and ensuring the integrity of the blockchain. They are selected based on the amount of cryptocurrency they have staked, and they must meet specific requirements, such as operating a reliable node. Additionally, validators are responsible for creating new blocks and confirming transactions in a proof of stake system.

Delegators, on the other hand, are crypto users who do not wish to operate a node but still want to participate in staking. Instead, they delegate their crypto assets to a validator, in exchange for a share of the rewards earned from the validator’s staking activities. Delegators can earn passive income without the technical responsibilities of running a node.

To increase the chances of earning rewards, many users join staking pools, which aggregate assets from multiple delegators. These pools allow participants to pool their resources, boosting their chances of being selected as a validator. The rewards are then distributed among all pool participants according to the amount of crypto they have delegated. Staking pools provide a way for smaller crypto investors to take part in staking while minimizing risks and maximizing rewards. Many platforms and crypto exchanges offer staking services, making it easy for token holders to start staking.

How Does Crypto Staking Work?

Selecting a Cryptocurrency for Staking

The first step in crypto staking is selecting a cryptocurrency that supports staking. Popular choices include Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and Tezos (XTZ), among others. Each cryptocurrency has unique staking rewards, network security, and specific staking terms. It’s essential to evaluate the potential returns and understand the risks before committing your tokens.

Staking Considerations and Requirements

After selecting a cryptocurrency, it’s important to understand the staking requirements. Some cryptocurrencies have a minimum staking amount, while others may allow you to stake any quantity. Additionally, some networks impose a staking period, meaning you’ll need to lock your tokens for a specified time, which limits access to your funds. Make sure to review the network’s requirements for staking rewards and penalties, as well as the expected duration of the staking period.

Setting Up a Staking Wallet or Platform

To stake crypto, you’ll need a compatible wallet or a staking platform. Many crypto exchanges, such as Binance or Kraken, offer built-in staking services with user-friendly interfaces. Alternatively, you can use a staking platform or decentralized finance (DeFi) platform that supports staking. Ensure your wallet is secure and properly set up for staking, as the safety of your crypto assets is critical.

Acquiring and Transferring Crypto for Staking

After selecting a cryptocurrency and setting up a wallet or platform, you need to acquire the crypto you wish to stake. You can buy crypto on exchanges or transfer assets from another wallet. Once you have the tokens, transfer them to your staking wallet or platform, where you can initiate the staking process. Many platforms also offer auto-staking features that automatically stake your crypto, saving you the hassle of manual management.

How to Make Money Staking Crypto

Staking crypto offers a way to earn passive income by receiving rewards for securing a blockchain network. The rewards, typically paid out daily, weekly, or monthly, are based on the Annual Percentage Yield (APY). The APY can vary by cryptocurrency and platform, with some offering fixed returns and others providing variable rates depending on factors like network performance and validator uptime.

Popular crypto exchanges and platforms like Binance and Kraken offer staking programs with different APYs for various assets. For instance, Ethereum’s staking rewards may differ from those of Cardano or Polkadot, with rates affected by factors such as validator efficiency and the overall health of the network.

However, it’s essential to understand the restrictions attached to staking. Some platforms may impose lock-up periods during which staked assets cannot be withdrawn, while others allow more flexibility. Always research the staking terms, rewards, and potential penalties before committing to a program.

Benefits of Staking Crypto

Staking crypto offers several key benefits, with passive income being one of the most attractive. By staking your crypto, you can earn rewards without actively trading or managing your assets. This process supports the security and decentralization of blockchain networks, ensuring stability and efficiency across the ecosystem. Staking is also easier than traditional mining, which requires technical expertise and expensive hardware. Platforms like Swapzone help simplify the process by comparing staking platforms, helping you find the best options to maximize your returns and minimize risks. Compared to mining, staking has lower environmental impacts, making it a more sustainable choice for crypto enthusiasts.

Risks and Challenges of Crypto Staking

While crypto staking offers numerous benefits, it also comes with significant risks and challenges that investors should carefully consider.

