Introduction

The landscape of cryptocurrency trading is evolving rapidly, with decentralized exchanges (DEXs) emerging as essential peer-to-peer marketplaces for trading digital assets. Unlike centralized exchanges, DEXs empower crypto traders by giving them full control over their funds through smart contracts. This enhances transparency and significantly reduces counterparty risk. In the context of the burgeoning decentralized finance (DeFi) ecosystem, DEXs play a crucial role by facilitating seamless transactions of cryptocurrencies. As more users seek instant access to a wide variety of tokens, the importance of DEXs in the cryptocurrency world continues to grow.

Definition and Context

What is a decentralized exchange? Simply put, a DEX is a platform that allows users to trade digital assets without needing intermediaries. Instead, decentralized exchanges work by utilizing smart contracts, which are self-executing contracts with terms directly written into code, to automate and secure financial transactions. This setup is common across most DEXs and has contributed to their rapid adoption as part of the broader DeFi ecosystem. The DEX meaning goes beyond just a trading platform—it represents a decentralized approach to finance that prioritizes user control, transparency, and security. As DeFi grows, DEX usage has surged, with many people viewing it as a solution for secure, transparent, and low-cost trading.

Decentralized exchanges enable users to retain complete control over their funds, in contrast to centralized exchanges (CEXs), which require users to deposit funds into accounts controlled by the exchange. Users can access these platforms through various apps or software on their smartphones, allowing for a seamless trading experience. With recent developments in blockchain technology and internet connectivity, DEXs are expected to become increasingly popular, particularly as they adopt new security features and enhance user experience.

How Do DEXs Work?

Understanding how decentralized exchanges (DEXs) function compared to centralized exchanges (CEXs) is essential for navigating the cryptocurrency landscape. Unlike centralized exchanges, which utilize order books to match buyers and sellers, DEXs operate primarily through two mechanisms: order book DEXs and automated market makers (AMMs).

Order Book DEXs

Order book DEXs closely resemble traditional CEXs by employing on-chain order books to facilitate trades of crypto-crypto pairs. However, on-chain transactions can be slow and costly, particularly on congested blockchains like Ethereum. Recent innovations, such as layer-2 networks, are addressing these challenges by enhancing transaction speed and reducing fees. Some order book DEXs are exploring hybrid designs that merge the advantages of traditional and decentralized models to optimize performance and user experience.

Automated Market Makers (AMMs)

AMMs represent a significant advancement in DEX technology, substituting order books with liquidity pools. These pools consist of cryptocurrencies deposited by users known as liquidity providers (LPs). When a trade is initiated on an AMM-based DEX, smart contracts automatically execute the transaction based on the existing pool ratios. This approach offers instant liquidity, enabling users to swap tokens seamlessly without needing an intermediary. AMMs democratize access to liquidity provision, allowing anyone to contribute to liquidity pools and earn rewards. By utilizing algorithmic trading, AMMs effectively address liquidity issues that plagued earlier DEXs. Popular AMM-based DEXs like Uniswap and Sushiswap have significantly influenced the DEX ecosystem, establishing a new standard for decentralized trading. Governance is another vital aspect of DEXs, with many leveraging Decentralized Autonomous Organizations (DAOs) for community-driven decision-making. The open-source nature of DEX code fosters transparency, enabling community audits and enhancing trust among users.

What Are the Advantages of Using a DEX?

- Decentralized exchanges (DEXs) offer several compelling advantages that set them apart from traditional centralized exchanges (CEXs). One of the most notable benefits is access to a wide variety of tokens. DEXs frequently list new and emerging tokens before they become available on CEXs, allowing users to trade diverse digital assets early in their market life cycle.

- Additionally, DEXs significantly reduce counterparty risks. Since trades are executed directly through smart contracts, users retain control of their funds, minimizing the potential for hacking attacks that can occur when assets are held by intermediaries. This decentralized model enhances user security and trust.

- Privacy is another crucial advantage, as DEXs do not require Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures. This anonymity allows users to trade without exposing personal information, fostering a sense of security and freedom.

