Introduction

Decentralized Finance (DeFi) is an innovative development in blockchain technology, offering a blockchain-based alternative to traditional financial services. By utilizing permissionless networks, DeFi eliminates intermediaries, enabling access to financial services through cryptocurrencies and smart contracts. This decentralized approach fosters alternative banking, allowing users to manage and exchange digital assets without relying on centralized institutions. With its potential to create a fully transparent and open financial system, DeFi is revolutionizing how individuals engage with the global financial ecosystem.

Understanding DeFi: Core Concepts

DeFi, short for Decentralized Finance, uses smart contracts and dapps (decentralized applications) on blockchain networks to deliver services akin to those offered by traditional banks. Unlike centralized finance, DeFi operates without intermediaries, relying on public blockchains to automate and secure financial transactions. Users interact with DeFi protocols through digital wallets, maintaining control of their funds at all times. While multiple platforms support DeFi, Ethereum stands out as the primary hub due to its robust ecosystem. DeFi applications, from lending protocols to decentralized exchanges, highlight blockchain’s potential to disrupt the financial industry by creating a more inclusive and accessible system.

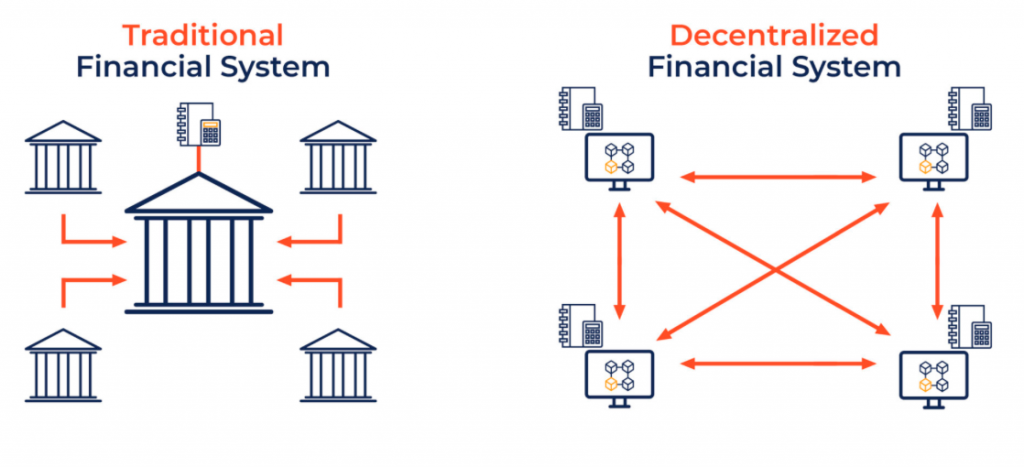

DeFi vs. Traditional Finance (CeFi)

Image source: Bake Blog – A User-Friendly Gateway to the World of Decentralized Finance.

DeFi represents a shift in the trust model, replacing reliance on centralized institutions with decentralized execution powered by smart contracts. Unlike commercial banks, which depend on intermediaries and operate within limited trading hours, DeFi platforms function 24/7, providing unparalleled accessibility to users worldwide. By eliminating intermediaries, DeFi reduces operational costs and fosters transparency, creating a financial system free from traditional constraints.

While DeFi emphasizes autonomy and openness, CeFi benefits from established regulatory frameworks and robust consumer protection, which DeFi currently lacks. DeFi users must navigate risks such as asset loss due to a forgotten private key or smart contract vulnerabilities. However, DeFi’s innovative approach to finance offers a compelling alternative by empowering users and creating a global, inclusive financial market. With its ability to enhance accessibility and transparency, DeFi is challenging the dominance of centralized financial institutions and reshaping how we interact with financial systems.

Key Characteristics of DeFi Applications

DeFi applications stand out due to their six defining features:

- Decentralized: DeFi eliminates centralized control, enabling users to directly interact with protocols without intermediaries.

- Permissionless: Anyone with an internet connection can participate, ensuring broad accessibility and inclusivity.

- Transparent: Transactions and smart contract operations are publicly recorded on blockchains, fostering trust and accountability.

- User-centric: These applications prioritize individual control, allowing users to manage their assets independently without relying on third parties.

- Interoperable: DeFi protocols are designed to work seamlessly with one another, creating a connected ecosystem where assets and services flow freely across platforms.

- Composable: Developers can build on existing DeFi protocols, stacking functionalities to innovate and create new financial products.

These features not only distinguish DeFi but also showcase its potential to revolutionize financial services by creating an open, flexible, and accessible financial ecosystem. This user-centric and innovative approach empowers individuals and paves the way for transformative change in how finance operates globally.