One of the main risks is the commitment period, during which your staked assets are locked up for a certain period. During this waiting period, you cannot sell or trade your tokens, which can be problematic if crypto prices decline. For instance, in the event of a market crash or if the value of your staked crypto decreases, you won’t be able to access your assets to mitigate potential losses.

Another risk is slashing, which is unique to proof of stake networks. If the validator you delegate your tokens to acts maliciously, behaves irresponsibly, or fails to properly validate transactions, a portion of your staked assets may be forfeited. This penalty can result in the loss of some or all of your staked tokens, depending on the severity of the failure. It’s crucial to choose a reliable staking service to minimize this risk.

To address liquidity concerns, liquid staking has been introduced as a potential solution. This allows users to stake their crypto while still maintaining access to a liquid asset, which can be traded or sold. However, liquid staking introduces additional risks, such as exposure to platform vulnerabilities or potential decreases in the liquid staking token value.

Market crashes and regulatory uncertainty are other critical factors to consider. Crypto works in a volatile environment, and market crashes can significantly affect the value of staked tokens. Additionally, the regulatory status of staking remains uncertain in many countries, with some jurisdictions still developing laws or regulations that could impact staking practices.

Furthermore, many crypto exchanges and staking services enforce lockup periods and unstaking periods, which can delay your ability to access your funds, limiting your flexibility in reacting to market conditions.

In conclusion, while staking can offer attractive returns and earning rewards, it is important to weigh the risks of staking crypto, particularly regarding price volatility, slashing, liquidity concerns, and regulatory challenges. Make sure to do your research and seek investment advice before committing to staking a specific cryptocurrency.

Popular Staking Cryptocurrencies

Several well-known cryptocurrencies offer staking opportunities, with Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and Solana (SOL) being among the most popular options. These cryptocurrencies stand out not only for their market capitalization but also for their unique blockchain features and staking rewards.

Ethereum transitioned from a Proof of Work (PoW) to a Proof of Stake (PoS) model with the Ethereum Merge, becoming one of the largest staking platforms in the cryptocurrency space. Ethereum offers staking rewards, with an annual percentage yield (APY) that varies depending on network conditions, validator performance, and the amount staked. Users can stake their crypto directly through a crypto wallet or staking service on exchanges.

Cardano operates on the Ouroboros PoS protocol and has a strong focus on security, scalability, and sustainability. Cardano’s staking system allows token holders to delegate their tokens to validators, making it accessible for both small and large investors. Staking rewards on Cardano are competitive, with APYs that vary based on staking conditions.

Polkadot, known for its interoperability and multi-chain capabilities, offers staking rewards that attract investors. Its system is designed to secure its parachains and relay chain while enabling cross-chain communication. Polkadot’s staking approach promotes decentralization and scalability.

When selecting a specific cryptocurrency for staking, it’s important to consider factors like staking rewards, minimum staking amount, and network stability. Evaluating these factors will help ensure the best returns and reduce the risks of staking crypto. Swapzone can simplify this choice by comparing platforms and rates for staking these assets, allowing users to evaluate options based on fees, yield, and lock-up terms.