- Furthermore, DEXs promote financial inclusion by providing global trading access, particularly benefiting users in developing economies who may lack access to traditional financial services. With strong execution guarantees and enhanced transparency, all transactions are recorded on the blockchain, ensuring verifiability and security.

- Finally, DEXs create opportunities for liquidity provision. Users can become liquidity providers in automated market makers (AMMs), earning fees from the trades occurring within these liquidity pools, thus generating passive income while contributing to the overall liquidity of the platform.

What Are the Potential Downsides and Risks of DEXs?

While decentralized exchanges (DEXs) offer numerous benefits, they also come with several challenges and risks that users should be aware of. One significant issue is the complexity of user interfaces. For newcomers to trading, DEXs can be daunting compared to the more intuitive platforms offered by centralized exchanges.

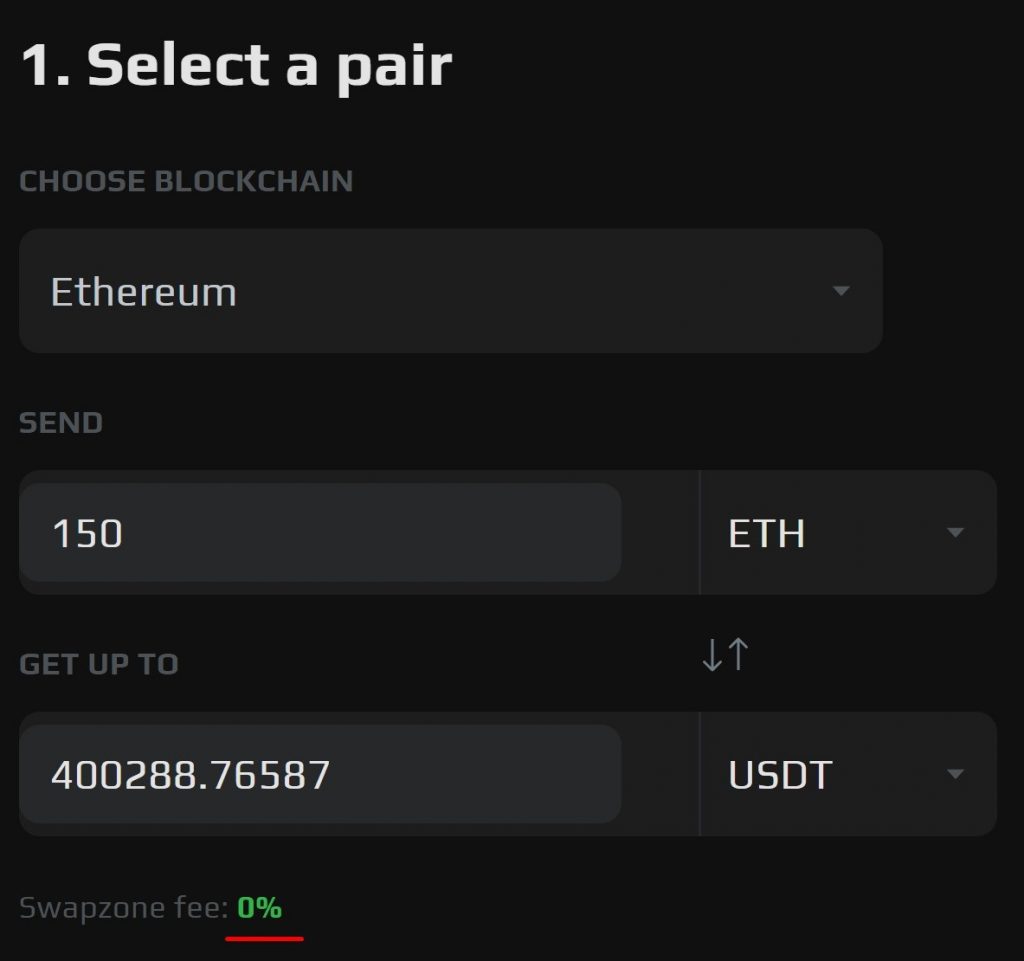

This complexity may deter some users; however, platforms like Swapzone.io aim to simplify the experience with user-friendly interfaces that guide users through wallet connections and trade executions. Users can easily monitor their transactions and maintain their portfolios with the right tools available on their smartphones. Another critical concern is smart contract vulnerability. Although DEXs utilize smart contracts to facilitate transactions, these contracts can contain bugs or security flaws, making it essential for users to choose well-reviewed platforms. Additionally, the presence of unvetted tokens introduces risks, as some may be scams or “risky coins.” Therefore, conducting thorough research before trading is crucial. Liquidity risks are also a significant factor. Liquidity providers may face impermanent loss if the prices of pooled tokens fluctuate significantly. Moreover, there’s a risk of frontrunning, where arbitrage bots can exploit transaction timing to gain advantages in high-liquidity pools. Network-related risks, such as high gas fees and slippage, can also affect trading costs and execution efficiency. As Ethereum and other blockchains experience congestion, users may encounter increased transaction fees and difficulties in exiting trades, highlighting the need for caution when engaging with DEXs.

Swapzone provides a valuable solution to the challenges associated with DEXs by offering a streamlined, intuitive platform for users. By eliminating transaction fees, Swapzone helps traders avoid the high costs typically associated with gas fees on decentralized exchanges. This cost-effectiveness allows users to engage in trading without the burden of excessive expenses. Moreover, Swapzone aggregates rates from multiple exchanges, ensuring users can find the best prices and execute trades quickly, minimizing the risks of slippage and liquidity issues.

How to Interact with a DEX