What are Smart Contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code on a blockchain. They automate processes, ensuring secure and efficient execution without intermediaries. A critical component of DeFi, smart contracts enhance transparency, fostering trust in decentralized systems. They enable the creation of complex financial products and services, driving innovation and efficiency across the decentralized finance ecosystem.

Components of the DeFi Ecosystem

The DeFi ecosystem is composed of diverse components that work together to create a robust and dynamic financial system:

- DEXs (Decentralized Exchanges): Facilitate peer-to-peer trading of digital assets without intermediaries, ensuring greater control and transparency for users.

- Aggregators: Streamline the DeFi experience by combining multiple protocols, enabling users to access better rates and services in one place.

- Digital Wallets: Provide secure storage and direct access to funds, allowing users to interact seamlessly with DeFi platforms while maintaining full control of their assets.

- Marketplaces: Enable the trading and exchange of unique digital assets like NFTs, fostering a new realm of digital commerce.

- Oracles: Bridge the gap between blockchain systems and real-world data, ensuring smart contracts can execute based on accurate external information.

- Layer 1 Networks: Serve as the foundation for DeFi protocols, with Ethereum playing a leading role due to its robust infrastructure and developer community.

- Stablecoins: Anchor transactions with price stability, mitigating the volatility of cryptocurrencies and enabling broader adoption.

These components collectively empower the DeFi ecosystem, enabling a wide range of financial activities and driving the evolution of a decentralized financial landscape. By combining innovation, efficiency, and accessibility, DeFi continues to reshape how financial services are delivered and accessed.

DeFi Use Cases and Applications

DeFi has revolutionized financial services by offering a variety of innovative applications that empower users with more control and flexibility:

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend and borrow digital assets in a decentralized manner, bypassing traditional banks and offering better interest rates.

- Trading: Decentralized exchanges (DEXs) such as Uniswap and SushiSwap enable users to trade assets directly, providing a more secure and transparent environment without intermediaries.

- Insurance: DeFi protocols like Nexus Mutual offer decentralized insurance products, providing coverage and risk management without relying on traditional insurance companies.

- Stablecoins: Digital currencies such as Dai and USDC maintain price stability, helping to reduce volatility in the crypto market and facilitating smoother transactions for users.

- Yield Farming and Liquidity Provision: Users can participate in yield farming by providing liquidity to pools on platforms like Yearn Finance, earning rewards in return. This encourages liquidity and enables users to earn passive income.

- Payments: DeFi also enables more efficient and cost-effective payments, reducing the need for intermediaries and offering faster, cheaper cross-border transactions.

To make the most of these opportunities, platforms like Swapzone provide an easy and efficient way to exchange cryptocurrencies, giving users seamless access to a wide range of DeFi applications. With its user-friendly interface and competitive rates, Swapzone helps users effortlessly dive into the world of decentralized finance and leverage its benefits.

These applications highlight how DeFi can transform traditional financial systems by offering enhanced accessibility, transparency, and new opportunities for users, making financial services more inclusive and efficient.

Practical Examples of DeFi Platforms

Several prominent DeFi platforms showcase the real-world applications of decentralized finance:

- dYdX: A decentralized trading platform that allows users to trade digital assets, including margin trading, derivatives, and perpetual contracts. dYdX leverages smart contracts and blockchain technology to offer transparent, trustless trading without intermediaries.

- Aave: A decentralized lending protocol that allows users to lend and borrow digital assets at competitive interest rates. Aave uses smart contracts to ensure secure transactions, and its features include flash loans, which enable users to borrow funds without collateral for short periods.

- Compound: Another leading lending platform, Compound allows users to earn interest by providing liquidity to different assets. It automates the process of lending and borrowing through smart contracts, making it easy for users to interact with digital assets without traditional banks.

- Dai: A stablecoin created by the MakerDAO system, Dai is pegged to the US dollar, offering stability in the often volatile cryptocurrency market. It is widely used in DeFi protocols for lending, borrowing, and trading.

- USDC: Another popular stablecoin, USDC is a fully-backed, transparent digital currency used for transactions within the DeFi ecosystem. Its stability and transparency make it a reliable asset for users looking to participate in decentralized finance applications.

The Potential Impact of DeFi

DeFi has the potential to significantly transform financial inclusion, particularly for the unbanked population. By removing the barriers created by traditional financial institutions, DeFi offers global access to financial services, allowing individuals in both developing and developed economies to participate in the financial system. This opens up opportunities for those who have previously been excluded due to geographical, economic, or regulatory constraints. DeFi’s open financial market enables anyone with an internet connection to access services such as lending, borrowing, trading, and payments, regardless of their location or financial status. This could potentially bridge the gap between the banked and unbanked populations, fostering economic growth and innovation worldwide. As DeFi continues to evolve, it holds the promise of democratizing access to financial tools, creating a more inclusive and equitable financial ecosystem.