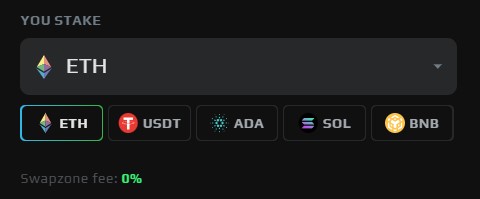

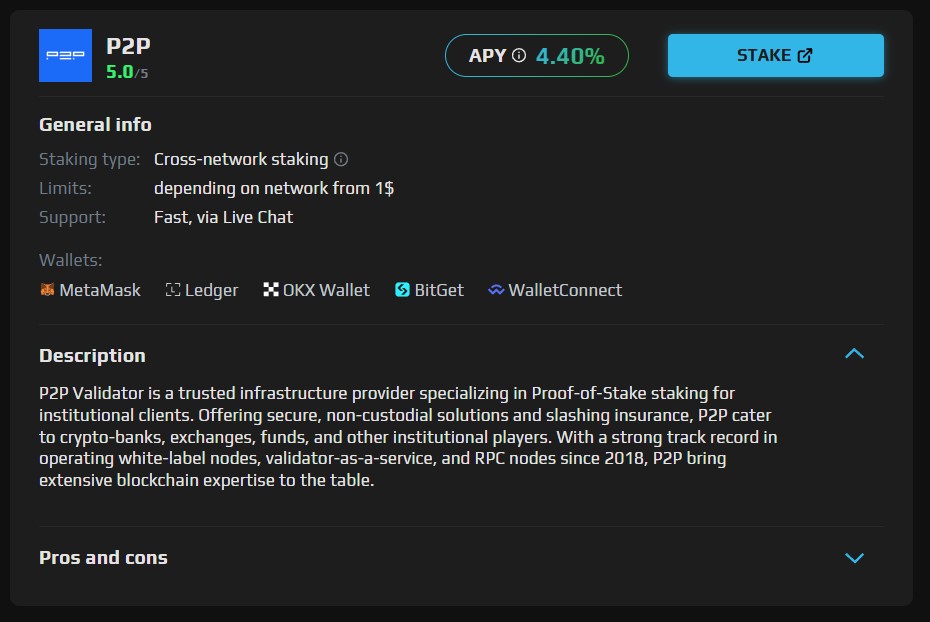

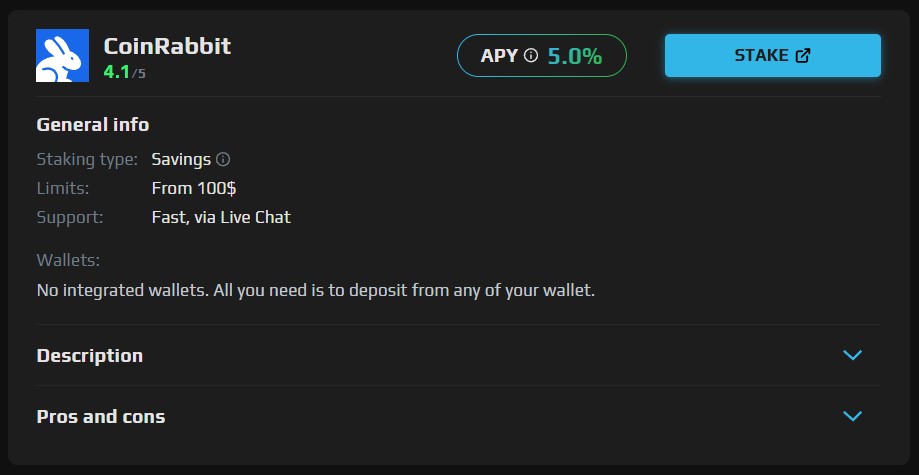

Staking Methods and Platforms

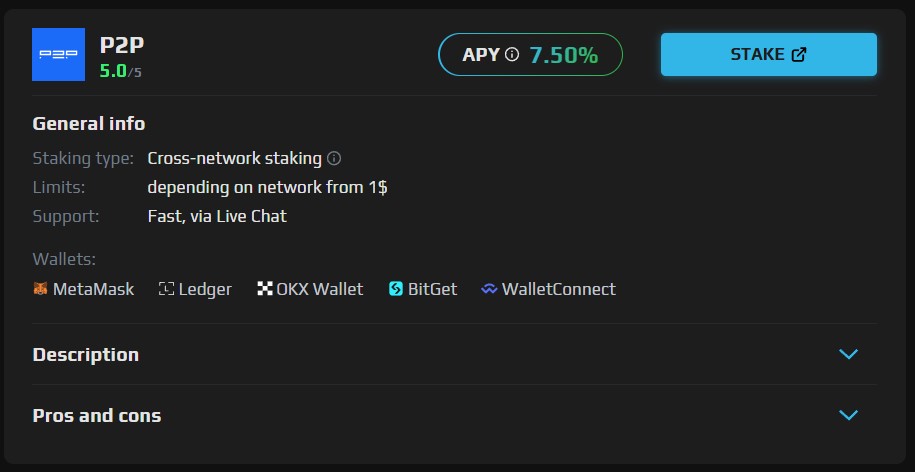

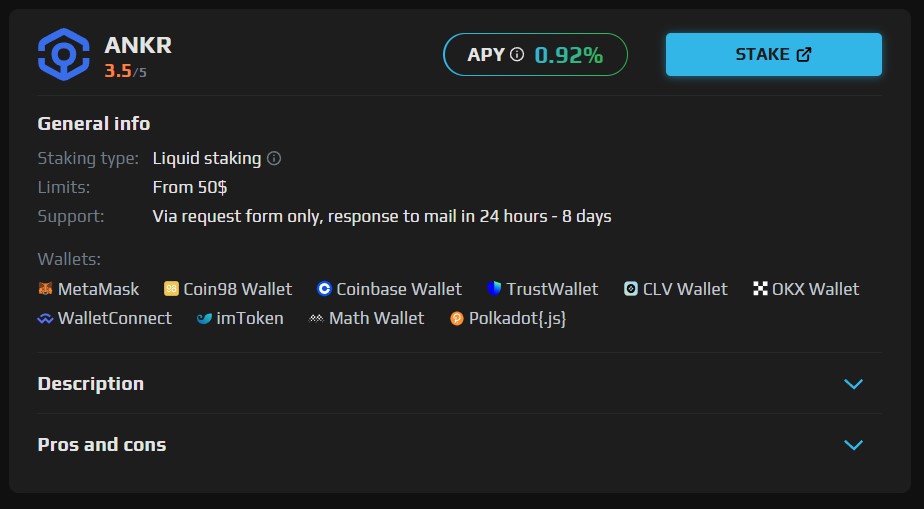

Swapzone offers users three popular staking methods—Savings Staking, Cross-Network Staking, and Liquid Staking—to accommodate different preferences and goals.

Savings Staking provides a straightforward approach, where users earn rewards by holding assets in a staking account.

Cross-Network Staking boosts earning potential by allowing staking across various networks without the need for complex setup.

Liquid Staking adds flexibility, enabling users to receive liquidity tokens for staked assets that can be used in DeFi while still earning rewards.

On Swapzone, users can compare multiple staking platforms, rates, and features, ensuring they find options that best align with their risk tolerance and staking goals. The platform provides insights to help users make informed decisions and maximize rewards.

Future of Crypto Staking

The future of crypto staking appears promising as blockchain networks increasingly transition to Proof of Stake (PoS) models, contributing to the overall growth of the crypto ecosystem. As more projects embrace staking, it will play a pivotal role in enhancing decentralization, improving tokenomics, and supporting evolving governance mechanisms.

Staking could become a key tool for fostering broader adoption of blockchain technology, providing both security and incentives for network participants. Furthermore, as decentralized finance (DeFi) and other blockchain-based applications expand, staking will likely be integral to the development and sustainability of these ecosystems. In this way, staking’s role in the crypto landscape is expected to grow, providing new opportunities for investors and improving the efficiency of blockchain networks.

Conclusion

Crypto staking offers a promising investment opportunity for those seeking passive income from their cryptocurrency holdings. However, it’s crucial to approach staking with a long-term perspective and conduct independent research to fully understand the associated risks. Before engaging in staking, carefully evaluate your investment goals and risk tolerance to make informed decisions that align with your financial strategy.

FAQs

What are the risks of staking crypto?

Staking crypto involves risks such as price volatility, slashing penalties, and lock-up periods that prevent you from selling staked assets during market downturns. These factors can lead to potential financial losses.

Is staking better than holding in crypto?

Staking can offer higher returns compared to holding, but it introduces risks like liquidity limitations and market fluctuations. It may be more rewarding but requires active management and a long-term approach.

Is crypto staking worth it?

Crypto staking can be valuable for earning passive income, but it demands careful research, awareness of risks like slashing, and consideration of market crashes. It’s worth it for those prepared for the potential downsides.