Interacting with a decentralized exchange (DEX) is a straightforward process. Begin by connecting your crypto wallet, such as Guarda, to the DEX platform. Ensure that you have enough Ethereum in your wallet to facilitate transactions. With the Ethereum network’s ongoing developments, including the ETH2 upgrade and layer 2 solutions, users can expect improved transaction speeds and overall efficiency. Once your wallet is connected and your funds are ready, you can start trading a variety of tokens available on the DEX. This seamless integration makes it easy for users to engage in decentralized trading.

DEX Fee Structure

Decentralized exchanges (DEXs) like Uniswap operate on a fee structure designed to reward liquidity providers. Each trade incurs a percentage fee that is distributed among these providers. However, users often face substantial costs from gas fees associated with transactions on the Ethereum network, which can overshadow the DEX fees. Fortunately, initiatives such as the ETH2 upgrade and layer 2 solutions are being implemented to reduce these gas fees, making DEXs more accessible and cost-effective for users.

Notably, Swapzone.io does not charge any commission, further enhancing the trading experience for users. Understanding these costs is essential for anyone looking to trade on DEXs.

Advanced Features and Security Enhancements

Decentralized exchanges (DEXs) are increasingly leveraging advanced technologies to enhance security and introduce sophisticated features that improve user experience. One significant integration is the use of oracle services, such as Chainlink Price Feeds, which provide accurate and real-time price data. This reliable data is crucial for executing trades and implementing advanced features like limit orders, allowing users to set specific conditions for their trades.

In addition to price feeds, Chainlink Automation plays a vital role in enhancing DEX functionality. This service facilitates smart contract automation, enabling users to create automated trading strategies without needing constant manual oversight. For instance, traders can set predefined conditions that trigger trades automatically, improving efficiency and responsiveness to market changes.

Moreover, these integrations allow for more efficient fee distributions among liquidity providers, ensuring they are adequately compensated for their contributions. By utilizing these advanced technologies, DEXs can significantly improve their overall functionality and security, making them more competitive with centralized exchanges. As the DeFi ecosystem continues to evolve, such innovations will be essential for attracting a broader user base and fostering trust within the community.

FAQs

What is the downside of DEX?

DEXs can be difficult to navigate and often have high gas fees. Users face risks from smart contract vulnerabilities and unvetted tokens. However, platforms like Swapzone.io simplify trading by aggregating rates and providing resources for informed decision-making.

What is DEX and what does it do?

DEX, or decentralized exchange, enables cryptocurrency trading without intermediaries. It utilizes smart contracts to automate and secure transactions directly on the blockchain, allowing users to trade various digital assets while maintaining control over their funds.