How to Get Involved in DeFi

Getting started with DeFi involves a few key steps. First, set up a digital wallet to store and manage your assets. Popular wallets like MetaMask or Trust Wallet provide access to DeFi platforms. Next, familiarize yourself with cryptocurrency basics, as most DeFi applications operate using digital assets like Ether (ETH) on the Ethereum network. Ethereum is the primary platform for DeFi development, supporting various decentralized protocols. Services like Amazon Managed Blockchain also support Ethereum, providing tools for building or interacting with DeFi applications. Before diving in, it’s essential to conduct thorough research on the platforms and protocols you plan to use. Since DeFi operates in a relatively unregulated environment, caution is important to ensure your investments are secure and your understanding is solid.

Making Money with DeFi

DeFi offers multiple ways to earn passive income through various strategies. Staking and yield farming are popular methods, where users lock up their assets in return for rewards or interest. Lending assets to others via DeFi platforms also generates interest, providing another avenue for income. Additionally, users can earn through transaction fees and governance tokens, which grant voting power on protocol decisions.

For those looking to explore these opportunities, platforms like Swapzone offer a convenient gateway to the DeFi ecosystem. Swapzone enables users to easily exchange cryptocurrencies, facilitating access to DeFi platforms where they can engage in staking, yield farming, or lending. Its intuitive interface and wide selection of supported tokens make it a valuable tool for both beginners and experienced users in decentralized finance.

While the potential for high returns in DeFi is attractive, it’s important to remember that these opportunities come with risks. Market volatility, smart contract vulnerabilities, and liquidity concerns should be carefully considered before investing. By using services like Swapzone, you can efficiently diversify your assets across multiple DeFi strategies while managing risks and maximizing potential rewards.

Risks and Challenges in DeFi

The DeFi space presents several risks and challenges that potential users and investors should be aware of. One major issue is scalability, as many DeFi platforms struggle to handle large volumes of transactions, leading to network congestion and high fees. Regulatory uncertainty is another concern, as DeFi operates in unregulated markets, making it susceptible to potential government interventions or changes in laws. The lack of consumer protection further amplifies the risks, as there are no established safeguards against fraud or loss.

Managing collateral is also critical, as users may need to lock assets in smart contracts, which could be liquidated if conditions aren’t met. Additionally, the loss of private keys can lead to permanent loss of access to funds, as DeFi systems rely heavily on self-custody. Security vulnerabilities in smart contracts and platforms are also a risk, as bugs or exploits could result in significant financial loss.

To navigate the DeFi space successfully, users must exercise caution, conduct thorough due diligence, and understand the full range of risks. While DeFi presents significant opportunities, it requires careful consideration, especially in an environment where user responsibility and the potential for losses are high.

The Future of DeFi

The future of DeFi depends on continuous innovation and overcoming current challenges. For mainstream adoption, regulatory developments are crucial, as clear regulations will help establish trust and legal frameworks. Additionally, solutions for scalability are essential to ensure DeFi can handle increasing demand. Despite these hurdles, the dynamic and rapidly evolving nature of DeFi opens up new opportunities for growth and transformation. As the ecosystem matures, DeFi has the potential to revolutionize finance by addressing existing limitations and expanding its reach globally. Continued research and development will play a vital role in shaping the future of decentralized finance.

Conclusion

DeFi is a new technology with the potential to revolutionize financial services, offering significant investment opportunities. However, it is crucial to make informed decisions when engaging with DeFi, as it carries inherent risks. As the DeFi ecosystem continues to evolve, staying informed about the latest developments and conducting thorough research will be essential for navigating this complex space. By understanding both the opportunities and challenges, investors can make smarter decisions in this rapidly changing environment.

FAQs

What is DeFi in crypto?

DeFi refers to decentralized financial systems built on blockchain technology that provide services such as lending, borrowing, and trading without the need for intermediaries or central authorities.

Is DeFi crypto a good investment?

DeFi investments can yield high returns but are highly volatile and involve risks like security vulnerabilities. Careful research and risk management are essential before investing.

Is crypto DeFi safe?

Crypto DeFi carries inherent risks, including vulnerabilities in smart contracts and potential loss of private keys. Users must be vigilant in securing their assets and understanding the risks involved.

What is the difference between crypto and crypto DeFi?

Crypto refers to digital currencies, while crypto DeFi encompasses decentralized platforms that leverage blockchain technology to offer financial services using cryptocurrencies.